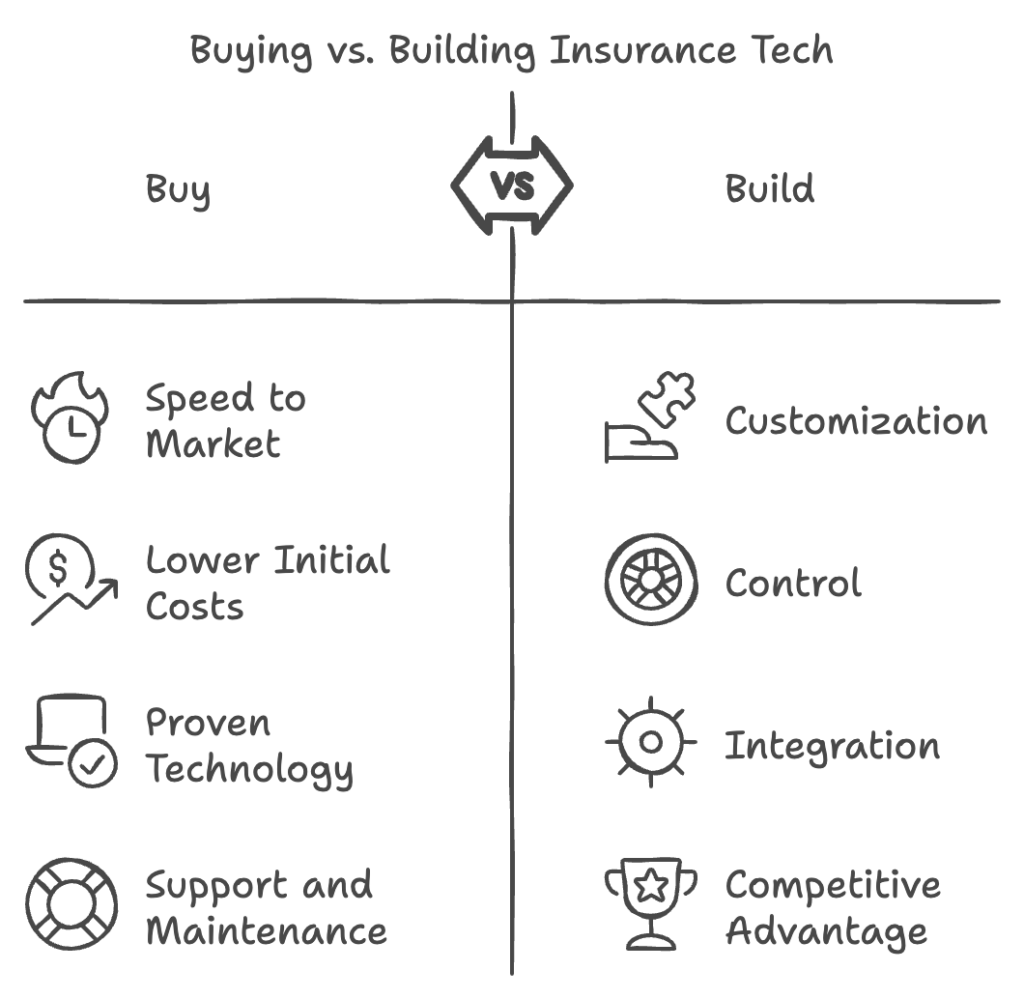

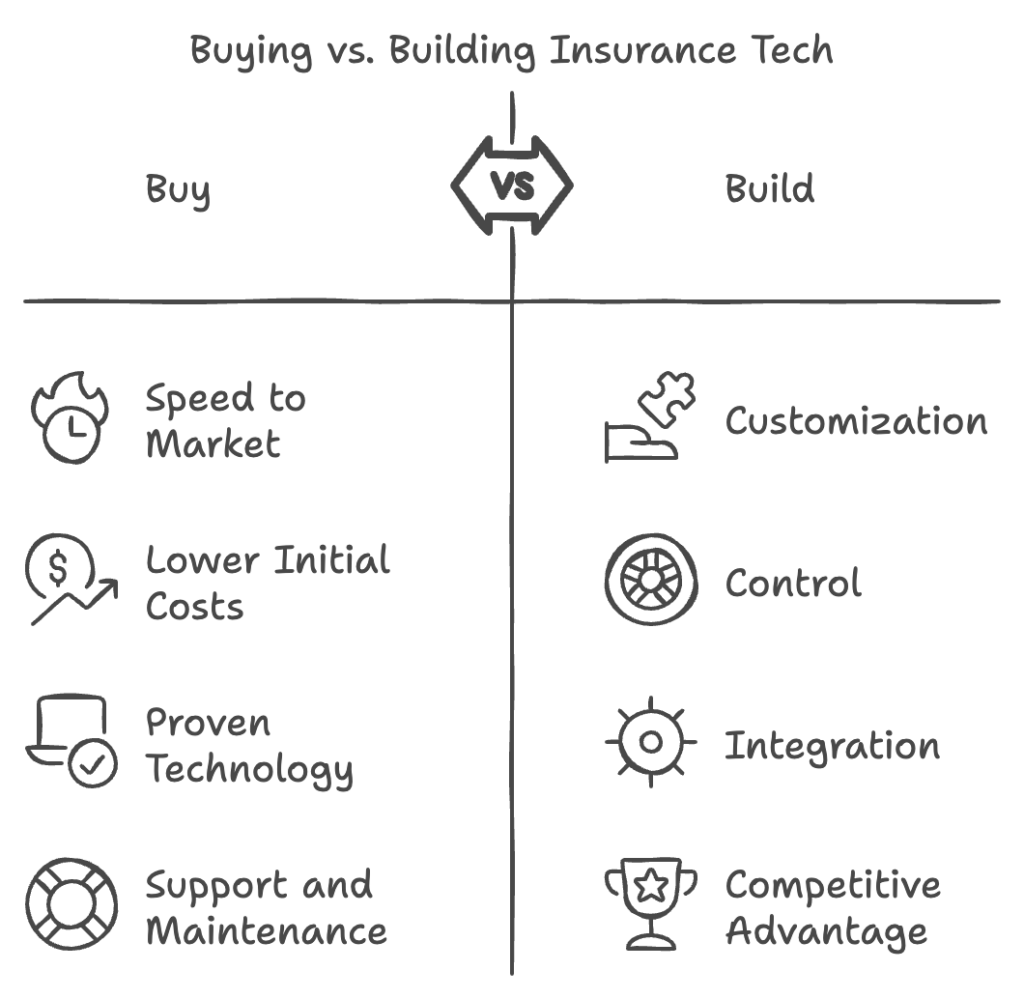

Insurance companies face a critical decision when undergoing digital transformation: should they build custom technology solutions in-house or purchase ready-made solutions from insurtech providers? This article explores the key considerations for both approaches, helping decision-makers navigate this complex choice.

Buying Insurance Tech Solutions

Buying off-the-shelf solutions can be an attractive option for many insurance companies. Here are some advantages:

- Speed to Market: Purchasing a ready-made solution allows companies to implement technology quickly, enabling them to respond to market demands and regulatory changes faster.

- Lower Initial Costs: Often, buying a solution can be less expensive upfront compared to the costs associated with developing a custom solution from scratch.

- Proven Technology: Established solutions typically come with a track record of performance and reliability, reducing the risk associated with new technology.

- Support and Maintenance: Vendors usually provide ongoing support and updates, which can alleviate the burden on internal IT teams.

Building Insurance Tech Solutions

On the other hand, building a custom solution has its own set of benefits:

- Customization: Tailored solutions can be designed to meet specific business needs and workflows, providing a better fit for unique operational requirements.

- Control: Companies have full control over the development process, allowing for adjustments and enhancements as business needs evolve.

- Integration: Custom solutions can be built to seamlessly integrate with existing systems, improving overall efficiency and data flow.

- Competitive Advantage: A unique solution can differentiate a company in a crowded market, potentially leading to a stronger market position.

Key Considerations

When deciding between buying and building insurance tech solutions, consider the following factors:

1. Cost Analysis

- Initial Investment: Compare the upfront costs of purchasing a solution versus the development costs of building one.

- Long-term Costs: Factor in ongoing maintenance, support, and potential upgrades for both options.

2. Time to Market

- Assess how quickly you need the solution. If immediate implementation is crucial, buying may be the better option.

3. Customization Needs

- Determine how much customization is necessary. If your requirements are highly specific, building may be the way to go.

4. Scalability

- Consider future growth. Will the solution scale with your business? Evaluate whether a purchased solution can adapt to your evolving needs.

5. Internal Expertise

- Assess your team’s capabilities. Do you have the necessary skills to build and maintain a custom solution, or would it be more efficient to rely on a vendor?

6. Vendor Reliability

- Research potential vendors thoroughly. Look for reviews, case studies, and testimonials to ensure you choose a reliable partner.

Conclusion

The decision to buy or build insurance tech solutions is not straightforward and requires careful consideration of various factors. By evaluating cost, time, customisation, scalability, and internal expertise, insurance companies can make a strategic choice that aligns with their long-term goals. Ultimately, the right decision will depend on the unique circumstances and priorities of each organisation.