Embracing technology is no longer optional; it is essential for gaining a competitive advantage. Digital tools and platforms enable insurers to streamline operations, enhance customer interactions, and improve overall efficiency. Organisations that leverage these innovations can not only meet but exceed customer expectations, setting themselves apart in a crowded marketplace.

This article aims to equip senior leaders with actionable strategies to navigate the complexities of digital transformation and optimise their distribution channels. By focusing on practical solutions, we will explore several essential approaches that can drive meaningful change in your organisation and position you for future success.

Review the customer journey, plan improvements based on their pain points and read the data

To successfully transform your insurance distribution, it is crucial to comprehend the complete customer journey—starting from the first interaction with your brand through to policy renewal. This understanding enables you to pinpoint critical touch points and tailor your offerings to better meet customer needs.

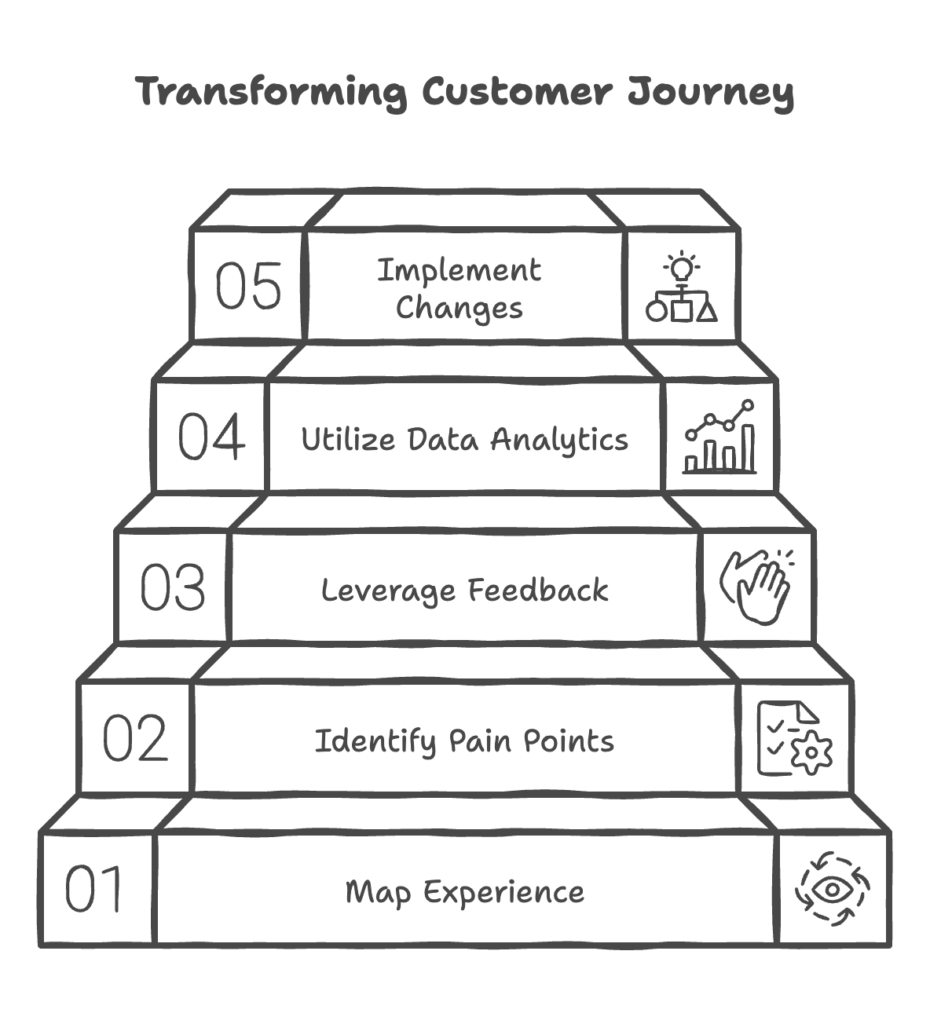

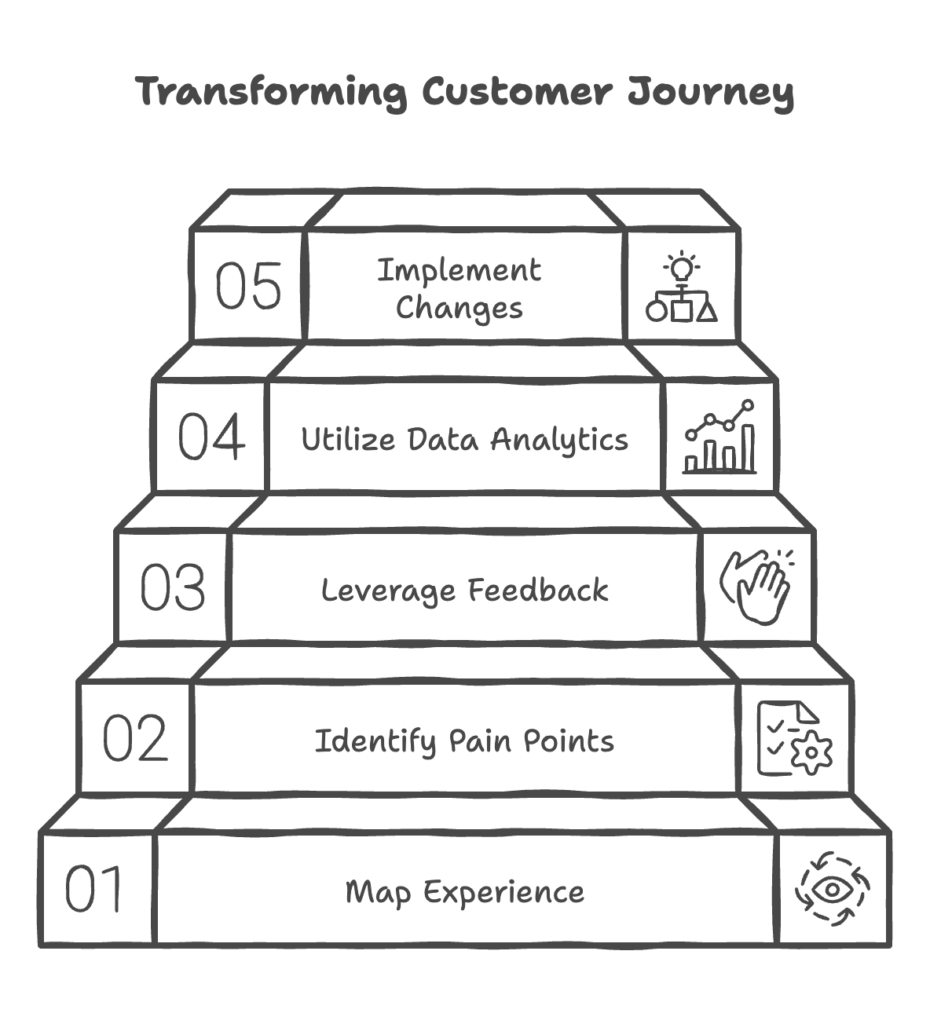

Key Steps to Analyse the Customer Journey:

1. Create a visual representation of the customer journey

This includes every stage, from awareness and consideration to purchase and renewal. By mapping these stages, you can identify where customers engage with your brand and where they may experience friction.

2. Identify your customers’ pain points in the journey

Review the journey map to highlight areas where customers encounter difficulties. For example, is the application process too lengthy? Are there delays in policy issuance? Understanding these pain points is essential for making impactful improvements.

3. Leverage customer feedback for “hidden” pain points

Regularly collect and analyse feedback from customers through surveys, interviews, and social media. Their insights can reveal common frustrations, expectations, and “hidden” pain points. Listening to your customers is vital for fostering loyalty and enhancing satisfaction.

4. Study data analytics for trends and patterns

Use data analytics tools to gather insights on customer behaviour and preferences. Look for trends in your data that reveal how customers interact with your distribution channels. For example, if most customers prefer online interactions, consider enhancing your digital platforms.

5. Implement improvements to your customer journey based on findings

Based on the insights gained from customer feedback and analytics, make targeted improvements to your distribution strategy. This could involve streamlining the application process, enhancing communication during claims, or providing more personalised policy recommendations.

By thoroughly understanding the customer journey, insurance companies can create a seamless experience that not only meets but exceeds customer expectations. This approach not only enhances customer satisfaction but also drives retention and referrals—key metrics for measuring success in the insurance industry. Remember, a customer-centric strategy is not just about selling policies; it’s about building long-term relationships that foster trust and loyalty.

Leverage omnichannel distribution to reach your customers where they prefer

In today’s insurance market, providing a seamless experience across multiple channels—whether online, mobile, or in-person—is crucial for meeting customer expectations. As consumers increasingly interact with brands through various platforms, insurers must ensure that their distribution strategy reflects this shift.

By leveraging an omnichannel distribution strategy, insurers can enhance customer engagement and satisfaction, leading to improved retention rates and increased sales. In a competitive landscape, a well-integrated approach not only meets customer expectations but also differentiates your brand as a leader in delivering exceptional service. The outcome is clear: a seamless omnichannel experience fosters loyalty and drives long-term success.

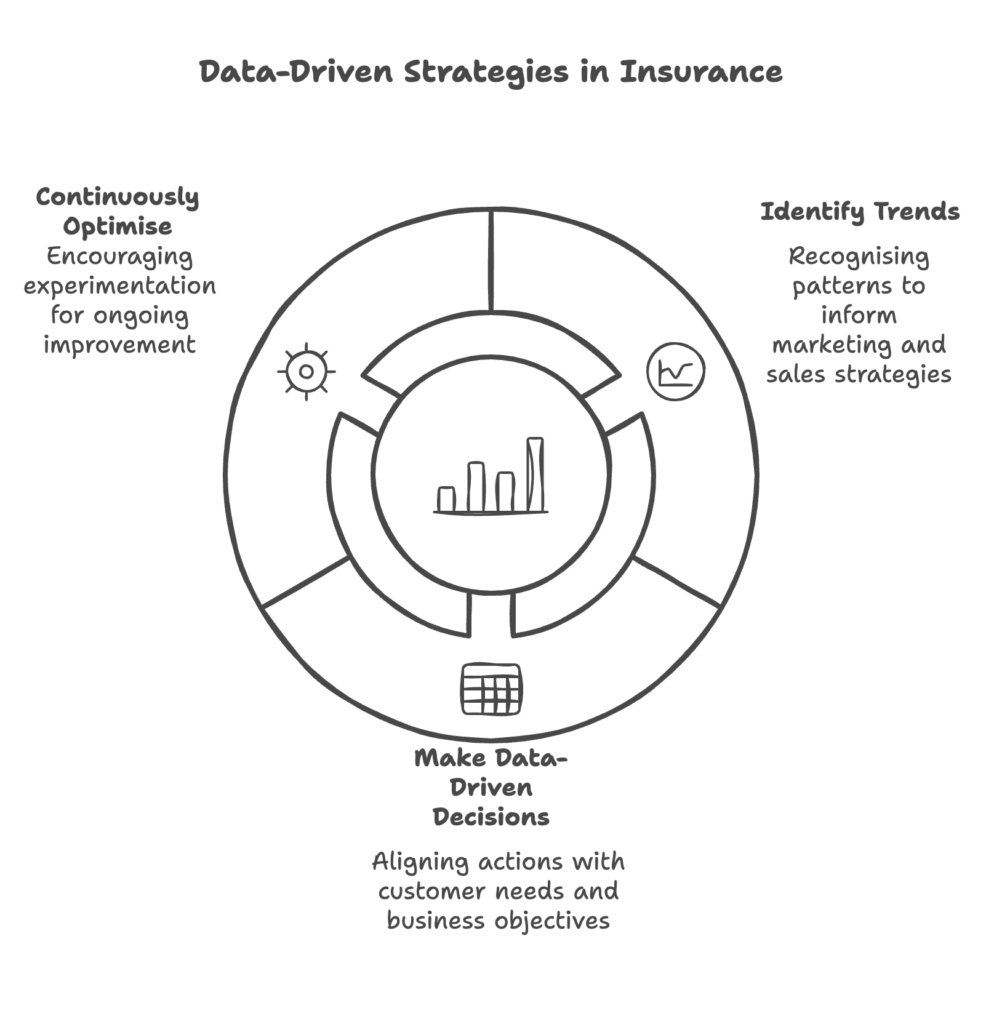

Embrace Data Analytics for Decision Making

Leveraging data analytics is essential for making informed strategic decisions that enhance insurance sales and service delivery. By harnessing insights from customer interactions and operational performance, insurers can identify trends, optimise processes, and ultimately drive revenue growth.

Ensure your team has the skills to analyse and interpret data effectively. Invest in training for staff on data analytics tools and techniques, enabling them to:

- Identify Trends: Recognise patterns in customer behaviour that can inform marketing and sales strategies.

- Make Data-Driven Decisions: Use analytics to back up strategic choices, aligning actions with customer needs and business objectives.

- Continuously Optimise: Encourage a culture of experimentation where team members can test new ideas based on data insights, leading to ongoing improvement.

Invest wisely in digital tools and platforms that solve immediate or near-term business needs

In today’s insurance landscape, investing in digital tools and platforms is crucial for enhancing customer engagement and streamlining operations. That said, not all digital tools and platforms are suitable, and it’s important to invest wisely in the ones that can solve specific business challenges. Here are key considerations to keep in mind:

Seamless integration with existing systems

Ensure that any new digital solutions can seamlessly integrate with your current systems. This reduces disruption and enhances overall functionality, allowing your team to leverage existing data and processes effectively. New tools that don’t integrate directly with your current systems through, for example, APIs, might cause more headache than good.

Scalability of Solutions

Choose digital tools that can grow with your business. Consider whether the platform can handle increased data volume or additional features as your needs evolve over time, thus protecting your investment.

Security and Compliance

Evaluate the security measures in place to protect sensitive customer data. Ensure that any digital tool complies with industry regulations and standards to avoid potential legal issues and build customer trust.

Analytics and Reporting Capabilities

Look for platforms that offer robust analytics and reporting functions. These capabilities should provide actionable insights into customer behaviour, sales trends, and operational performance, enabling data-driven decision-making.

Vendor Support and Reputation

Research the vendor’s track record and support services. A reliable partner can provide ongoing support and updates, ensuring that your investment remains relevant and effective. Their track record in the insurance industry plays a big part in whether they understand your business as well.

By prioritising these factors, you can select digital tools that not only meet immediate needs but also support long-term growth and adaptability in the evolving insurance market. The right investments can lead to improved customer interactions, increased market penetration, and ultimately, a stronger competitive position.

Optimise Your Agent and Broker Networks

To enhance the effectiveness of your distribution partners, leveraging technology is essential. Optimisation can significantly improve sales performance and customer satisfaction. Here are key considerations to guide your strategy:

Implement Performance Tracking Systems

Some agency businesses rely on data that only get updated at the end of every month, making decision making tough and based on stale data. Adopt systems that allow for real-time performance tracking. This will help you monitor agents’ progress against set targets, enabling timely interventions when needed. Data-driven insights can reveal best practices and areas requiring additional support.

Run Targeted Marketing Campaigns

Utilise data analytics tools to segment your customer base and identify high-potential markets. By understanding customer preferences and behaviours, you can equip your agents and brokers with tailored marketing strategies that resonate with specific demographics, driving more effective outreach and sales.

Incorporate Gamification Elements

Introduce gamification into your incentive programs to motivate agents and brokers. By establishing leaderboards, rewards for reaching milestones, and friendly competitions, you can increase engagement and drive performance while making the sales process more enjoyable. More complex gamification would typically require a mobile app and robust infrastructure to execute.

Streamline Onboarding Processes

Optimise the onboarding experience for new agents and brokers by creating a structured and efficient program. This can include automated training modules, mentorship pairings, and easy access to resources. A smooth onboarding process helps new hires become productive faster, enhancing overall network performance. This is where a mobile app with real-time data syncs and updates would make onboarding more effective and pleasant for your agents.

For example, Igloo Agent, our agency management solution, is a tested and proven solution that helped Igloo scale insurance distribution through sales intermediaries across three markets in the Southeast Asian region, boasting over 15,000 users. It has helped the business optimise, manage, streamline and optimise performance.

Measure Success and Adapt Strategies According to Results

To ensure the success of your distribution initiatives, it’s crucial to implement systems that track the effectiveness of your new strategies. By regularly assessing performance metrics, you can make informed decisions that drive growth and enhance customer satisfaction.

Appropriate channel sales growth tracking and attribution

Monitor sales performance across different channels such as offline placements, agents and direct-to-consumer sources. This will help identify top performers and areas needing improvement. Use this data to refine your incentive programs and resource allocation. The attribution model for each channel should be adapted accordingly as well to ensure fair and effective comparison. For example, offline touch points are harder to attribute sales to, so offline-to-online sales conversion systems should be put in place.

Customer satisfaction surveys across channels

Regularly gather feedback from customers regarding their experience with your agents, brokers, and even customer service staff. This can be done through surveys or direct outreach. High satisfaction scores correlate with higher renewal rates and can highlight effective engagement strategies to improve repeat sales.

Regular market share analysis to understand market positioning

Keep an eye on your market position relative to competitors. Understanding shifts in market share can inform strategic decisions about where to focus your distribution efforts. External and macro factors can sometimes demand adaptation to the evolution of customer needs.

Sound strategy with room for flexibility and changes

Be prepared to pivot your strategies based on the insights gathered from these metrics. If certain approaches are not yielding the expected results, adapt quickly to new methods that may resonate better with your agents or customers.

By continuously measuring success and remaining flexible, your organisation can enhance its distribution capabilities, improve operational efficiency, and ultimately drive sales growth. This proactive approach positions you to respond effectively to changing market conditions and customer expectations.

Start transforming your insurance distribution approach today

Transforming insurance distribution through technology is no longer a luxury; it’s a necessity for staying competitive in today’s dynamic market. It’s crucial for executives to assess their current distribution strategies and identify areas for improvement.

Are you ready to transform your insurance distribution and stay competitive in today’s fast-paced market? Connect with Igloo to discover how we can help you implement agile, data-driven strategies that enhance operational efficiency and drive sales growth.