In the current insurance landscape where digital experiences are increasingly preferred by customers, the way products are distributed plays a crucial role in determining the success and profitability of insurance companies. Today, insurers must adapt their distribution strategies to meet these expectations or risk missing revenue opportunities and a loss of market share to more agile competitors.

The Hidden Costs of Inefficient Insurance Distribution

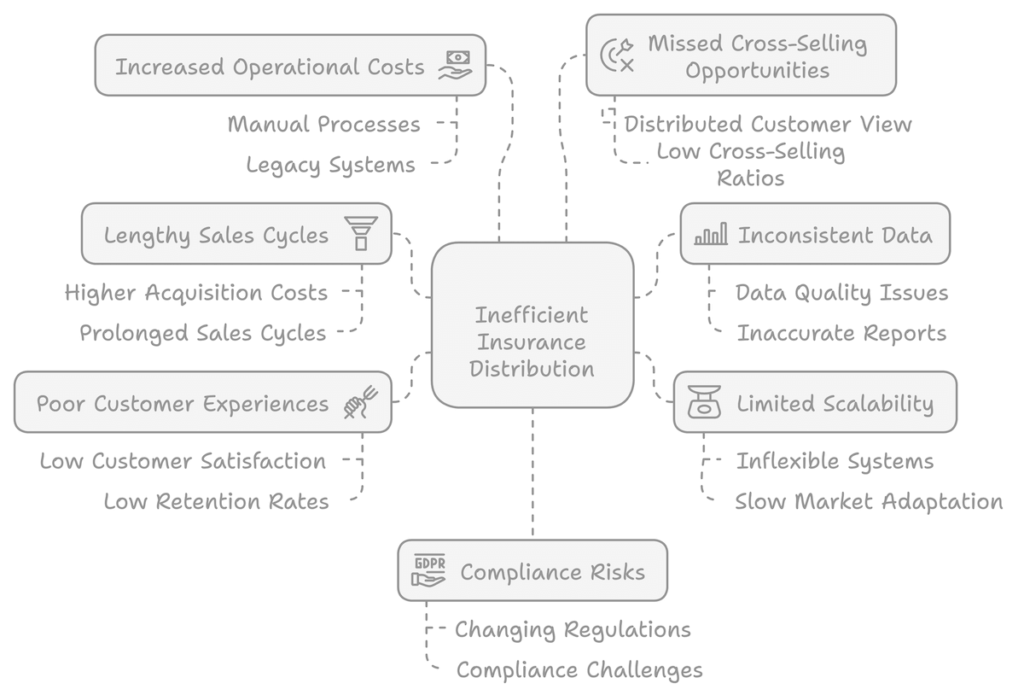

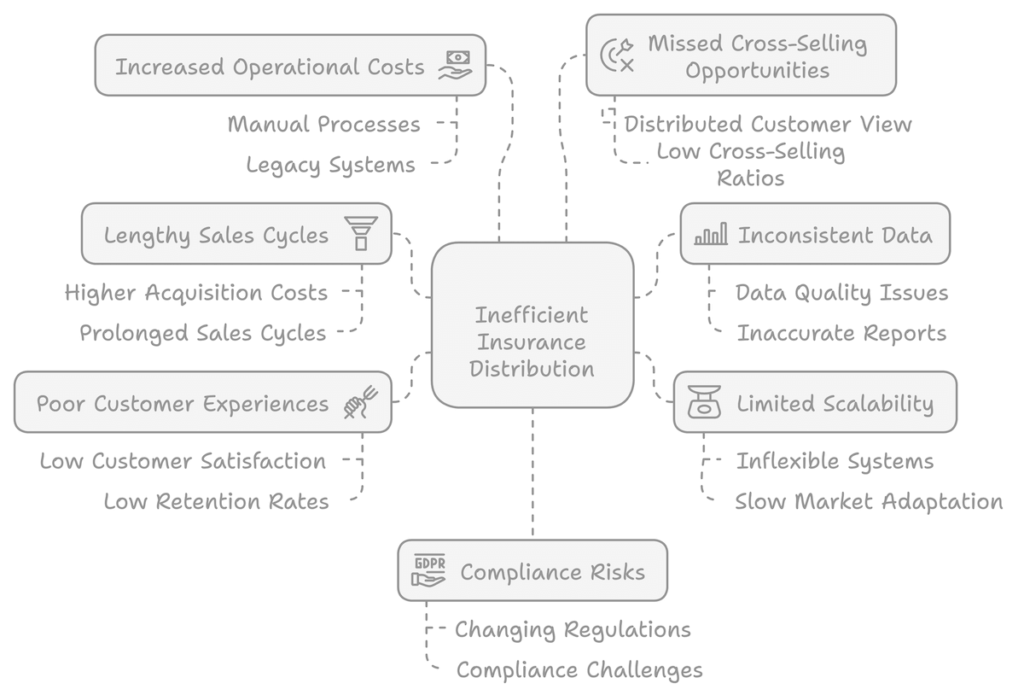

Many insurance companies still rely on outdated distribution methods, such as manual paperwork, siloed systems, and inefficient processes. These inefficiencies can lead to a host of challenges, including:

- Lengthy sales cycles and high customer acquisition costs

- Inconsistent data and difficulty in generating accurate reports

- Limited scalability and inability to adapt to changing market conditions

- Poor customer experiences and low retention rates

These hidden costs can have a significant impact on an insurer’s bottom line. A recent study found that inefficient distribution practices can result in up to 20% of lost revenue for insurance companies. Additionally, the operational costs associated with maintaining outdated systems and processes can eat into profits and hinder growth.

Lengthy sales cycles and high customer acquisition costs

Inefficient distribution methods often result in prolonged sales cycles, which can significantly increase customer acquisition costs. According to a study by Accenture, inefficient processes can increase the cost of acquiring a new customer by up to 30%.

Statistics: The average cost of customer acquisition in the insurance industry is $900, but this can be much higher for companies with inefficient processes (Insurance Information Institute, 2020).

Inconsistent data and difficulty in generating accurate reports

When distribution systems are not integrated, data inconsistencies become common, leading to challenges in generating accurate reports and making informed decisions.

Statistics: A survey by Deloitte found that 67% of insurance executives cited data quality and availability as a major challenge in their digital transformation efforts.

Limited scalability and inability to adapt to changing market conditions

Outdated distribution systems often lack the flexibility to scale operations or quickly adapt to market changes, putting insurers at a competitive disadvantage.

Statistics: McKinsey reports that insurers with agile distribution models can reduce their time-to-market for new products by up to 40%.

Poor customer experiences and low retention rates

Inefficient distribution often leads to subpar customer experiences, resulting in lower customer satisfaction and retention rates.

Statistics: According to J.D. Power, overall customer satisfaction with insurance providers increased by 13 points (on a 1,000-point scale) when digital channels were effectively integrated into the distribution process.

Increased operational costs

Manual processes and legacy systems require more manpower and maintenance, leading to higher operational costs.

Statistics: A report by Gartner suggests that insurance companies can reduce operational costs by up to 30% by implementing modern, efficient distribution systems.

Missed cross-selling and upselling opportunities

Without a unified view of customer data, insurers often miss out on valuable opportunities to cross-sell or upsell products.

Statistics: McKinsey found that insurers with efficient, data-driven distribution models can increase their cross-selling ratios by up to 20%.

Compliance and regulatory risks

Inefficient distribution systems may struggle to keep up with changing regulations, exposing insurers to compliance risks.

Statistics: A survey by Wolters Kluwer found that 47% of insurance companies cited keeping up with changing regulations as a major challenge, which can be exacerbated by inefficient distribution systems.

These hidden costs can have a significant cumulative impact on an insurer’s profitability and competitiveness. A study by Boston Consulting Group found that insurers with efficient distribution models achieved 5-10% higher growth rates and 3-5% higher profitability compared to their peers with less efficient models.

By addressing these inefficiencies, insurance companies can not only reduce costs but also improve customer satisfaction, increase sales, and gain a competitive edge in the market.

Exploring Potential Solutions

To overcome the challenges of inefficient insurance distribution, insurers must embrace modern solutions that streamline processes, improve data accessibility, and enhance the customer experience. Some potential solutions include:

Implementing a unified distribution platform that integrates with core systems and provides real-time data insights.

- Automating manual processes through the use of robotic process automation (RPA) and artificial intelligence (AI).

- Adopting a multi-channel distribution strategy that leverages digital channels such as mobile apps, chatbots, and online portals.

- Investing in data analytics and machine learning to gain deeper insights into customer behaviour and preferences.

Get Started On Improving Insurance Distribution

Igloo has developed an unrivalled track record and expertise in working across the insurance value chain to unlock revenue growth for insurance companies, insurance sales intermediaries and consumer platforms.

That’s why we’ve developed a suite of modern distribution solutions designed to help companies streamline processes, expand distribution, improve data accessibility, and enhance the customer experience.

To learn more about how our solutions can help your organization drive revenue growth and stay competitive, schedule a demo today.

Don’t let inefficient distribution hold you back – take the first step towards modernizing your insurance distribution strategy with us!