Consider this: a recent report by Capgemini revealed that 67% of customers switched their insurer within the last five years, primarily due to the ease of digital processes. This striking statistic underscores a critical movement in our industry. Consumer expectations are evolving rapidly, and traditional insurance distribution methods are being challenged like never before. If you’re operating with offline, in-person strategies, and heavy reliance on paper-based processes, it’s time to reevaluate and adapt. The future is replete with opportunities, and with the right steps, we can transform challenges into triumphs.

The Shifting Landscape of Consumer Expectations

Consumer behaviour is changing at an unprecedented pace.

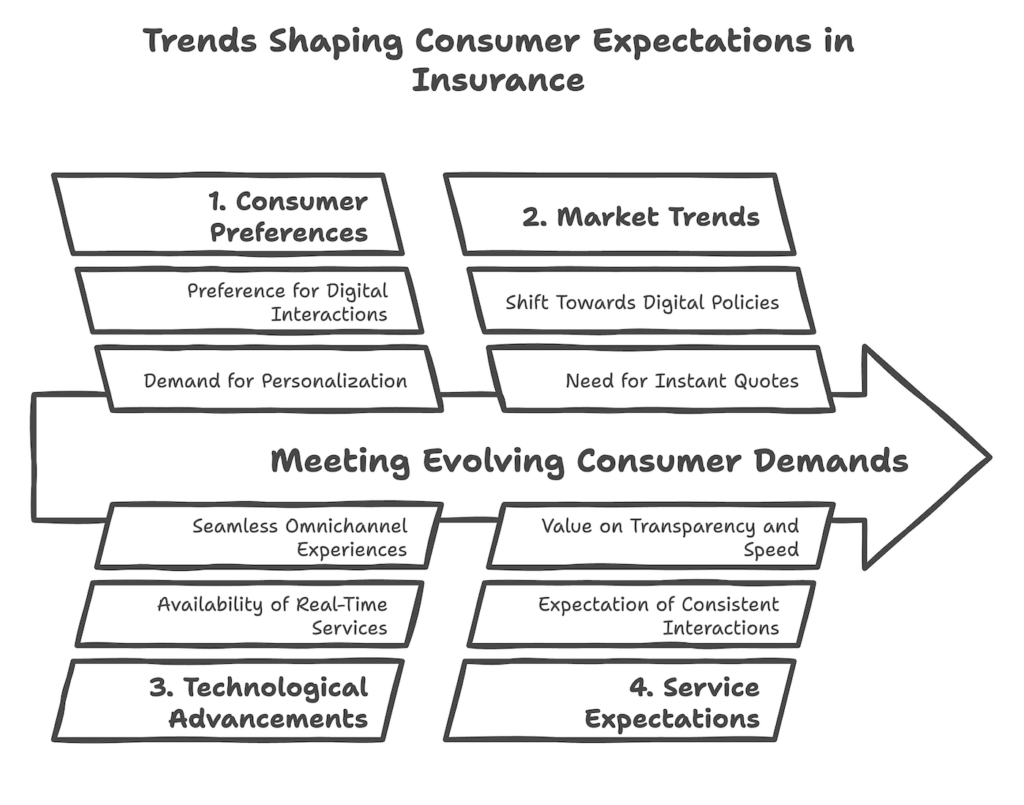

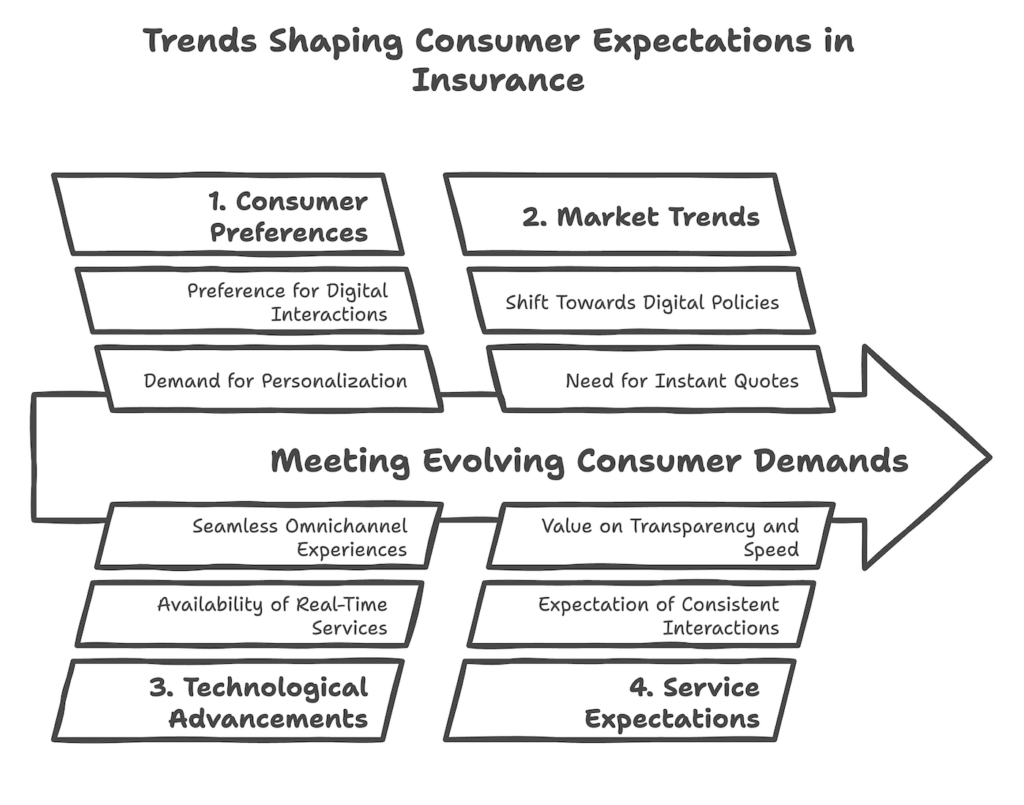

Various shifts in technology, user behaviour are shaping the demands and expectations consumers have on brands and how good and services are delivered.

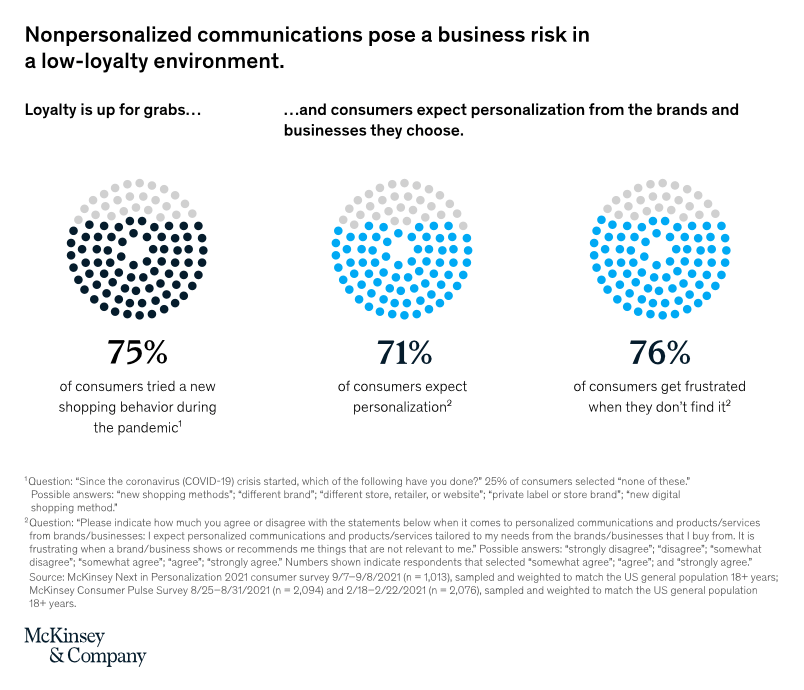

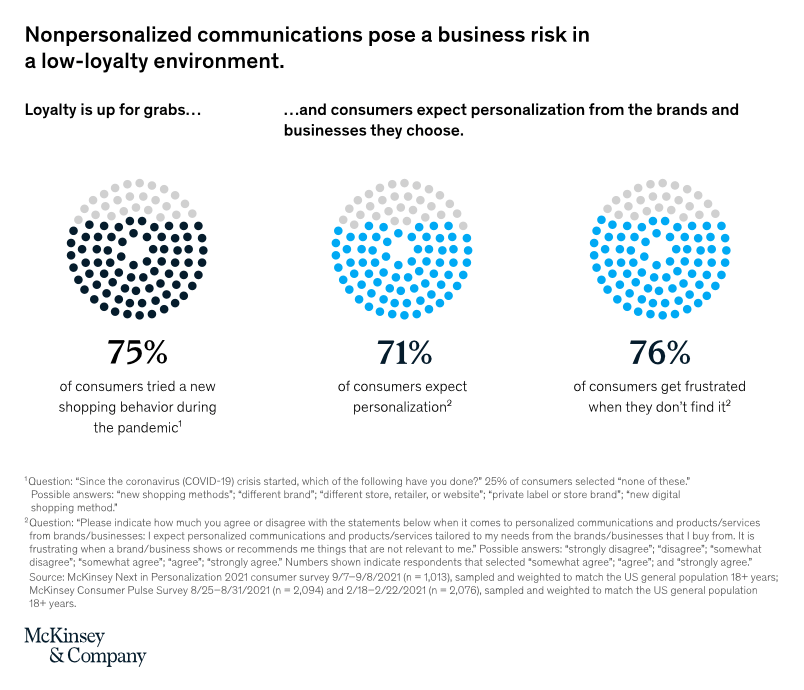

McKinsey found that 71% of customers expect personalised and consistent interactions across departments, such as contact centres and social media. They value seamless, omnichannel experiences that are swift, transparent, and user-friendly. Today’s consumer demands convenience and immediacy, often preferring digital interactions over traditional in-person meetings or phone calls. The demand for real-time services extends to instant quotes, digital policies, and personalised offerings.

Today’s consumer also demands convenience and immediacy, often preferring digital interactions over traditional in-person meetings or phone calls. The demand for real-time services extends to instant quotes, digital policies, and personalised offerings.

The growing impatience because of increasingly prevalent real-time experience erodes customer loyalty, especially when brands struggle with delivering truly authentic personalised services, as shown in McKinsey’s report.

Overcoming Challenges Of Traditional Operational Processes

Navigating these shifting expectations can be daunting, particularly for companies entrenched in traditional operational methods.

The inefficiencies of manual, paper-based processes can no longer be ignored. According to Deloitte, automating administrative tasks can reduce time spent on manual operations and improve productivity by up to 37% by 2025. This inefficiency detracts from the customer experience, adversely affecting satisfaction and retention rates.

Scalability is another concern. Relying on a large workforce to manage paperwork doesn’t just inflate operational costs; it hampers agility, making it harder to respond to market changes and evolving consumer demands.

How Modern Distribution Solutions Help Meet Customer Expectations

But there is a path forward—one that embraces digital transformation and leverages the power of modern distribution solutions.

Technologies such as AI and automation can revolutionise inefficiencies. Consider the innovative example of Lemonade: by employing AI in their claims process, they reduced claim handling time from days to seconds.

Data-driven personalisation is another powerful tool. Accenture reports that 92% of customers are willing to share personal data with brands to offer personalised recommendations. Leveraging big data allows us to tailor offerings, enhance customer interactions, and build lasting relationships.

Embracing Change: Steps to Modernise Distribution

Adoption of technology and a commitment to modernisation are paramount and require a conscious. methodical holistic approach:

- Start by investing in the latest digital tools and forming strategic tech partnerships.

- Training your workforce to adeptly use these systems is crucial in ensuring smooth transition and operation.

- Streamline your processes by automating administrative tasks and integrating comprehensive digital onboarding and servicing platforms.

- Lastly, enhance customer engagement by developing consumer-centric digital touchpoints and actively listening to feedback

- Empower your customers with self-service options and real-time support, ensuring they feel valued and in control.