Gartner’s Top Strategic Technology Trends for 2026 make it clear: the mandate is building with AI, not just using it. The report highlights “AI-Native Development Platforms,” predicting by 2030, 80% of organizations will run with smaller, AI-augmented engineering groups.

For APAC’s insurers, this is a survival plan.

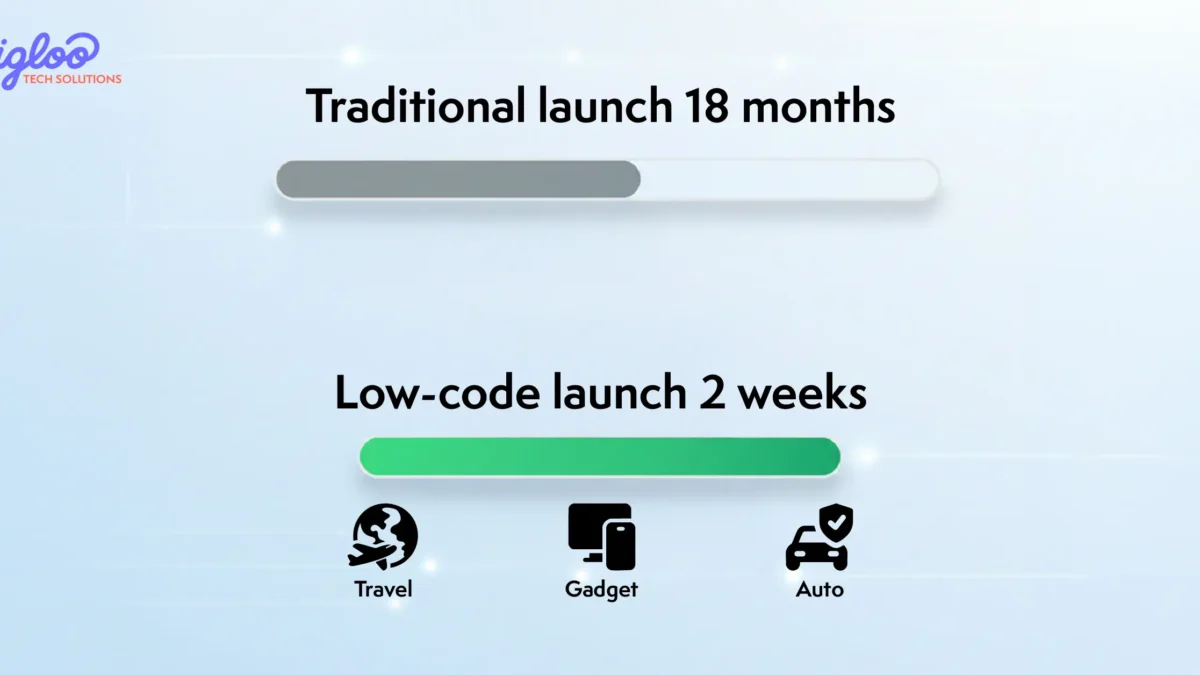

Ask an insurer in the Philippines or Vietnam about partnering with an e-commerce platform. The enthusiasm is often killed by the engineering team’s timeline. A new launch can take 12-18 months, a non-starter for tech partners.

This is because traditional core systems are monolithic ‘systems of record’. A modern low-code core is the opposite: an agile, API-first ‘system of innovation’ for rapid integration.

It’s the new stack for GTM speed.

The High Cost of “Business as Usual”

Traditional core systems were built for stability, not speed. They are complex, expensive to maintain and require specialised, legacy coding languages.

This creates two massive problems:

- Paralysed Go-to-Market (GTM): Launching a simple embedded insurance product—like gadget protection on an e-commerce site—becomes a massive integration project.

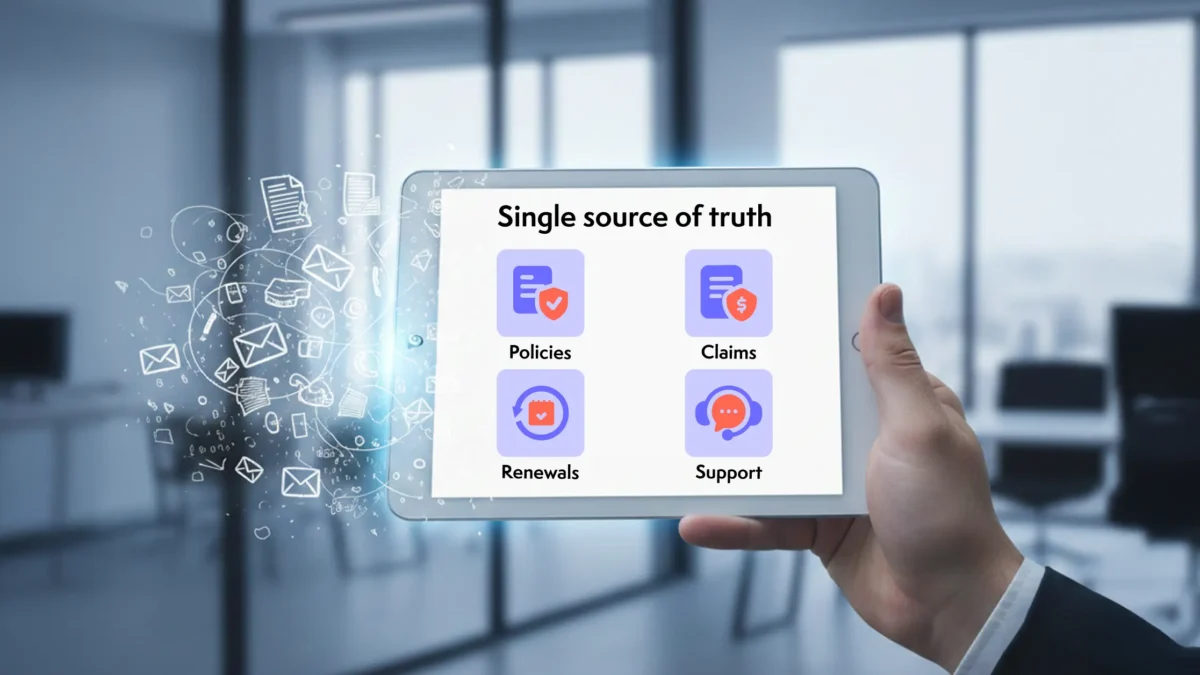

- Inefficient Operations: Processes like claims and underwriting are bolted onto this old core, forcing reliance on manual work, spreadsheets, and disconnected systems.

In the fast-paced APAC market, this operational drag is untenable. Digital-native consumers expect instant, app-based experiences. Super-apps and ride-hailing companies won’t wait a year for an insurer to build a custom API. They will find a partner who can move in weeks.

The New Core: How LCNC and AI Work Together

This is where the new stack changes the model entirely through its low-code platform and AI engine.

Think of it as the difference between building a house from scratch (and all the concrete, wiring, and plumbing) and assembling a high-tech, prefab home. LCNC provides the pre-built, configurable modules (APIs, UI, workflows), while AI provides the intelligent automation (eg. underwriting, claims) that runs inside it.

1. Low-Code: The GTM Accelerator

Low-code platforms are built on an API-first architecture. This means they are designed to connect to other systems easily, acting as a flexible ‘engagement layer’ that can sit on top of or even bypass the old core.

Instead of coding from zero, an insurer’s business team can use a visual interface to “drag and drop” components to build and launch a new insurance product. This compresses the product development lifecycle from over a year to a matter of weeks.

Suddenly, partnering with a new travel app in Vietnam or a digital wallet in Indonesia isn’t an 18-month engineering project. It’s a quick configuration. This is the engine that makes scalable B2B2C distribution models and embedded insurance possible.

2. AI: The Operations Engine

But a fast GTM is undermined if the operations behind it are still bogged down by manual processes. This is where AI is integrated. An AI engine automates the high-volume, low-complexity tasks that consume massive manhours.

For example, when a claim is filed for that new embedded product, AI can:

- Instantly verify policy details against the record.

- Use optical character recognition (OCR) to read receipts or damage photos.

- Run fraud checks against a pre-set rules engine.

- Approve and trigger payment for simple, low-value claims in seconds.

This frees human teams to handle the complex, high-empathy cases where they add the most value. It’s not about replacing people; it’s about augmenting them to manage a high-volume digital business.

From System of Record to System of Innovation

When you combine a low-code GTM with AI-powered operations, the entire business model shifts.

Insurers are no longer just product manufacturers. They become agile, tech-enabled partners who can co-create and deploy dozens of micro-insurance products across a wide ecosystem. They can test a new product, see if it works, and scale it or shelve it without a massive sunk cost.

A recent report from BCG highlights AI’s tangible impact, noting insurers can cut claims costs by 20% and speed processing by 50%. Since legacy cores can’t, the key is an LCNC and AI stack with backwards compatibility. Platforms like Igloo Tech Solutions enable this, offering a practical way to achieve these capabilities without a high-risk core replacement.

The question for insurers is no longer if they should modernize, but how. The monolithic approach is broken. The future belongs to platforms that are flexible, intelligent, and built for partnership.

Is Your Core System an Anchor or an Engine?

The ability to say “yes” to a new digital partner in APAC is the new competitive benchmark. A modern, low-code platform is the foundation for that “yes.”

Igloo offers a SaaS-based insurance-as-a-service platform, providing the exact capability for insurers and partners to build and scale new products at the speed of the digital economy.

Ready to boost revenue and improve efficiency? Stop letting your core system be an anchor. Connect with Igloo’s Tech Solutions team to discuss how our SaaS-based low-code platform fast-tracks your GTM, scales distribution, and streamlines operations—all aligned with your specific distribution model and regulatory environment across APAC.