SINGAPORE, 27 July 2021 — Singapore-headquartered regional insurtech Igloo today announced its partnership with Singapore’s leading food delivery platform, foodpanda, to offer personal accident cover to foodpanda riders and their loved ones. The policy, named PandaCare, aims to provide riders with fuss-free, wallet-friendly insurance coverage that they can also extend to immediate family members.

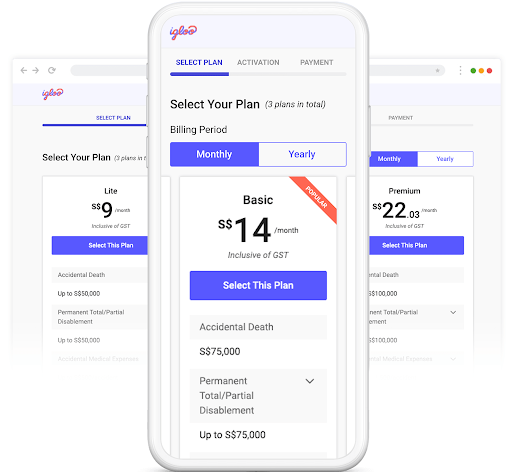

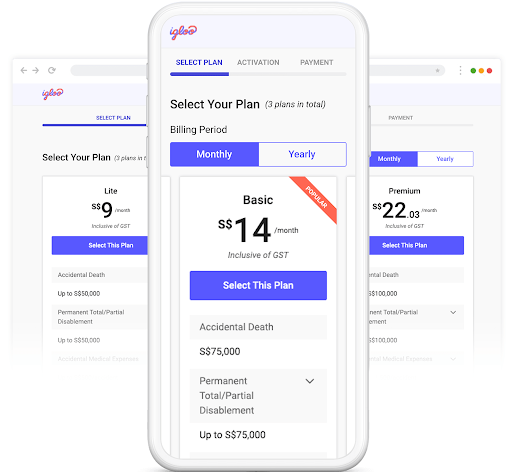

PandaCare, underwritten by MSIG Insurance, is specifically designed for gig economy workers and encompasses six benefits: Accidental Death, Accidental Medical Expenses, Accidental Mobile Phone Screen Damage, Daily Hospital Cash, Permanent Total/Partial, Disablement and Temporary Disablement. While most Personal Accident insurance plans charge on a per year basis, PandaCare can be purchased monthly – from as low S$9/month – with personal accident coverage of S$50,000. What’s more, riders can purchase PandaCare for their immediate family members.

With the COVID-19 lockdown last year, the region has seen a rise in new food delivery consumers; 34% of digital consumers in SEA moved online for food delivery in 2020. Likewise, there has also been an increase in rider sign-ups as more individuals turn to freelance gigs. Becoming a delivery rider is fast becoming an attractive role for those who value flexibility – such as those who already have a full-time job, or students who are on vacation. As such, PandaCare seeks to provide delivery partners and their families with a peace of mind as they travel the roads to meet heightened demand from Covid-19 dining restrictions.

Raunak Mehta, Chief Commercial Officer of Igloo said, “Food delivery services and delivery riders have played an essential role in our lives, particularly in the last year. This is highlighted once again as Singapore hunkers down with the recent safe distancing measures. As riders meet the surge in demand, it is important that they have access to affordable and comprehensive insurance coverage so they can do their jobs with peace of mind. Together with MSIG and foodpanda, we’ve customised an affordable, accessible product delivered through a simplified purchase and claims management journey for this very important segment.”

To purchase, foodpanda riders just need to access the PandaCare purchase page on desktop or mobile and answer three simple questions. Next, they choose from three plans: Lite, Basic or Premium, fill in their personal details and make a payment using a credit or debit card. Making claims is simple too, with riders able to log in to a claims management portal to submit and view their claims status.

Jorge Rubio, Operations Director, foodpanda Singapore, said, “Our riders’ safety has always been our priority. Since the pandemic outbreak, delivery riders have played a critical role in helping the community stay safe. By partnering Igloo to launch PandaCare, we hope to provide not only our riders, but their families as well, access to wallet-friendly, fuss-free option of protecting themselves so that they can have a peace of mind while they are on the road.”