Pet Insure Plan

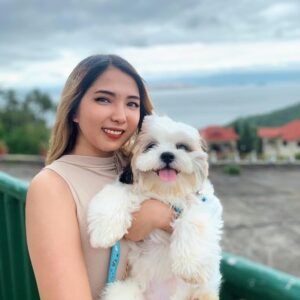

Affordable pet protection for dogs, from PHP 650

How to buy on the GCash appPowered by

Underwritten by

Protect your dog with the Pet Insure plan, powered by Igloo

What’s covered?

Medical Reimbursement

Your pet requires consultation, tests, scans, surgery, hospitalization, and medication

Cruciate Ligament Injuries

Your pet has sustained cruciate ligament injuries

Burial Assistance

Cremation or burial expense if your pet had to be euthanised

Owner’s Liability

You incur legal liabilities to third party due to your pet’s actions

What’s not covered?

Injury by the Owner

Pet injury or loss of life which resulted from intentionally inflicted injury by the owner or any of the owner’s family members

Death other than Euthanasia

The death/killing of the insured pet other than euthanasia

Pets for Special Tasks

Pets raised and used for special activities, in terms of stunt, police, fighting, sport

Affordable plans, from PHP 650

- Protection period

- 1 month

- 3 months

- 6 months

- 9 months

- 12 months

The pet protection recommended by pet owners and veterinary professionals

Pet Insure (Dogs) is available via the GCash app

To apply, follow these steps or watch the video tutorial here:

Step 1: Launch the GCash app

Step 2: Tap GInsure

Step 3: Tap Lifestyle Insurance

Step 4: Tap Pet Insure (Dogs)

Make sure your account is fully verified before proceeding.

Step 5: Read through the details then tap Next

Step 6: Answer the lifestyle questions to see your eligibility for the product. Tap Next

Step 7: Select the coverage level that suits your needs. Tap Next

Step 8: Confirm your details and tick the checkbox if you agree to the terms and conditions. Tap Confirm and Pay

Step 9: Review payment then tap Agree to pay the amount using your GCash balance

Done!

Frequently Asked Questions

What is Pet Insure?

Pet Insure is an insurance designed for pets and their owners. Pet Insure offers a 3-in-1 package benefit such as medical reimbursement, pet owner’s liability, and 24/7 pet owner’s personal accident cover.

What is covered?

The coverage mainly consists reimbursement for pet’s medical care, pet’s burial assistance due to euthanasia, owner’s legal liabilities due to pet’s actions, owner’s personal accident whose age is within 18-64 years old.

Can I buy this product?

You can avail of Pet Insure if you:

- Are within 18-75 years old

- Are a Filipino or legal Philippine resident

- Have a GCash account

- Have a house dog pet between the age of 6 month and 8 years

Can I buy it for someone else?

No, the insured must be the one to purchase and provide pertinent details and declarations with respect to the pet to be insured.

How many policies can I buy?

There is no limit to the number of policies you may purchase under your name, provided each policy covers a different pet, satisfying that only one (1) policy shall be in force per pet per policy period. Provided further that the maximum allowable cumulative limit for Personal Accident Cover shall be PHP 100,000.00 only, regardless of the number of insured pets or policies in force.

How do I pay for my insurance?

Payments will be deducted from your GCash wallet.

What shall be done after purchase?

You will need to activate your policy within seven days. Otherwise, your policy can never be activated.

When will my coverage start?

Your coverage begins at 12:01 AM Philippine Standard time the day following the date of activation.

What is the waiting period for Pet Insure?

Pet Insure has a waiting period of 14 days from the effectivity of the policy in respect of Section 1 – Medical Reimbursement. During such time, if pet is diagnosed or suffers from any injuries, sickness or illness, any expense necessarily incurred to relieve pet of such condition shall not be recoverable or reimbursible from the policy.

How do I make a claim?

After purchase, click on your policy in GInsure > My Insurance Products. You’ll be directed to the Policy Page where you can submit claims.

Or you may send a claim request directly by accessing the link: https://www.malayanonline.com/makeaclaim

How are the benefits paid out?

The claim proceeds for Pet Insure are paid through fund transfer. Please present the following required documents:

- Certification bearing bank account details (preferably RCBC account; other bank accounts will still be subject for management’s approval) duly signed by the insured (template will be provided)

- Valid ID of the signatory on the release documents

- Any document that will prove or show insured’s bank details

- Signed release document (template will be provided)

How much can I get from my Pet Insure?

This is subject to the submitted official receipts for reimbursement and the limit of coverage. Items excluded on the policy will not be reimbursed.

More questions or concerns?

Should you have any concerns, You may:

Call Malayan Insurance at (632) 8628-8628 or (632) 8242-8888 local 8628;

Send an email at csc@malayan.com;

Go to https://www.malayan.com/contact and fill out the form in this link;Visit Malayan Insurance customer service Counter at 4th Floor Yuchengco Tower, 500 Quintin Paredes Street, Binondo, Manila