For the last decade, the Southeast Asian digital economy was defined by a single mandate: growth at all costs. Super apps in Indonesia, Vietnam, and the Philippines burned cash to acquire users, subsidising rides and offering massive discounts on food delivery.

That era is over.

Today, for market leaders, the mandate has shifted to profitability. With scale secured, the priority moves from acquisition to increasing the Average Revenue Per User (ARPU) of the ecosystem you already have. This is where ancillary revenue becomes critical.

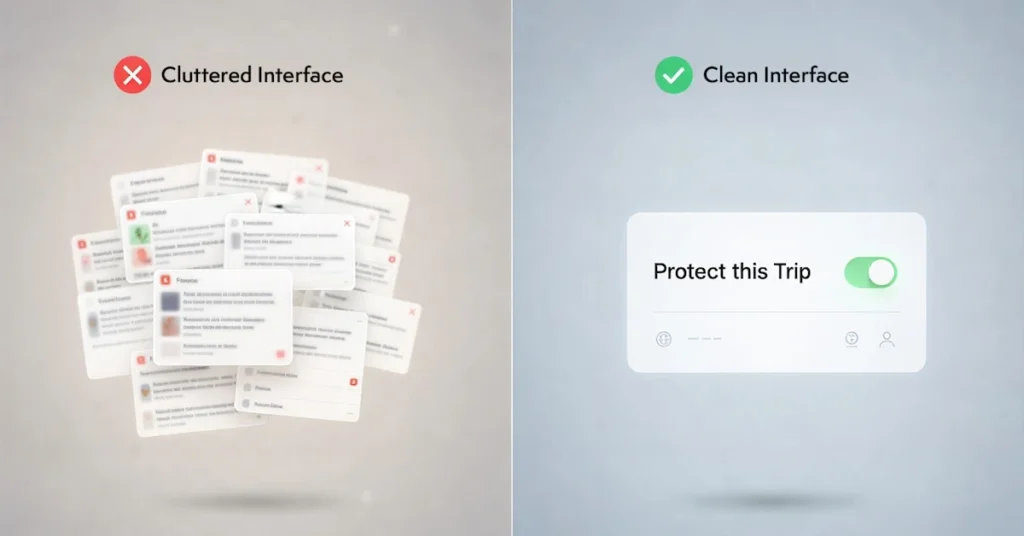

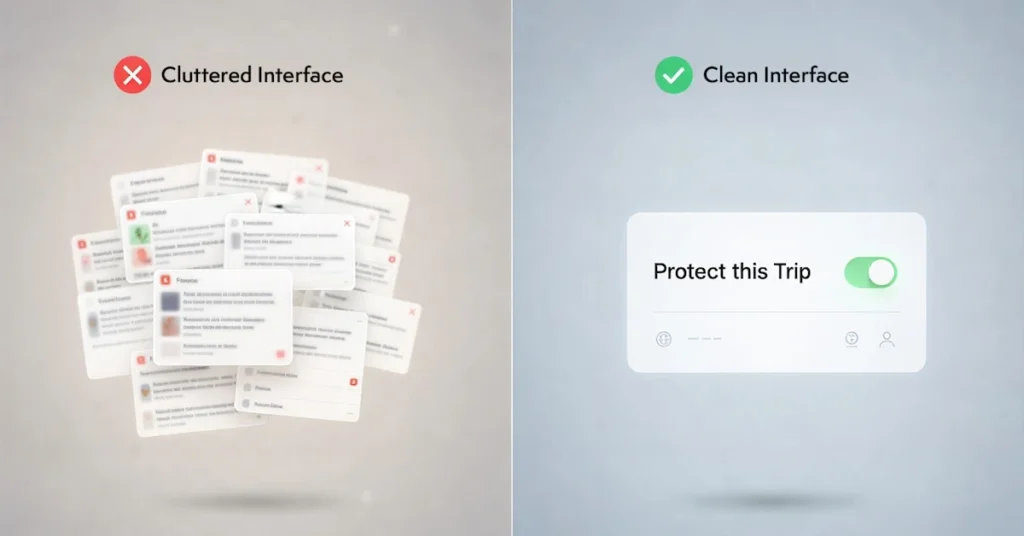

But here lies the tension: Product Managers are terrified of “feature bloat.” They worry that adding more services will clutter the interface, increase friction, and ultimately drive users away.

This fear is valid for ads or cross-selling unrelated products. But embedded insurance is different. When executed correctly, protection doesn’t hurt the User Experience (UX); it actually completes it.

Here is the blueprint for how Super Apps are using embedded insurance to drive revenue without breaking the user journey, and how insurers can frame the conversations with them.

The “Feature Bloat” Fallacy

There is a misconception in UI/UX design that “less is always more.” While minimalism is good, utility is better.

If a user is booking a flight from Manila to Singapore during the monsoon season, they aren’t just buying a seat; they are buying the expectation of arrival. If you offer them flight delay protection within the booking flow, you aren’t cluttering the screen. You are addressing a specific anxiety relevant to that exact moment.

Relevance reduces friction.

When insurance is presented as a standalone product in a “Financial Services” tab, it feels like an upsell. It feels like a chore. But when it is embedded as an add-on during checkout (e.g., “Protect this purchase for $5”), it is perceived as a feature of the core product.

Data supports this. In e-commerce, offering return shipping protection has been shown to increase conversion rates, not decrease them. Why? Because it removes the hesitation of “What if this doesn’t fit?”

The Economics of Micro-Premiums

The reason traditional insurers failed to penetrate the digital economy early on was a mismatch in unit economics. An insurer looking for $500 annual premiums cannot service a user buying a $4 bubble tea or a $10 ride.

Super Apps operate on high frequency and low transaction values. The insurance model had to adapt to match this.

This is where “sachet” insurance—or micro-insurance—wins. By breaking coverage down to the transaction level (e.g., covering a single ride, a single shipment, or a screen crack protection plan for one month), the premium becomes negligible to the user.

The magic lies in the attachment rate, not the premium size.

Consider a ride-hailing app in Jakarta handling 2 million rides a day. If they offer a “Ride Safety” add-on for 1,000 IDR (approx. $0.06 USD), and achieve a 20% attachment rate, they are generating significant daily ancillary revenue with zero inventory cost.

For the platform, this is pure margin. For the user, the cost is so low it bypasses the psychological barrier of “spending money.”

Context is King: The “Right Time” Strategy

The success of embedded insurance relies entirely on context. You cannot effectively sell a comprehensive life insurance policy when someone is merely ordering a burger.

To monetise protection without hurting UX, the offer must match the user’s immediate intent.

- The Travel Booking: The user is worried about cancellations or lost bags. Offer: Travel delay and baggage protection.

- The Gadget Purchase: The user is worried about dropping their new phone. Offer: Screen crack protection or extended warranty.

- The Bill Payment: The user is worried about cash flow. Offer: Bill protection in case of income loss.

This requires a tech stack capable of ingesting real-time data to serve the right policy at the right millisecond. It requires dynamic pricing that adjusts risk based on the specific user and transaction. Static, one-size-fits-all policies do not work in a dynamic Super App environment.

Turning Claims into Retention Tools

The biggest risk to UX isn’t the sale; it’s the claim.

Historically, insurance claims are painful. Forms, phone calls, and weeks of waiting. If a Super App integrates an insurance partner that acts like a traditional insurer, they risk destroying their brand equity.

If a user buys shipping protection on an e-commerce platform and the package arrives damaged, that user expects the resolution to be as fast as the purchase was.

Automated claims are the retention engine.

Leading platforms are now using parametric insurance and AI-driven claims processing to settle payouts instantly. If a flight is delayed, the system knows immediately and triggers a voucher or refund to the user’s e-wallet. No forms required.

When a user experiences a claim paid out in seconds, their trust in the platform skyrockets. They don’t just become an insured user; they become a loyal one.

The Path Forward

For Super Apps in Southeast Asia, the race for profitability is a race for relevance.

Ancillary revenue through embedded insurance offers a unique path: it monetises risk in a way that benefits the user. It moves the platform relationship from purely transactional (“I buy this from you”) to relational (“You protect me when I buy this”).

The blueprint is clear: keep it relevant, keep it micro, and keep it fast. Don’t sell insurance; sell the confidence to transact.Connect with the Igloo Tech Solutions team to see how our SaaS infrastructure allows insurers and Super Apps to deploy dynamic, embedded protection that feels native to your platform.