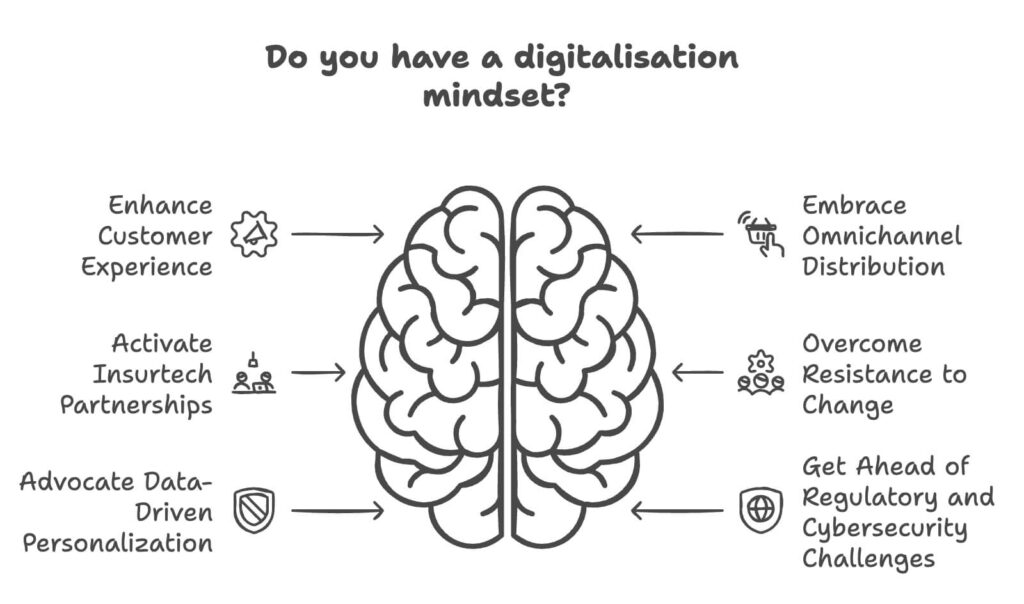

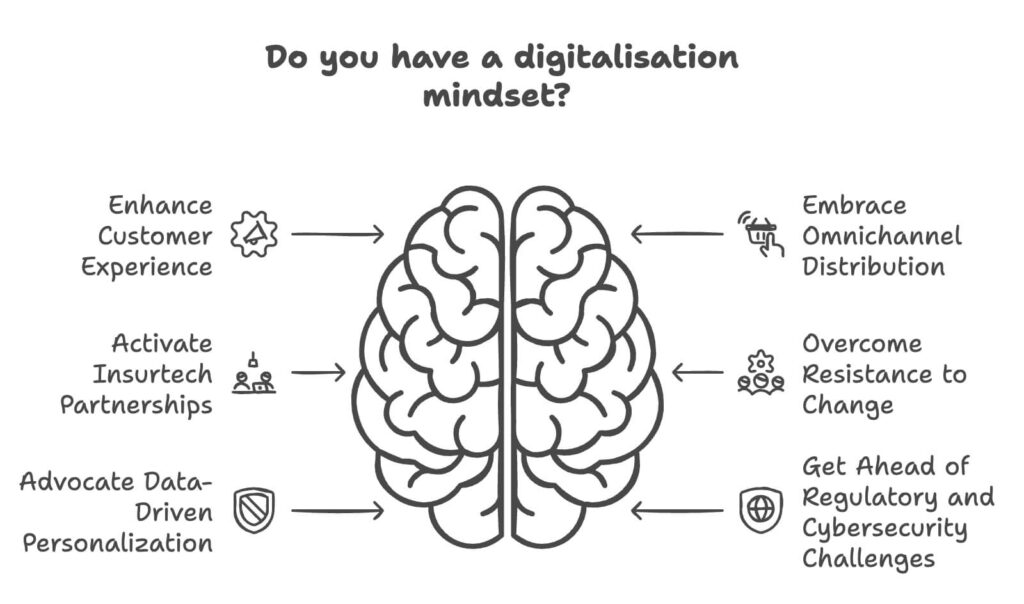

The insurance industry is undergoing a seismic shift, driven by changing customer expectations, technological advancements, and intense market pressures. Customers today demand personalised experiences, seamless interactions, and round-the-clock accessibility, challenging traditional distribution models.

The proliferation of digital technologies, such as artificial intelligence, machine learning, and data analytics, has opened up new avenues for insurance companies to streamline operations, enhance customer engagement, and gain a competitive edge.

Moreover, the rise of insurtech firms and disruptive business models has intensified the need for established players to embrace digital transformation. Digitally-led insurers have outperformed their traditional counterparts, capturing higher growth rates and improved profitability. To remain relevant in this rapidly evolving landscape, insurance companies must prioritise modernising their distribution strategies, leveraging innovative solutions to meet the demands of tech-savvy customers and stay ahead of the competition.

1. Enhancing Customer Experience with Technology

The insurance industry is leveraging the power of artificial intelligence (AI), machine learning (ML), and data analytics to revolutionise customer experiences. By harnessing these cutting-edge technologies, insurers can personalise products, streamline operations, and improve customer engagement.

AI and ML algorithms can analyse vast amounts of customer data, including demographics, behaviour patterns, and preferences, to create highly tailored insurance offerings. This level of personalisation not only enhances customer satisfaction but also increases the likelihood of retaining and attracting new customers.

As McKinsey & Company suggests, AI will reshape claims, distribution, and underwriting processes, enabling insurers to provide more personalised and efficient services.

2. Embracing Omnichannel Distribution

In the digital age, customers expect seamless interactions across multiple channels and touchpoints. An omnichannel distribution strategy is crucial for insurance companies to meet these evolving expectations. By integrating various platforms such as websites, mobile apps, social media, and physical branches, insurers can create a unified and consistent customer experience.

Omnichannel strategies allow insurers to capture and organise customer data accurately, enabling personalised interactions and targeted offerings [https://diceus.com/how-to-achieve-omnichannel-cx-insurance/]. This approach dramatically increases customer satisfaction and conversion rates, as customers can seamlessly transition between channels without losing context or data [https://www.wavestone.com/en/insight/omnichannel-strategy-how-insurance-companies-ensure-a-successful-path-into-the-future/].

Implementing an effective omnichannel strategy involves building a personalised sales experience, creating action-based insurance products, and fostering effective customer relationship management. By embracing omnichannel distribution, insurance companies can enhance customer engagement, improve retention, and gain a competitive edge in the market.

3. Activate Insurtech Partnerships: A Gateway to Innovation

The Global InsurTech Report for Q2 2024 by Gallagher Re highlights the growing prominence of B2B insurtech companies, with 57.41% of property and casualty (P&C) insurtech deals going to these firms in the second quarter of 2024. This trend underscores the increasing demand for insurtech solutions that can be seamlessly integrated into existing insurance operations.

Insurtech partnerships can unlock a wide range of benefits, including:

- Access to cutting-edge technologies: Insurtech companies are pioneering the use of artificial intelligence (AI), machine learning, and advanced data analytics to revolutionise risk assessment, pricing, and claims processing.

- Innovative business models: Insurtech startups are challenging traditional insurance models by introducing new approaches, such as on-demand insurance, peer-to-peer models, and usage-based pricing.

- Accelerated digital transformation: Insurtech companies are inherently digital-native, with a deep understanding of modern technology stacks and agile development methodologies.

However, it is crucial for insurance companies to carefully evaluate potential insurtech partners, considering factors such as their technology capabilities, market fit, scalability, and alignment with the company’s strategic goals.

4. Overcoming Resistance to Change

One of the significant hurdles in modernising insurance distribution is the resistance to change within traditional insurance firms. Many established companies have deeply entrenched processes and mindsets, making it challenging to embrace digital transformation. However, overcoming this resistance is crucial to adapt in the current dynamic climate.

To address this challenge, a comprehensive change in management strategy is essential. Effective communication and education are key to aligning stakeholders with the vision for digital transformation. Leaders must clearly articulate the benefits of adopting new technologies, such as improved customer experiences, operational efficiencies, and competitive advantages. Providing training programs and resources can help employees understand and embrace the new technologies and processes.

By proactively addressing resistance to change and implementing effective strategies, insurance companies can pave the way for a successful digital transformation, enabling them to stay ahead in the rapidly evolving market.

5. Advocate Data-Driven Personalisation

In today’s customer-centric landscape, personalisation is key to delivering exceptional experiences and fostering loyalty in the insurance sector. By leveraging data analytics and big data technologies, insurers can gain invaluable insights into customer behaviour, preferences, and needs. This wealth of data enables companies to move beyond generic, one-size-fits-all offerings and tailor insurance products and services to individual customers.

As highlighted by ThoughtWorks, data is increasingly recognised as a strategic asset for insurers, empowering them to deliver highly personalised customer experiences. By harnessing the power of big data and advanced analytics, insurers can unlock a deeper understanding of their customer base, enabling them to anticipate needs, identify cross-selling opportunities, and proactively address pain points.

6. Get Ahead of Regulatory Changes and Cybersecurity

As the insurance industry embraces digital transformation, navigating regulatory requirements and addressing data privacy concerns become paramount. The evolving cyber threat landscape, including ransomware, social engineering, and third-party breaches, demands robust cybersecurity measures to safeguard customer data and maintain compliance.

Insurers must prioritise the implementation of comprehensive cybersecurity strategies, encompassing advanced threat detection, incident response protocols, and employee training programs. Compliance monitoring and management systems play a crucial role in keeping track of regulatory requirements, ensuring adherence to data protection laws and industry standards.