For the last decade, the insurance industry in Asia has faced a paradox.

Massive demand exists. Millions of consumers in Vietnam, Indonesia, and the Philippines are buying their first high-end smartphones and booking domestic flights online. These consumers want protection for these purchases.

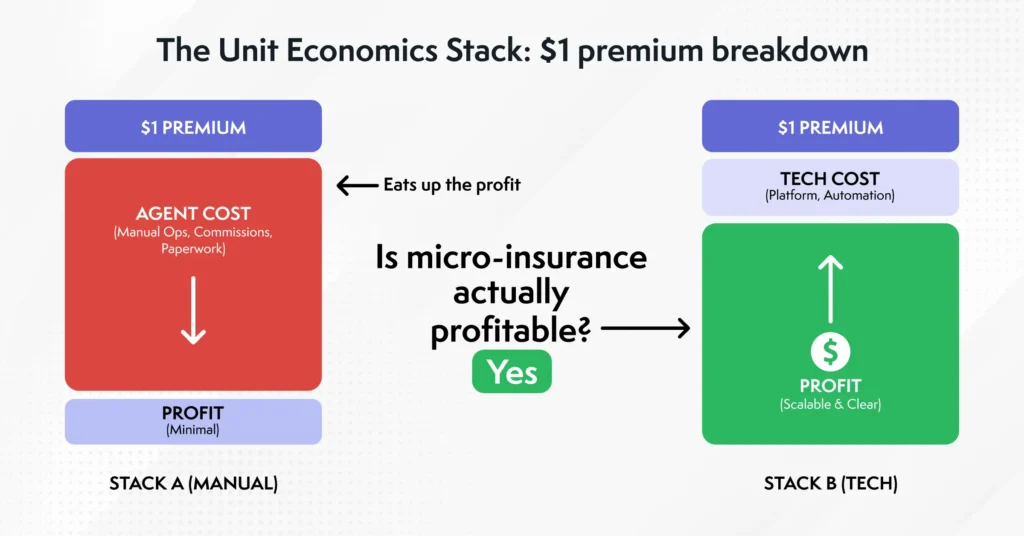

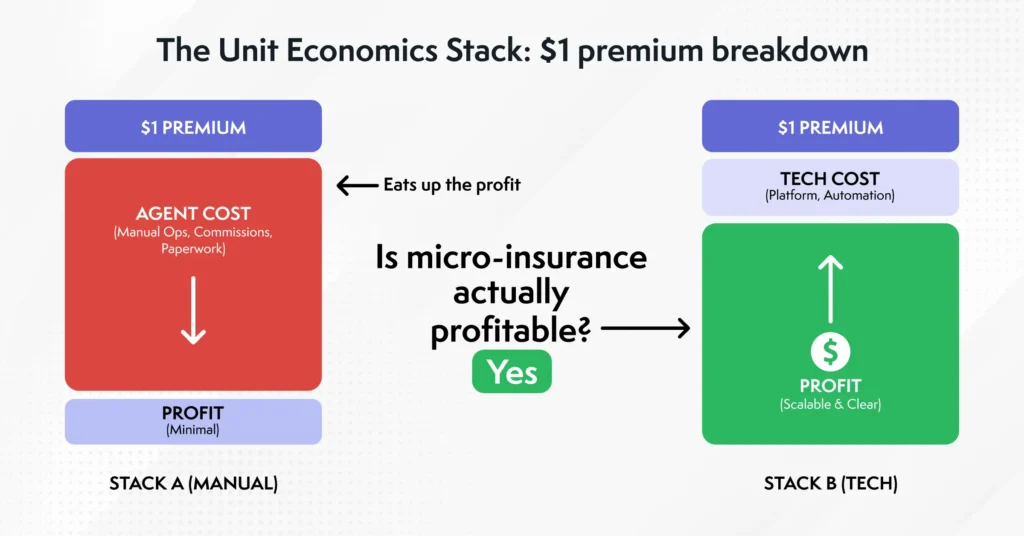

Yet, supply remains virtually zero. Traditional insurance agents cannot afford to sell a screen protection policy for a $3 premium. The commission on such a sale is mere cents, while the cost of driving to meet the client, filling out paperwork, and processing the payment costs dollars.

The maths fails the agency channel.

E-commerce platforms stepped in to solve this puzzle. By embedding micro-insurance directly into the checkout flow, they cracked the code on distribution economics. They turned a product that the industry previously ignored due to high overhead into a high-margin revenue stream that scales with every click.

The Unit Economics of the “Add-On”

The magic of embedded e-commerce insurance lies in the dramatic reduction of Customer Acquisition Cost (CAC).

In a traditional model, an insurer pays for marketing, commissions, and branch operations. To cover these costs, the policy premium must be substantial, usually hundreds of dollars.

In the embedded model, the customer acquires the core product (e.g., a laptop on Shopee or Lazada) first. The insurance offer rides on the rails of that existing transaction.

- Marketing Cost: $0. The customer is already in the checkout funnel.

- Sales Cost: $0. The “agent” is a simple checkbox.

- Processing Cost: Near-zero. The API handles binding and payment instantly.

Even after factoring in the platform’s commission, the near-zero acquisition cost means the insurer can offer coverage for as little as $1 or $2 and still generate a healthy profit margin.. This opens access to a massive “long tail” of insurable risks, such as shipping loss, screen cracks, and extended warranties, that traditional insurers could never profitably underwrite.

Even after factoring in the platform’s commission, the near-zero acquisition cost means the insurer can offer coverage for as little as $1 or $2 and still generate a healthy profit margin.

Deloitte confirms this shift, forecasting that embedded models will divert billions in premiums away from traditional channels by 2030 as insurers bypass these legacy distribution costs.

Context: The Ultimate Sales Driver

Beyond economics, e-commerce platforms possess a psychological advantage that agents lack: Context.

Traditional insurance sales often feel intrusive because they interrupt the customer’s life. Cold-calling someone to sell accident insurance creates high friction. However, offering “Shipping Protection” the moment a customer worries about their package getting lost creates low friction. Offering “Gadget Protection” the moment a customer spends a month’s salary on a new phone provides help, not annoyance.

The offer functions as a feature of the product, not a sales pitch.

This contextual relevance drives conversion rates that dwarf traditional digital marketing. Consumers consistently show a high preference for purchasing protection from trusted e-commerce brands at the point of sale. While a banner ad for insurance might see a 0.5% click-through rate, a well-placed embedded checkbox captures significantly higher consumer intent.

The Need for Speed vs. Legacy Latency

For e-commerce giants, Gross Merchandise Value (GMV) and conversion speed take priority. Anything that slows down the checkout process poses an existential threat.

This creates a conflict with traditional insurance infrastructure. Legacy insurance core systems move slowly; they might take seconds to rate a risk. In the e-commerce world, a 2-second delay in page load time causes cart abandonment rates to spike.

The engineering team at an e-commerce platform will never approve an integration that introduces latency.

This is why the tech stack matters. To play in this space, insurers cannot rely on internal legacy cores. They need a digital insurance core that doubles up as a middleware layer like Turbo, specifically designed for high-volume, low-latency e-commerce transactions.

This technology must:

- Ingest cart data (Item value: $500, Category: Electronics).

- Rate risk instantly.

- Return a dynamic price ($3.50 premium).

- Bind the policy upon payment success.

It must execute all of this in milliseconds, ensuring the shopper never sees a loading spinner.

Trust: The Hidden GMV Booster

For the platform, the benefit of embedded insurance extends beyond commission revenue. It drives the core business.

Insurance builds trust, and trust drives GMV.

Consider a customer in rural Indonesia debating whether to buy a high-end refrigerator online. They hesitate. What if it arrives dented?

If the platform offers an affordable “100% Protection Plan” at checkout, that hesitation vanishes. The insurance acts as a trust bridge, giving the consumer confidence to complete the purchase.

Data supports this: Leading industry analysis highlights that embedded financial services directly increase basket sizes and customer lifetime value for merchants. Customers spend more when they know their investment is safe.

The Future: From Static to Dynamic

We currently operate in “Phase 1” of embedded e-commerce insurance: static attachment. (e.g., Buying a phone? Add insurance.)

The next wave will be Dynamic Personalisation. All powered by AI.

- Risk-Based Pricing: Instead of a flat fee, the API analyses return history to offer a personalised premium.

- Hyper-Segmentation: A customer buying baby formula receives a “Family Health Starter Pack” offer.

- Behavioural Triggers: A customer who abandoned a cart due to shipping costs receives a retargeted “Free Shipping Insurance” offer.

Solving the Puzzle Together

The “Protection Gap” in Asia never stemmed from a lack of demand.The industry simply failed at distribution. Swiss Re estimates this gap at $390 billion in Asia alone.

E-commerce platforms provided the highway to reach these millions of customers. Now, insurers must provide the vehicle.

Insurers must stop viewing micro-insurance as “small change.” McKinsey projects the embedded insurance market in Asia to reach $270 billion by 2030. In the volume game of the digital economy, these small transactions add up to billions in revenue. But capturing this value requires leaving the legacy mindset behind.

Igloo Tech Solutions enables this transition. Our low-code, API-first platform allows insurers to plug directly into the region’s largest e-commerce ecosystems, delivering milliseconds-fast protection that drives revenue for you and trust for your partners.

Ready to Scale Your Digital Distribution?

The e-commerce checkout represents the most valuable real estate in the digital economy. Connect with Igloo’s Tech Solutions team to discuss how our platform can help you secure your spot and turn high-volume traffic into high-margin protection.