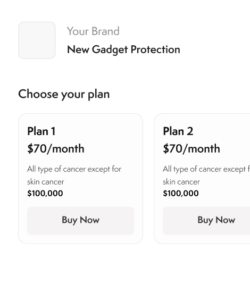

Offer insurance products to your customers through a branded marketplace

Offer direct access to the perfect insurance products, ensuring protection for your customers and their families with Igloo’s end-to-end digital insurance platform.

Book a demo

Powerful white-label insurance marketplace designed to boost ancillary traffic and generate revenue

Benefits

Flexible

Choose modules you require - telesales, marketing automation, comparison, "buy-now-upload-later".

Streamlined UX

Intuitive user interface which enhances conversion rate.

Product diversity

Provide your customer with customised insurance products that complement your business offerings.

Third-party integrations

Igloo’s open APIs make integrating with other critical third-party tools or software easy and fuss-free.

Infinite flexibility

Igloo's infrastructure adapts to any scenario, allowing you to start from scratch, import ready-made blueprints, or build reusable components for multiple products.

Scalable

Launch new products and enhance content with minimal development as your business evolves.

Open up a new revenue channel with your own insurance marketplace

End-to-end customer journey

Customised brand experience

Deliver a fully branded experience that resonates with your customers, leveraging your company’s identity and values.

Conversion rate optimised

An intuitive, user-friendly platform gives your customers a straightforward purchasing process, enhancing satisfaction and reducing drop-offs.

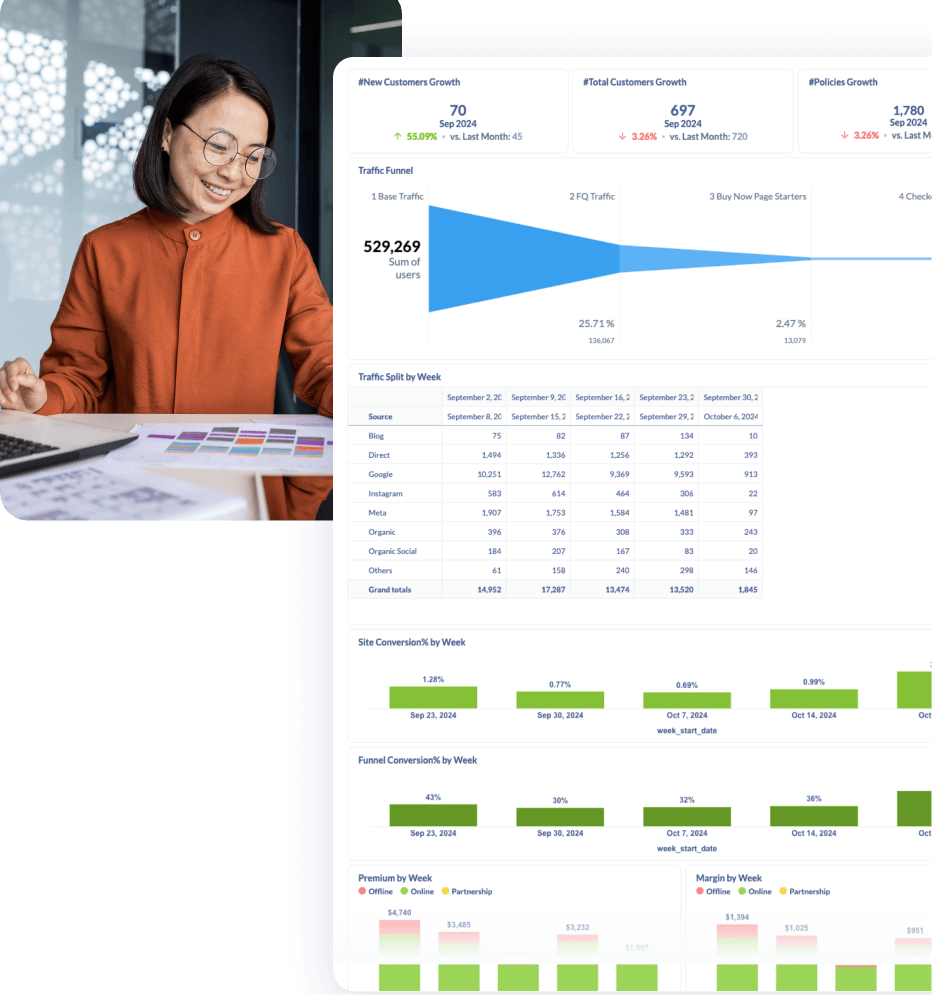

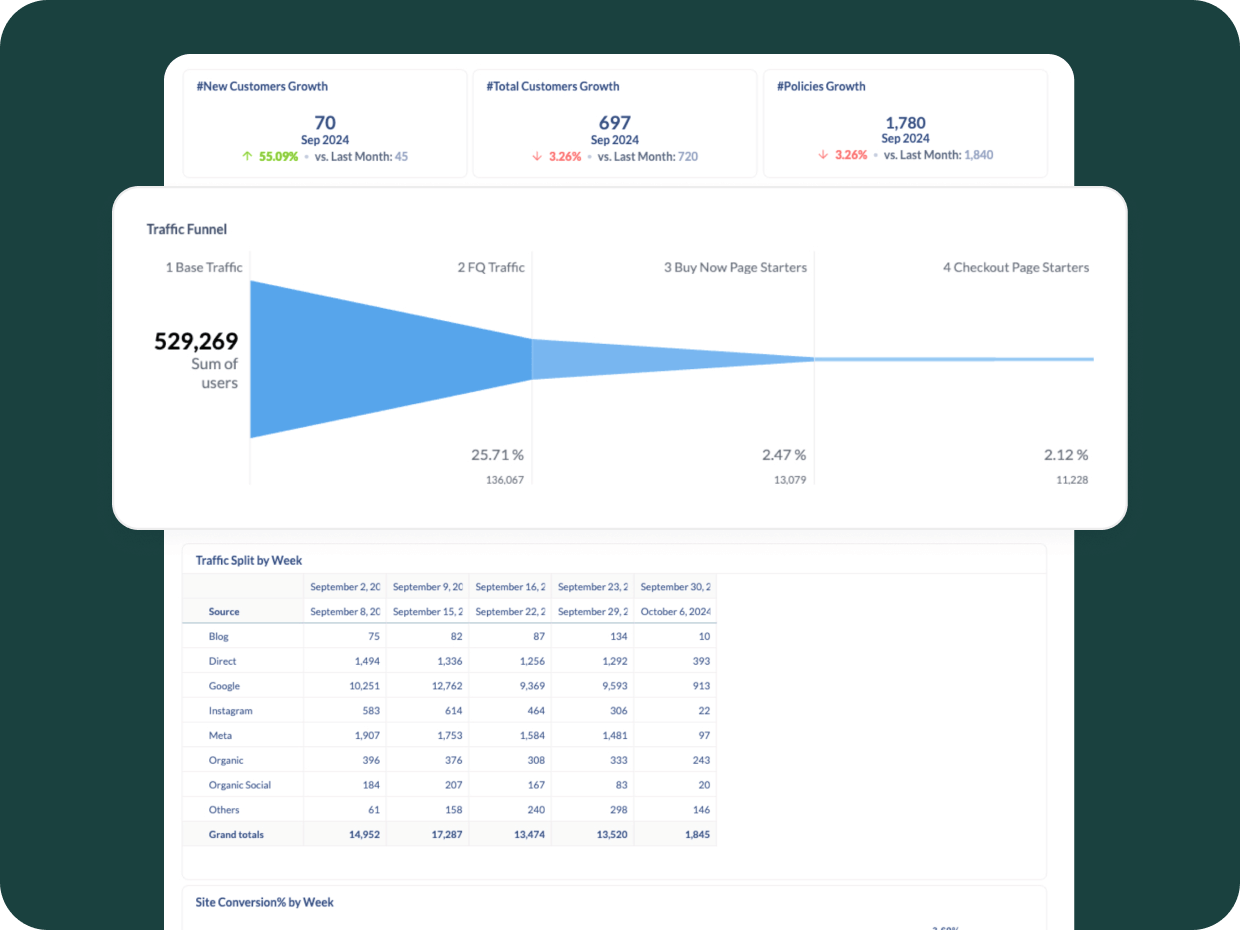

Analytics dashboard

Gain valuable insights into customer behavior, preferences, and demographics.

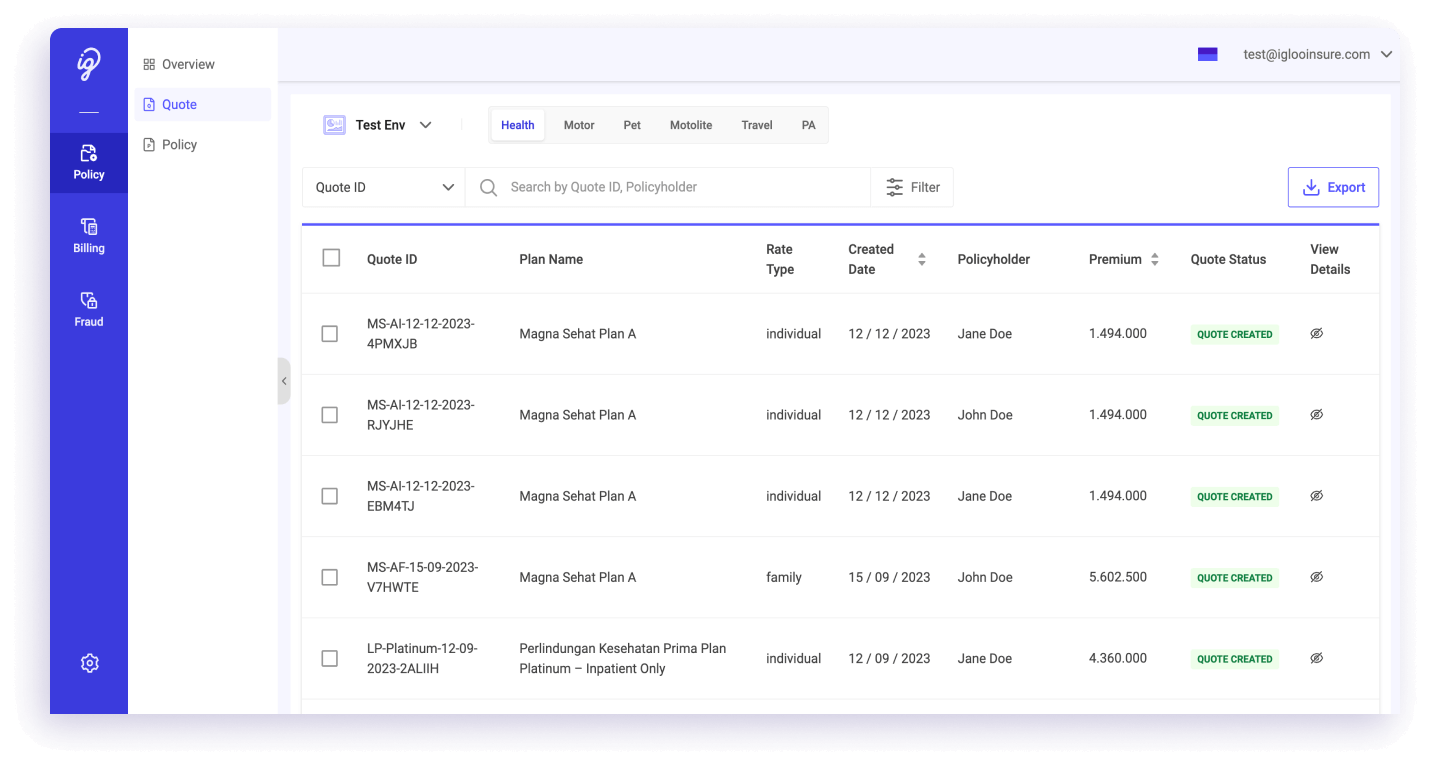

Centralised policy management

Manage all of your policies, claims and renewals in one centralised platform. Igloo consumer's admin portal also gives you a central view of your customers, bill management and reconciliation capabilities.

260+ insurance products

Offer curated options that fit your customers' unique needs, featuring products from multiple insurers via Igloo’s extensive connectivity.

Higher scalability

Rapidly launch diverse insurance products with minimal development required.

Transparency

Enable your customers to transparently discover prices and products.

End-to-end solution to offer insurance products to your customers

Flexible and customisable modules that address every stage of the customer buying journey. Add, remove or enhance specific features based on your evolving business needs.

Features

Sell

SEO-friendly website

Mobile responsive, SEO-ready web platform for customers to browse and purchase products.

Telesales capability

Follow up with leads through voice and chat.

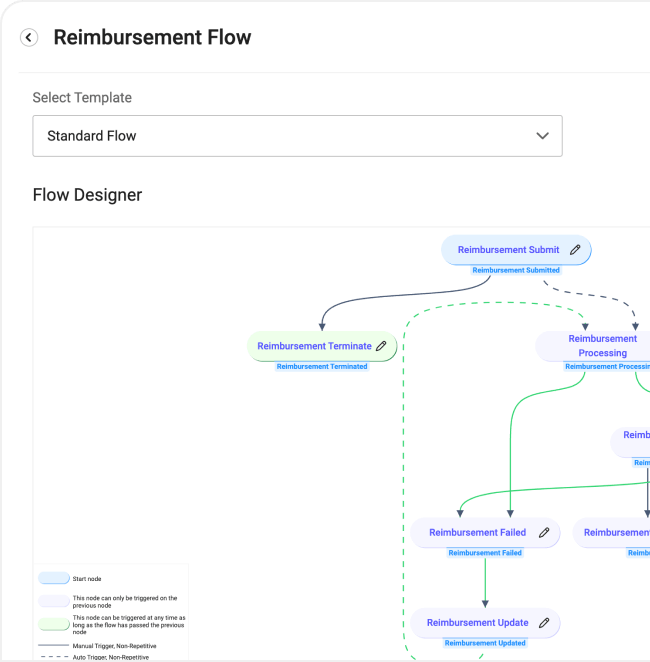

Marketing automation

Scale your marketing efforts, convert leads and increase repeat purchases using logic flows.

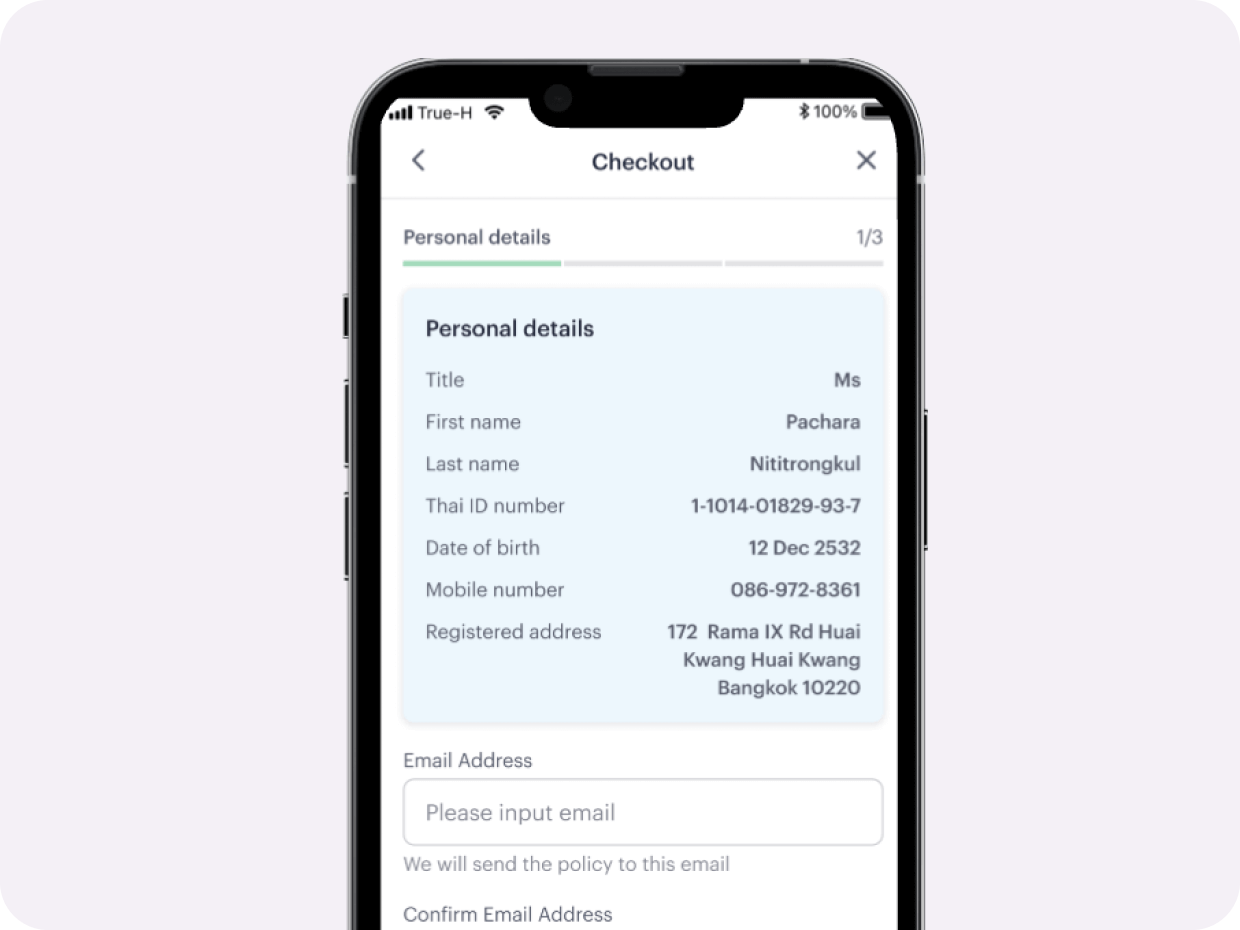

Purchase flows

Allow hassle-free guest checkouts, “buy now, upload later” to reduce drop-off, and integrate with various payment methods.

Multi-language CMS

Serve content to multiple markets in their local languages on a single platform.

Manage

User authentication

Enable account sign-up, email verification through one-time password (OTP).

Leads management

Store, manage and communicate with leads.

Customer portal

Facilitate seamless policy issuance and claims management, ensuring a smooth transaction process.

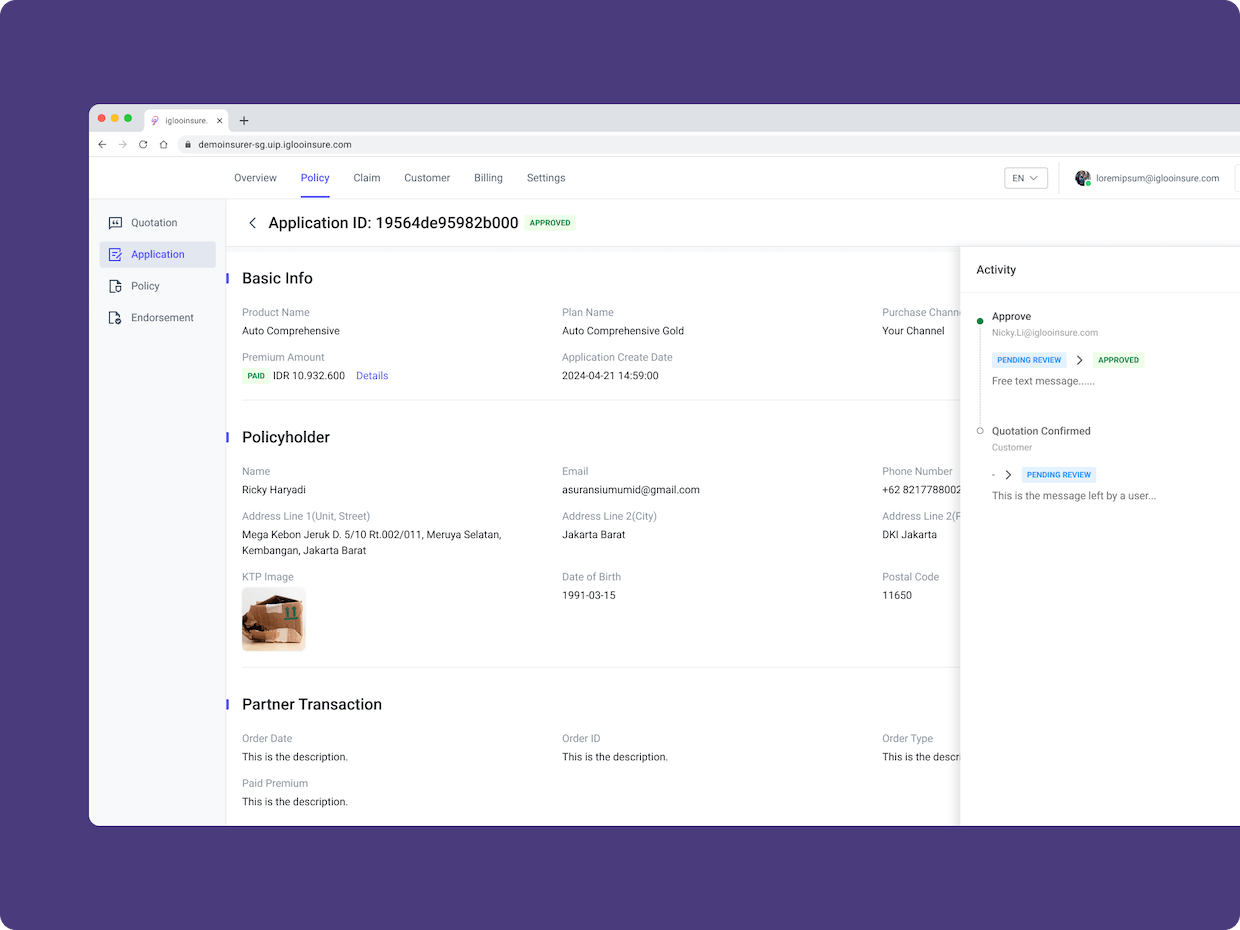

Admin portal

Get a high level overview of customers, purchase history, renewals, policy management and claims.

Analyse

Usage tracking

Every user’s session on the platform is tracked from entry to exit, giving a comprehensive full funnel view of the customer journey.

A/B testing capability

Create experiments to test marketing initiatives and improve conversion rates.

Performance Analytics

Analyse product performance and customer purchase trends to identify areas for improvement and strategic decision-making.

How leading e-Wallet TrueMoney Thailand sold insurance products at scale to their 27+ million app users

Case study

Background

TrueMoney has 27 million app users that mostly use the app to make digital payments, pay at 7-11 and top up their True prepaid sim card. They have the ambition to become a financial service super app and started to offer insurance products.

Requirements

- Full digital journey adapted to each insurance product (ie PA, motor, travel, etc.)

- Simple product configurator and builder

- Fast product launch with products from multiple insurers

- Dashboard to track key metrics

Pain points

- Previous tech vendor’s solution could not support purchase journeys for different insurance products

- No easy way to configure and launch new products

- No proper dashboard to track key performance metrics

Igloo's direct-to-consumer solution addressed their pain points and delivered impactful results

TrueMoney created an additional revenue stream using Igloo Consumer to embed an end-to-end insurance marketplace in their app to offer insurance products to their 27+ million users.

Solution

White-label insurance marketplace

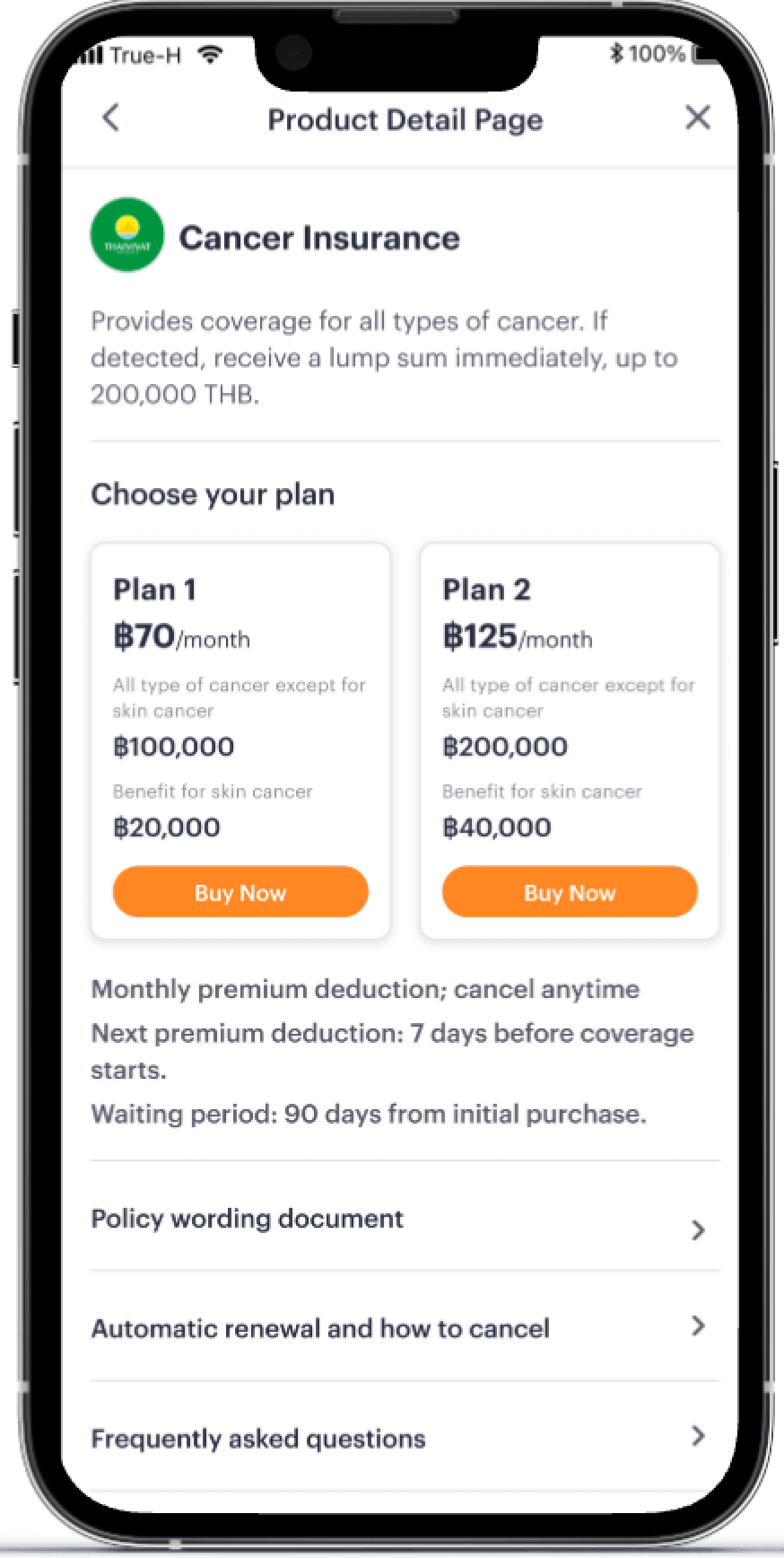

TrueMoney's 27+ million app users get access to a full-feature, end-to-end insurance marketplace, allowing them to purchase a wide range of insurance products offered by various insurers, all without leaving the TrueMoney app for a seamless buying experience.

Familiar user experience

Payment gateway, notifications, UI/UX and more are all adapted to TrueMoney's brand identity to ensure customer familiarity and high take-up rates of insurance products within the marketplace.

End-to-end customer journey

Customers can directly pay with their preferred payment method, receive confirmation, and get access to a customer portal to review their policy information.

Insurer portal

For both the TrueMoney team and their insurer partners to track the performance of the partnership.

Book a demo of Igloo Consumer and uncover the possibilities for your business

Contact us

Fill in your details and one of our team members will contact you shortly.