PandaCare - Takaful Motorcycle Cover

Hey Pandas! PandaCare protects you and your motorcycle round-the-clock!

In partnership with regional insurtech Igloo, foodpanda brings you the PandaCare program which comprises Takaful Motorcycle Cover and CyclePac (optional), to protect you as you ride on hassle-free. PandaCare is covered by Zurich General Takaful Malaysia Berhad.

Why PandaCare?

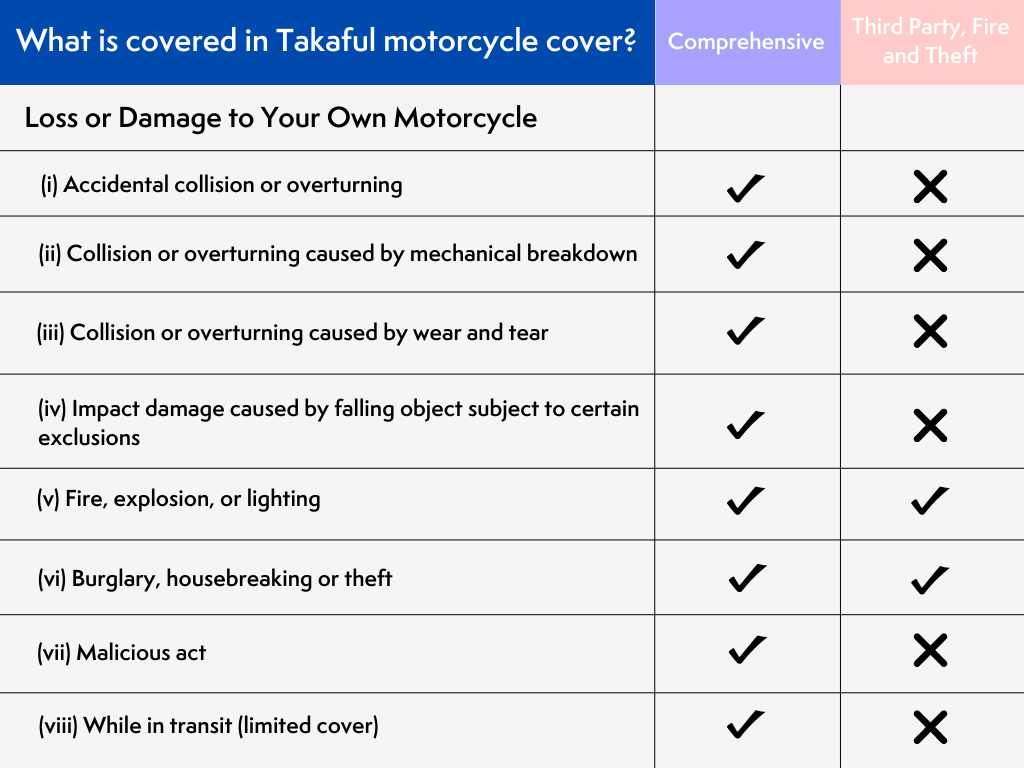

PandaCare covers you across risks that you may bear while making deliveries on the road.

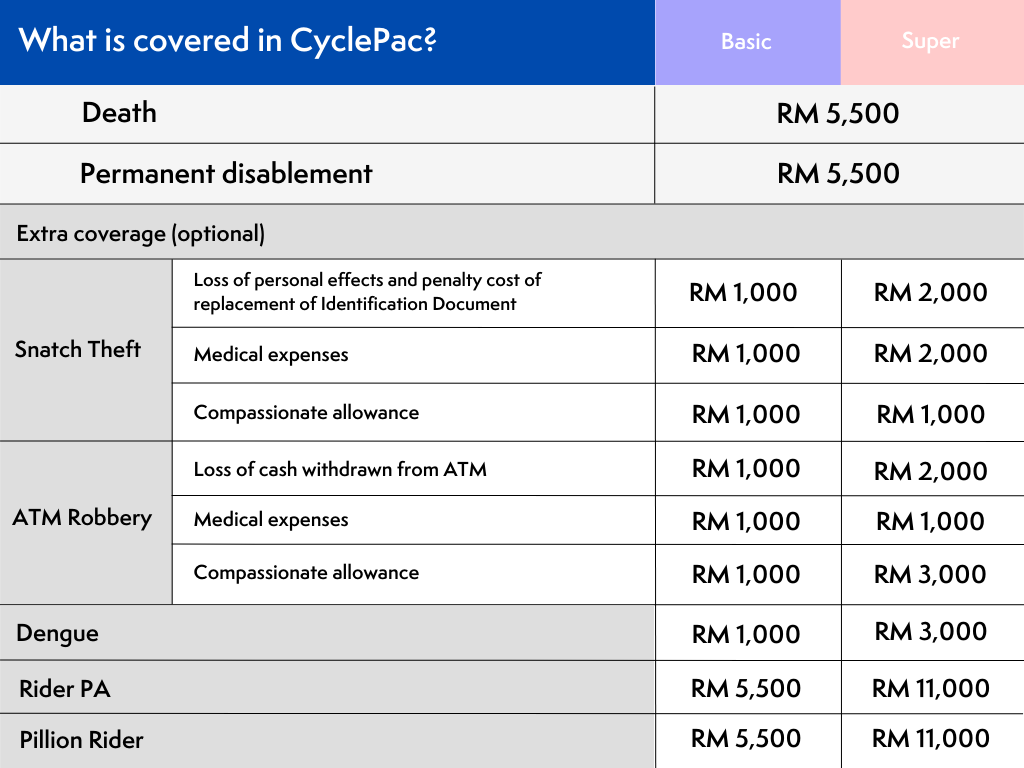

You can also choose to add on CyclePac Takaful coverage from as low as RM 23.78/ month – a yearly renewable certificate that provides compensation in the event of disability of the motorcyclist caused solely by violent, accidental, external and visible events.

Click here to get started!

Click here to get started!How to sign up?

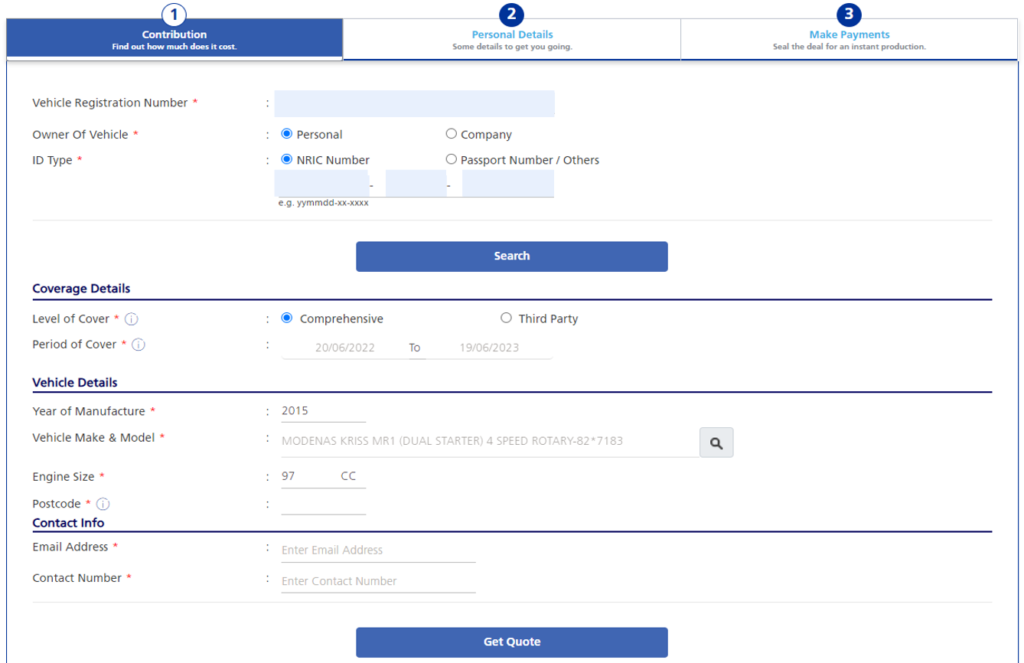

Step 1: Get the instant quote here.

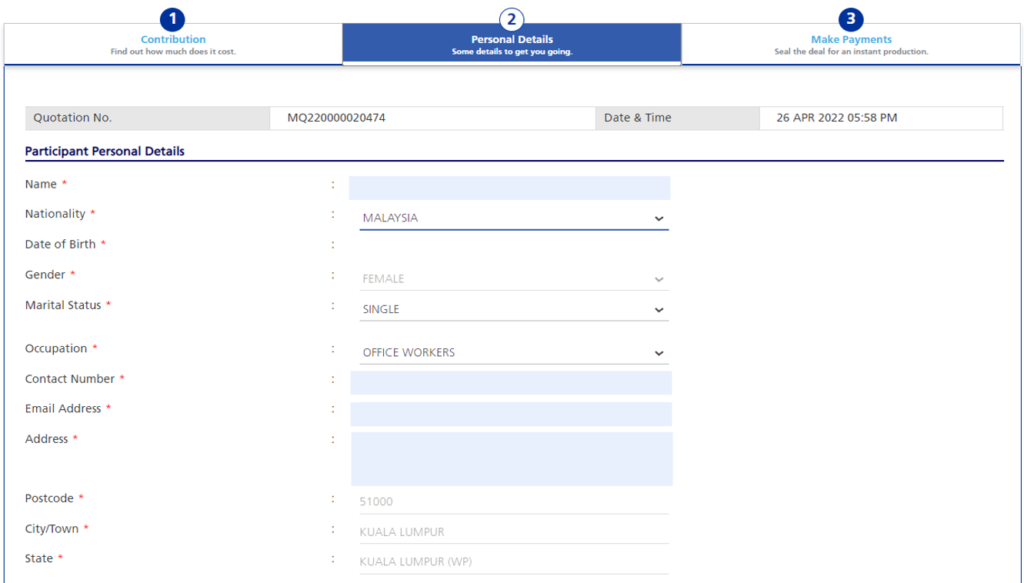

Step 2: Key in your personal details.

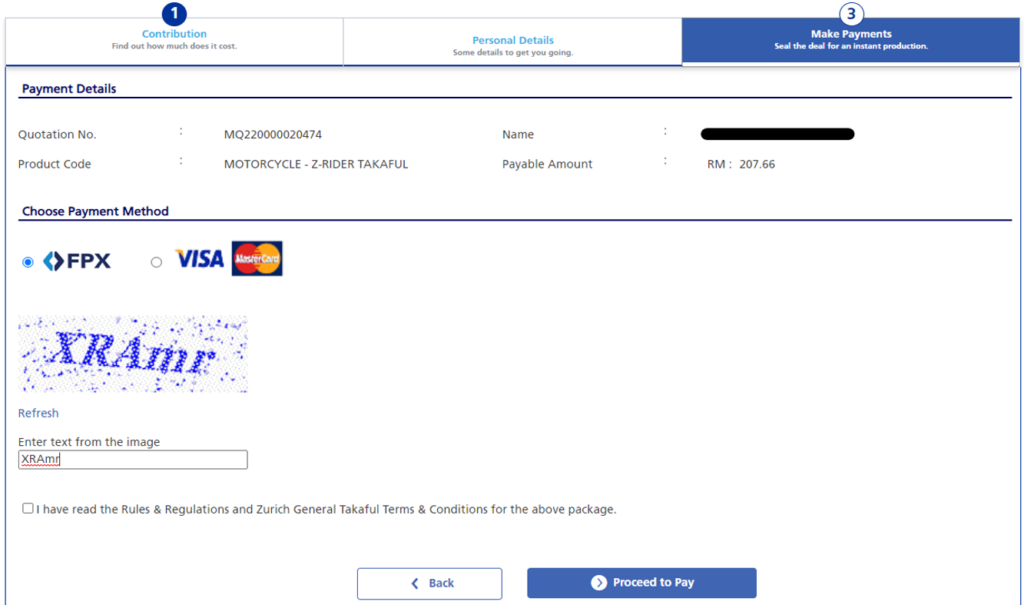

Step 3: Make contribution to seal the deal!

- By clicking the button above, you hereby confirm that you have read the Personal Data Protection Notice as published on Zurich General Takaful Malaysia Berhad’s website (https://www.zurich.com.my/pdpa)

- You hereby confirm that you’ve read the PDS before conclude the sales/payment.

- You hereby consent to the processing of my personal data for marketing and promotional purpose by other service providers and/or other related services of business partner, with whom Zurich General Takaful Malaysia Berhad maintains business referral or other arrangements.

Frequently Asked Questions

Who can apply for this certificate?

Anyone between 18 to 65 years old who owns a motorcycle.

What is the requirement to apply for this certificate?

It is compulsory for the motorcycle owner to have a valid driving license and valid road tax. This does not include road tax that has expired date.

How many certificates can I own?

You may only have one active certificate at any one time.

Who can ride my motorcycle?

The ‘Single Rider’ cover only protects the rider named in the certificate. Select the ‘All-Riders’ cover during subscription instead if you would like to cover anyone (with a valid license and your permission to ride) who rides your motorcycle.

Does this protection cover my pillion rider?

You may subscribe to the add-on to cover legal liability to the pillion rider (excludes pillion riders being carried for hire/reward, and when their death or injury arises out of and in the course of employment by you). To extend personal accident coverage to the pillion rider, subscribe to the Cycle PAC rider.

Which territory is my motorcycle covered?

This Takaful only covers you in Malaysia, Singapore and Brunei in accordance to the laws of Malaysia.

What are the situations where benefits will not be payable?

Exceptions include consequential losses, loss of use, depreciation, theft of accessories, breakdown/malfunction of parts, damage to tyre(s), causes of nature, loss of electronic data, cheating or criminal breach of trust.

Can I cancel my certificate?

You can cancel at any time by returning the Original Certificate of Takaful (CT) or, if the CT has been lost or destroyed. A duly certified Statutory Declaration (SD) must be provided to confirm this. You will be entitled to a refund of contribution (calculated based on active period of takaful), if no claim was incurred prior to cancellation.

What should I do in the event of an accident or theft?

- Report accidents to the police within 24 hours as required by law

- Inform Igloo as soon as possible about any incident which may give rise to a claim

- Submit to Igloo all letters, claims, writs and summons you have received from third parties as a result of the incident, alongside completed claim forms

- Send your motorcycle to an Approved repairer for repairs

View claim forms for motor accident, and for motor theft.

What if I have more questions?

Please write to us at cs.my@iglooinsure.com or WhatsApp us at +6012 2471910.

Operation hours – 10am to 5pm (Monday – Friday except Public Holiday)

Disclosures & Consent

Please read the Product Disclosure Sheet for more information about the product and take note of your Duty of Disclosure before proceeding for quotation.

Duty of Disclosure Link:

https://egms.zurich.com.my/zMotor/main/DutyofDisclosure