General insurance provides financial protection against losses and liabilities arising from unforeseen events. It covers individuals and businesses against damages to assets and properties. With various policy types available, general insurance is key to safeguarding one’s hard-earned assets.

Motor Insurance

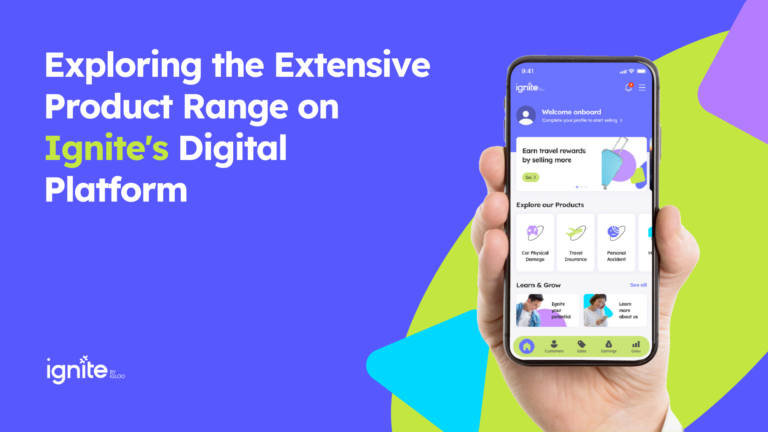

Motor insurance is mandatory for all vehicles plying on public roads. It has two components – third-party liability covers injury or damage caused to others, while own damage covers damage to the insured vehicle from accidents, theft, disasters etc. Add-on covers can also be purchased. Motor insurance ensures vehicles remain protected against physical damage and related financial burdens.

Health Insurance

Health insurance covers hospitalization costs arising from illness, surgeries, critical illness etc. It provides a cashless facility through network hospitals or reimbursement of claims. Individual plans cover self, spouse and children while group health plans are provided by employers. Health cover is essential today given rising medical costs.

Home Insurance

Home insurance covers damages to the structure and contents of the home due to disasters, theft, fire etc. It ensures the building as well as household items and valuables. Home insurance also covers alternate accommodation costs if the house is not habitable after an incident. It is a must-have for all homeowners.

Travel Insurance

Travel insurance provides financial protection against overseas or domestic trip-related contingencies like medical emergencies, flight delays, lost baggage etc. Customized plans can be purchased based on trip duration, destinations and traveler age. Overseas travel insurance is highly recommended.

Marine Insurance

Marine insurance covers goods, cargo and freight in transit via sea, air or road. It insures against losses arising from damage, piracy, natural disasters etc. Marine insurance is useful for organizations involved in exports, imports and transport.

Commercial Insurance

Policies like business interruption, cyber, errors & omissions liability, directors & officers liability, commercial property insurance etc. cater specifically to business assets and risks. Suitable commercial covers are a must for companies based on their size and sector.

For insurance agents, having knowledge of these policies is key to assess client needs and offer tailored solutions. Customers have varied insurance requirements based on assets owned, income, health profiles, and business activities. Agents can combine appropriate policy types to create optimal protection. Offering the right product mix helps maximize value for policyholders. Keeping customers insured with a balanced portfolio of plans to cover their most important assets and risks is crucial for agents to boost long-term retention.

As an insurance agent, ensure you are updated with all types of general insurance to support your customers’ diverse needs.