Work as a full-time Ignite agent

The insurance landscape in Southeast Asia

As we delve deeper into the global digital era, Ignite, with its extensive selection and user-friendly platform, is poised to be a game changer. By bridging the gap between agents and a large body of uninsured individuals, Ignite lays the foundation for considerable financial benefits. Welcome Ignite. Welcome Growth.

Steps to become an Ignite full-time agent

4 simple steps to start selling insurance products to your clients and hit milestones to get extra incentives.

Step 1

Kickstart Your Ignite Journey: Sign up today and unlock your potential.

Step 2

Empower Yourself: Engage in our comprehensive training

Step 3

Accelerate Your Success: Boost your earnings, and make your mark with each sale.

Step 4

Build Leadership: Assemble your team and generate passive income.

Step 1

Kickstart Your Ignite Journey: Sign up today and unlock your potential.

Step 2

Empower Yourself: Engage in our comprehensive training

Step 3

Accelerate Your Success: Boost your earnings, and make your mark with each sale.

Step 4

Build Leadership: Assemble your team and generate passive income.

Benefits of being an Ignite agent

Why Ignite?More Prospects with Small Premium General Insurance

Starting with low-premium general insurance products could serve as an ideal stepping stone to eventually introducing customers to life insurance products. Offering low-cost, high value policies can not only build trust but also set customers on the path for larger life insurance commitments.

This approach is especially effective in Vietnam’s burgeoning market, where first-time buyers may feel more at ease with smaller, manageable commitments.

Tailored Solutions for Upselling Current Customers

One of the most significant opportunities lies in upselling to existing customers. As a life insurance agent, your relationship with current clients puts you at an advantageous position to understand their needs better.

Every interaction can unveil scope for upselling, and with Ignite’s diverse insurance offerings, possibilities are only multiplied. A casual conversation can reveal a customer’s need for general insurance coverage, such as car, health, home, or travel insurance, creating the perfect upselling opportunities.

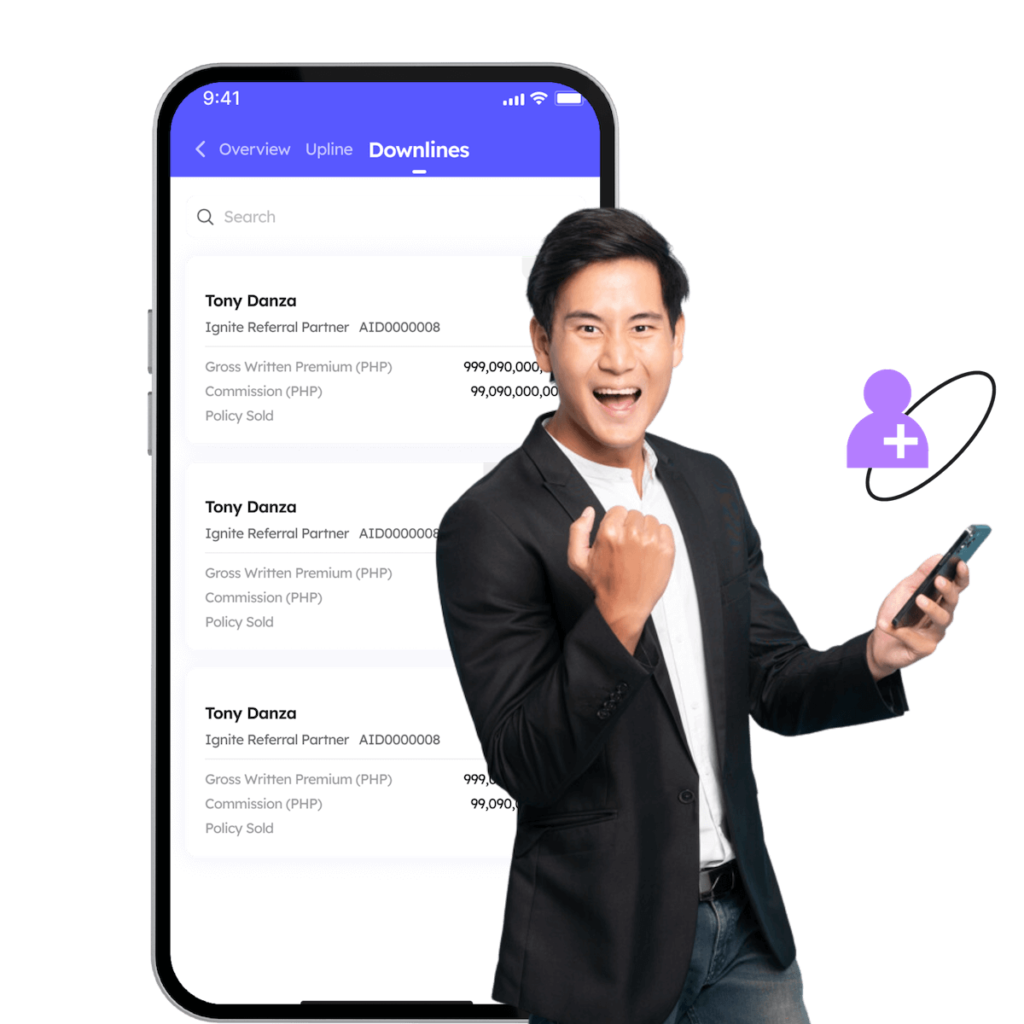

Sell Anywhere, Manage Everything

Experience the convenience that Ignite adds to your operations. With Ignite, geographical limitations should no longer hamper your potential – the app enables agents to sell beyond borders while managing their entire team within a single app. From recruitment and training to policy management and customer communication, Ignite encompasses all, fostering a seamless workflow that saves time and decreases operational costs.

What a full-time Ignite agent said

“Our work entails face-to-face meetings with clients and this usually takes time because traffic jams are so bad. And this client-facing is just one aspect of our job, we need to attend to time-consuming processes for onboarding clients, claims settlement, appraisal, and more.”

An insurance agent using Ignite from Indonesia

Frequently asked questions about being a full-time Ignite agent

Who can sign up with Ignite by Igloo to refer insurance products?

You can be an Ignite agent if you’re a local resident in your country above the age of 18 and own a smartphone. Whether you’re an office worker, a student, a housewife, a retiree, a travel agent, or an insurance partner, you can refer to various insurance products with the Ignite by Igloo app, at your own time, from wherever you are.

What's special about App Ignite?

By giving agents the ability to conveniently cross sell different types of insurance in a single app, Ignite helps an agent become the go-to trusted source for their client’s wider insurance needs, creating more opportunities to earn the commissions that will propel their own success. We also offer a faster and simpler sales and claims process, making the agent’s job more rewarding than ever before. This is how Ignite helps:

- Sell multiple insurance products in one app, even remotely

- A wide range of carefully selected insurance providers

- Simple, easy, fully digitized sales and claims process

- Secure payment processing. Transact with confidence

What type of information that I need from customers to issue a policy?

It depends on the product type that your customer will buy. The essential information includes:

- Customer name

- DOB

- ID number

- Address

- Phone number

- Policy term

What will happen when my customer's policy expires? Does Ignite have a reminder?

The feature of a reminder of premium payment time/reminder of the end of the insurance period/reminder of renewal… is available in the application to support you in taking care of your customers. Don’t forget to notify your loyal customers about the validity period, reminders to renew…and this is also the chance for you to increase your income.

Can I change premium and coverage period after payment?

Depending on the product that the customer participates in, the insurance premium & term can be changed.

How do I know I have successfully purchased insurance on Ignite by Igloo?

When the partner completes filling in the information provided by the customer & pays the insurance premium successfully, the COI is sent to the email registered in the contract. At the same time, the status of policy issuance will be updated in the Referrals sections.

How long will a policy be issued?

Depending on the insurance product, the time to issue the COI will be different; the customer receiving the COI after completing the payment will range from 5 minutes to 24 hours. You can also contact your Manager at Ignite by Igloo for assistance if your customr still needs to receive the COI.

How do my customers check the Terms & Conditions of the product?

Terms and conditions of the product will be sent to the customer’s email along with the COI.

My customer has already joined an insurance plan. Would he/she be able to join a similar product distributed on Ignite?

Insurance products help protect customers against accidental risks or losses in life; your customer can own many other insurance products with additional benefits besides those they already purchased. Diverse product offerings on Ignite by Igloo are for you to discover.

Join Ignite now!

Interested to find out more about Ignite? Get in touch with us with this form.