The insurance industry is facing unprecedented challenges and opportunities. Traditional distribution models are becoming increasingly outdated, and insurers who fail to adapt risk being left behind. If you’re still relying on old-school methods to sell your insurance products, it’s time for a serious makeover. Here’s why:

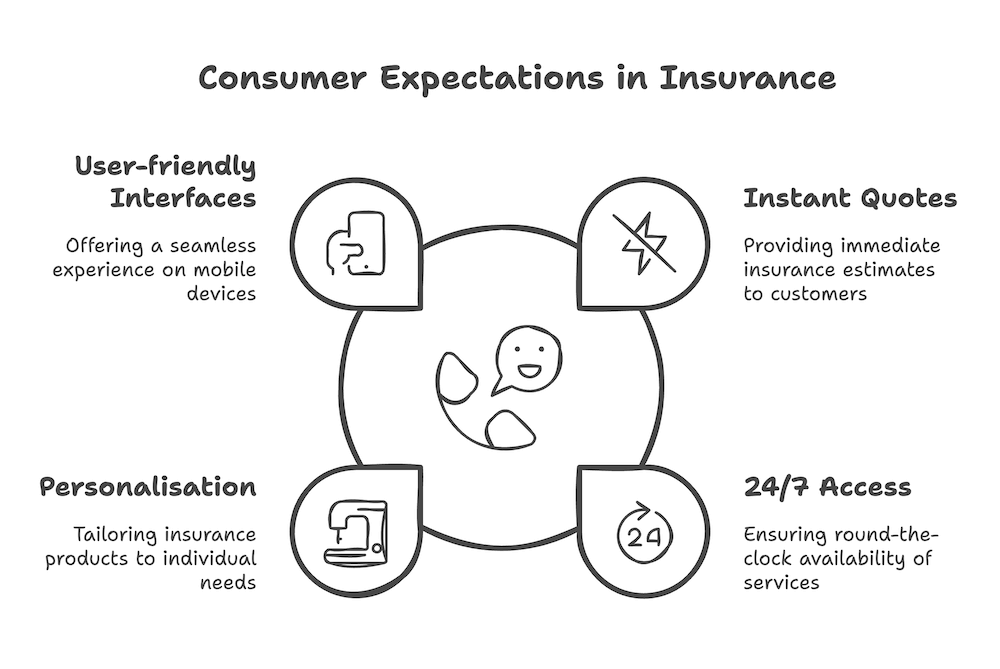

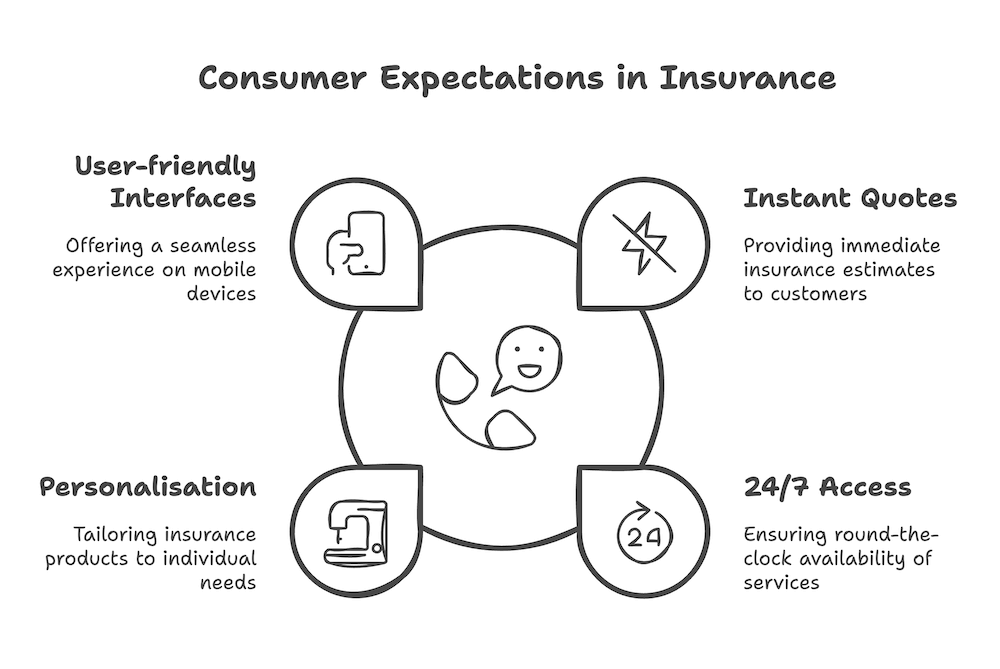

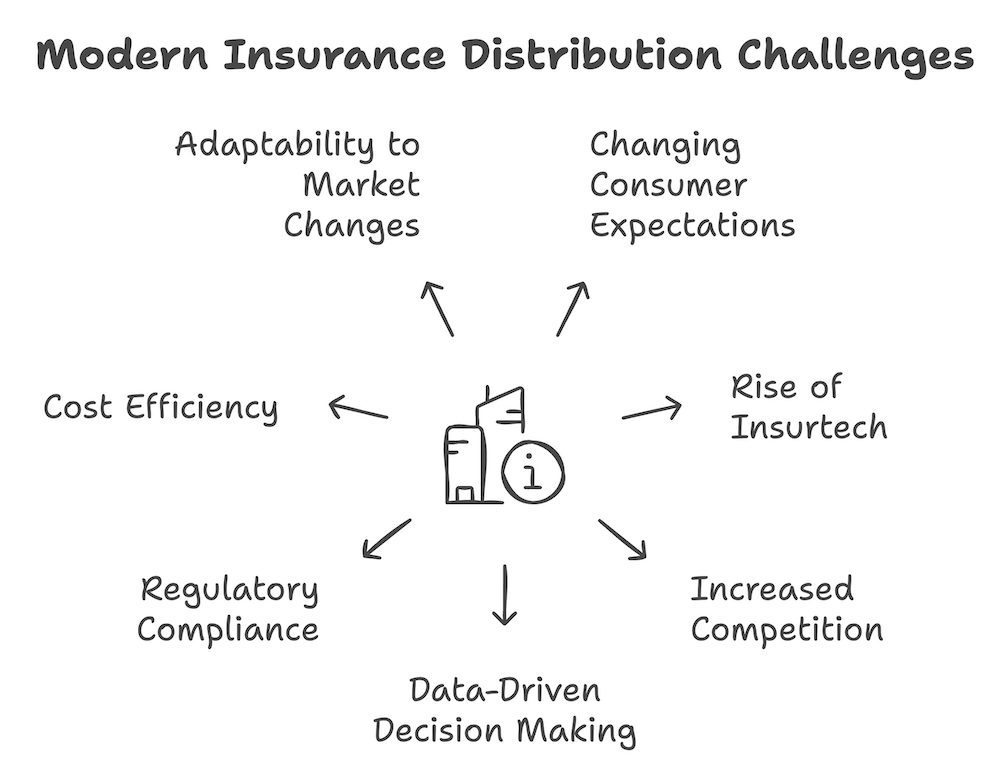

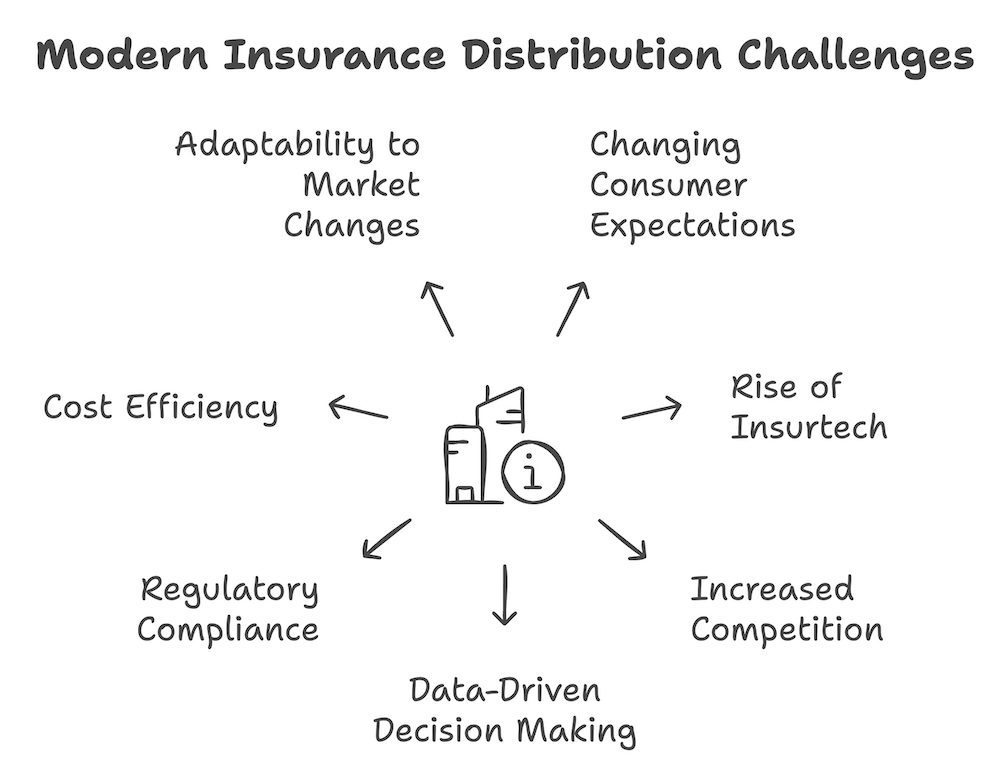

Changing Consumer Expectations

Modern consumers expect seamless, digital-first experiences in every aspect of their lives – and insurance is no exception. They want:

- Instant quotes and policy issuance

- 24/7 access to information and support

- Personalised products and services

User-friendly mobile interfaces

If your distribution model doesn’t cater to these expectations, you’re likely losing potential customers to more tech-savvy competitors.

The Rise of Insurtech

Insurtech companies are disrupting the industry with innovative solutions that streamline processes, reduce costs, and improve the customer experience. By leveraging technologies like AI, machine learning, and blockchain, these fleet-footed disruptors are setting new standards for efficiency and convenience.

Increased Competition

The insurance market is becoming increasingly crowded, with new players entering the field and established companies expanding their offerings. To stay competitive, you need a distribution model that allows you to reach customers through multiple channels and provide a superior customer experience.

Data-Driven Decision Making

Modern distribution models harness the power of data analytics to:

- Identify target markets more accurately

- Tailor products to specific customer needs

- Optimize pricing strategies

- Improve risk assessment

Without these capabilities, you’re operating at a significant disadvantage.

Regulatory Compliance

As regulations become more complex and stringent, manual processes are becoming increasingly risky and inefficient. A modern distribution model can help ensure compliance while reducing the burden on your team.

Cost Efficiency

Outdated distribution models often involve multiple intermediaries and manual processes, driving up costs and reducing profitability. By streamlining your distribution with digital solutions, you can significantly reduce operational expenses and improve your bottom line.

Adaptability to Market Changes

The insurance industry is constantly evolving, with new risks emerging and customer needs shifting. A flexible, technology-driven distribution model allows you to quickly adapt to these changes and seize new opportunities as they arise.

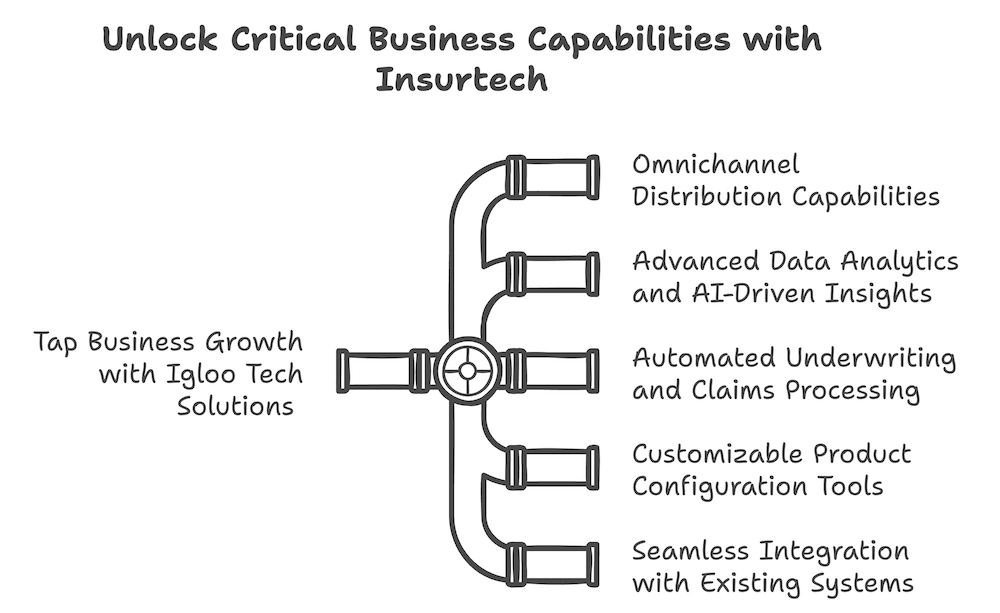

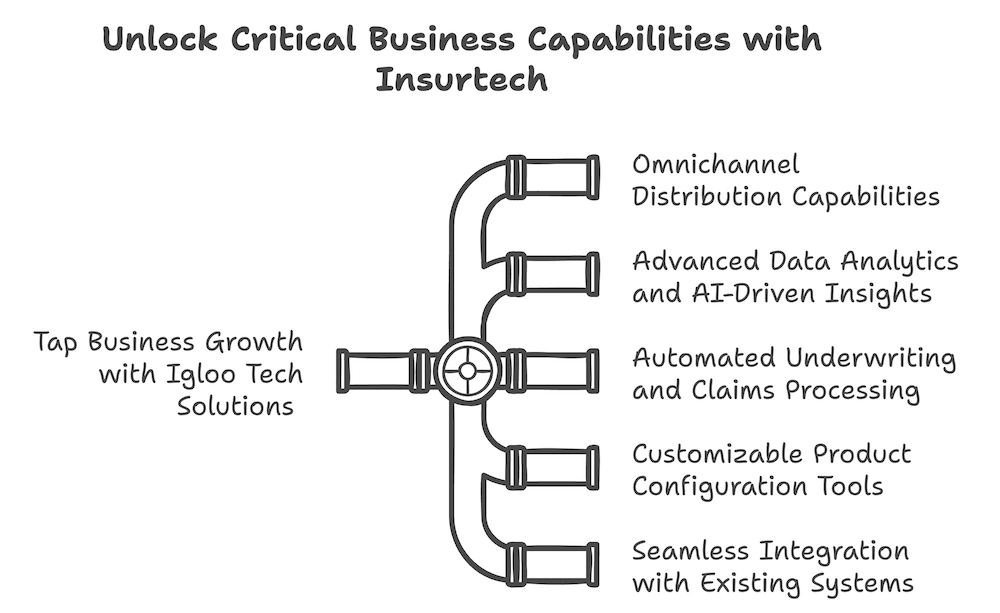

The Solution: Embracing Insurtech

To give your distribution model the makeover it needs, consider partnering with an insurtech provider that offers:

- Omnichannel distribution capabilities

- Advanced data analytics and AI-driven insights

- Automated underwriting and claims processing

- Customisable product configuration tools

- Seamless integration with existing systems

By embracing these technologies, you can transform your distribution model into a powerful engine for growth, efficiency, and customer satisfaction.

The insurance industry is at a crossroads, and the path forward is clear: embrace digital transformation or risk obsolescence. By giving your distribution model a much-needed makeover, you’ll be well-positioned to thrive in the new era of insurance. Don’t wait – the time to act is now.