Any insurance exec tasked with digital transformation or expanding distribution will tell you – integrating new technologies with existing infrastructures is complex work.

Yet, striking the balance of implementing digital solutions fast with minimal disruptions and overhauls to existing systems and infrastructure is crucial for enhancing customer experiences, improving efficiency, and staying competitive. In this article, we explore practical strategies for achieving balance, ensuring that your organisation can innovate while still leveraging the strengths of its established systems.

The Hold of Legacy Systems and Processes

They served you well before, but are now outdated platforms that struggle to meet modern consumer needs, leading to slow processing and increased errors. They can hinder customer experience, as today’s consumers expect quick and seamless interactions. Transitioning to modern solutions is essential for improving efficiency, enhancing customer satisfaction, and driving business growth.

To stay competitive, it’s crucial to acknowledge the limitations of these systems and explore modern solutions. Upgrading technology can streamline operations, enhance customer interactions, and support your growth in a fast-evolving market.

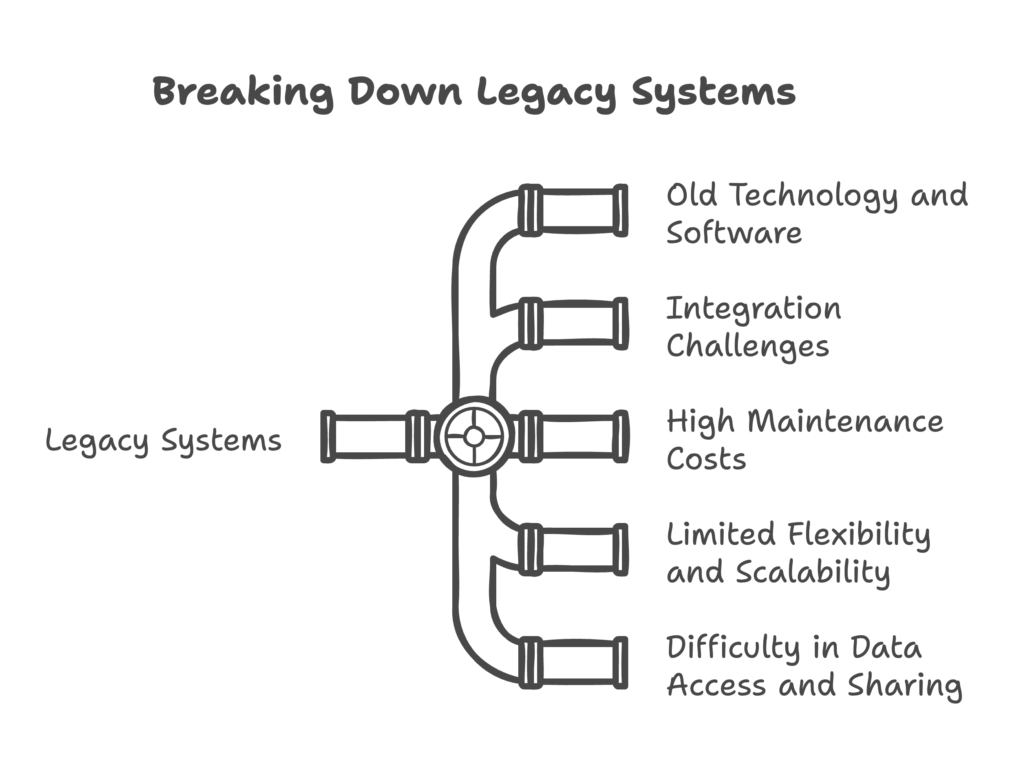

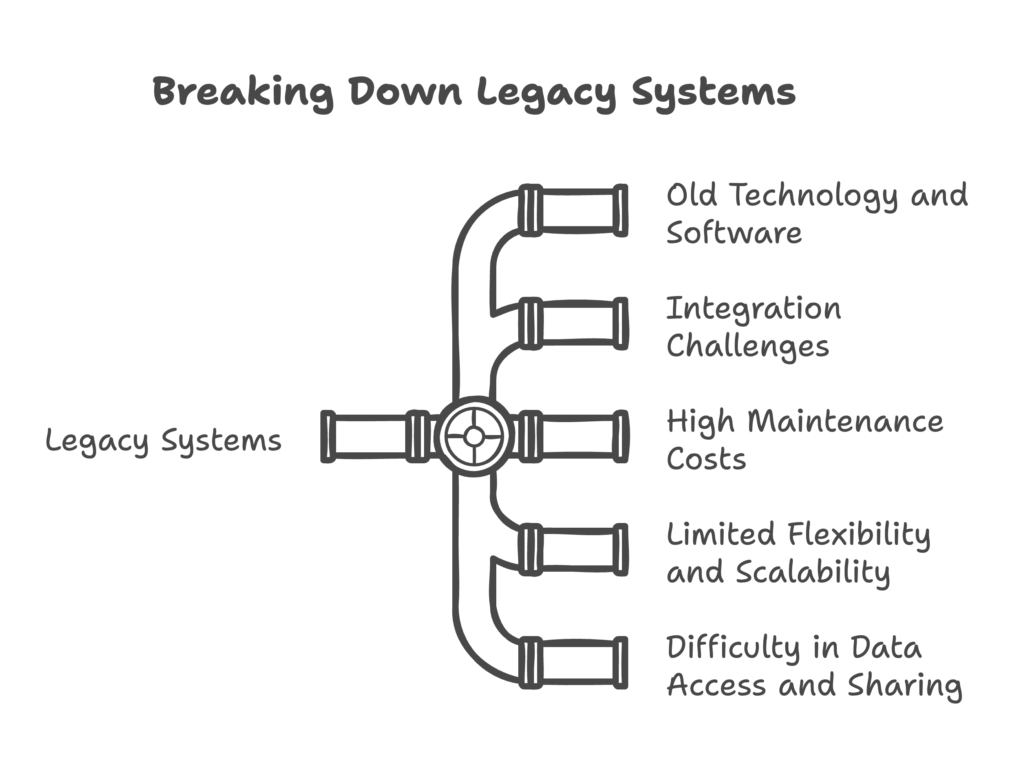

Legacy Systems and processes hold you back with:

- Old technology and software

- Integration challenges

- High maintenance costs

- Limited flexibility and scalability

- Difficulty in data access and sharing

Old technology and software

Outdated technology hinders insurance companies from reaching their potential, leading to slow operations and frustrated customers. Updating systems is crucial for staying competitive, as modern software improves efficiency, data management, and customer service. Investing in new technology can enhance products, attract more clients, and boost profitability, making the transition worth the effort.

Integration challenges

Insurance digitisation faces challenges from outdated legacy systems that hinder information sharing, leading to delays and errors. Companies must plan integration efforts, selecting compatible tools or investing in middleware to connect different systems. Addressing these issues enhances operations and improves service quality for customers.

High maintenance costs

Outdated systems in the insurance industry create data silos, making it difficult for teams to access vital information for decision-making and customer service. Investing in cloud-based digital tools allows for real-time data integration and sharing, enhancing collaboration and operational efficiency. This approach improves customer experiences and enables quicker responses to market changes.

Limited flexibility and scalability

Outdated systems hinder data access and sharing in insurance companies, delaying claims and limiting collaboration. Investing in modern technology, like cloud-based solutions, enables seamless data flow and informed decision-making. This improves efficiency, enhances customer experiences, and allows for quicker responses to market changes, supporting future growth.

Difficulty in data access and sharing

Insurance companies face challenges with scattered data stored across different systems, making it hard to understand customer needs and leading to delays in decision-making. Secure data sharing between departments and partners also poses risks of compliance issues and data breaches. Investing in digital solutions to streamline access and sharing can break down silos and improve operations, ultimately boosting customer satisfaction.

Heeding The Call for Insurance Digitisation

Insurance digitisation uses digital technology to streamline operations, moving from paper systems to automated solutions like online applications and digital signatures. This shift enhances customer experience, reduces costs, and allows for quicker responses to market changes. Embracing digital tools is vital for offering faster services and personalised products, keeping companies competitive in a technology-driven landscape.

Innovation is crucial for insurers to meet evolving customer demands for quick, easy, and personalised services. By adopting new technologies, companies can streamline operations, reduce costs, and improve customer satisfaction. Embracing innovation not only enhances customer experiences but also helps insurers stay competitive and explore new revenue opportunities.

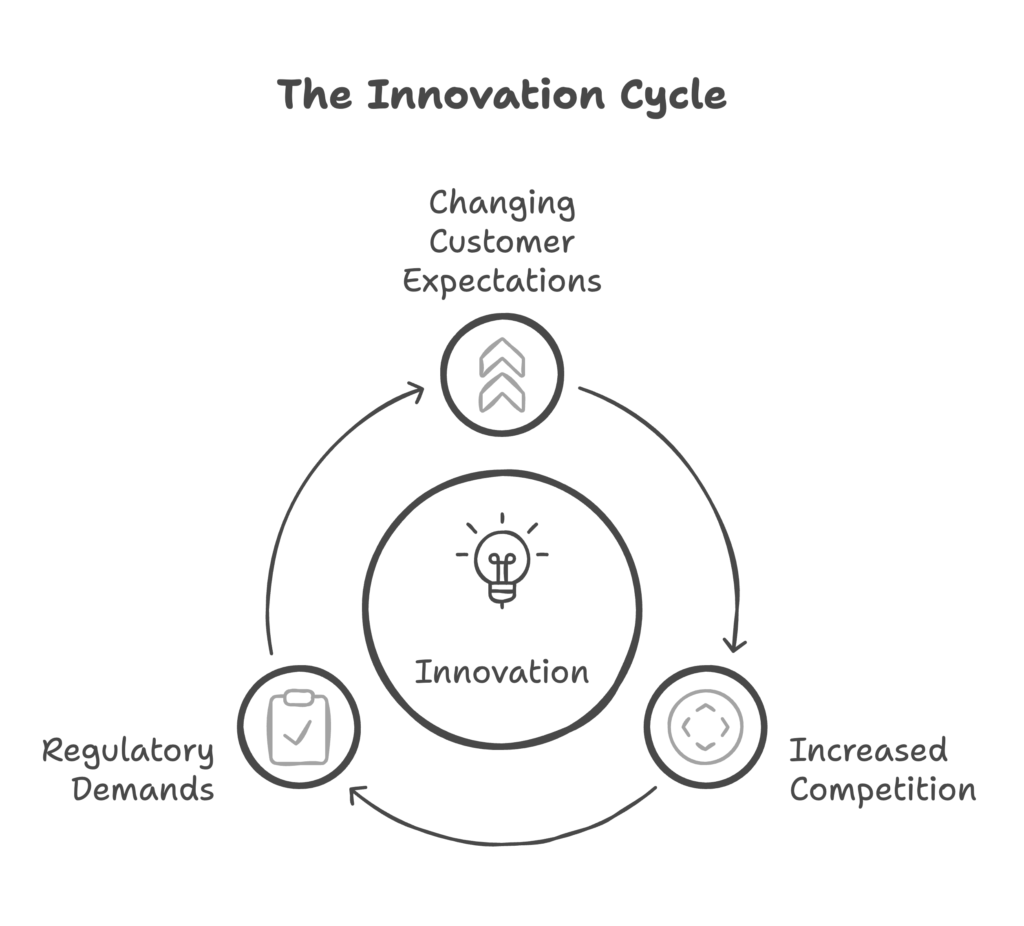

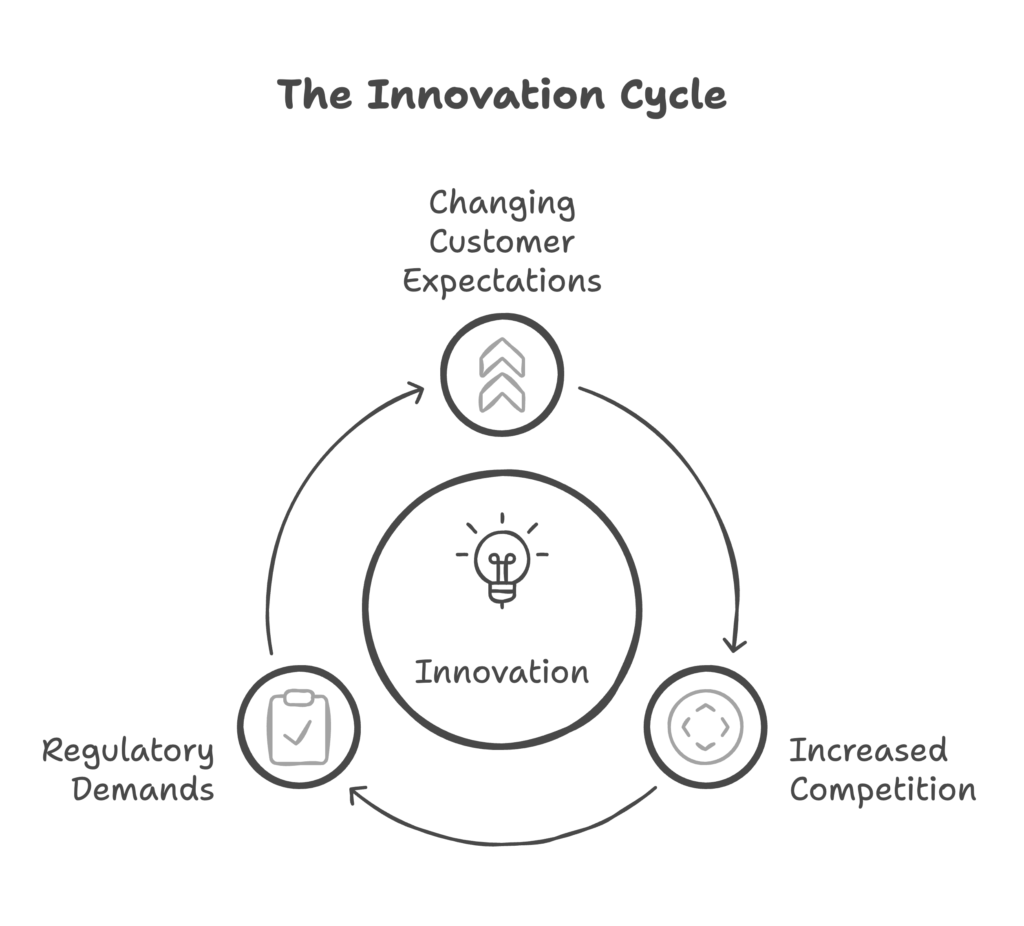

The Need for Innovation stems from the mounting pressures from:

- Changing customer expectations

- Increased competition

- Regulatory demands

Changing customer expectations

Customer expectations in insurance are changing, with many seeking quick and seamless experiences similar to tech companies. Insurance firms must adapt by embracing digital tools and investing in user-friendly platforms to streamline processes and enhance interactions. Prioritising customer experience will strengthen relationships and foster loyalty, ensuring competitiveness in today’s market.

Increased competition

The insurance industry faces increased competition from startups and tech firms using digital tools to deliver innovative products. Established insurers must adapt by embracing digital transformation, investing in technology for better data analysis, customer insights, and streamlined operations. Enhancing distribution channels is crucial to reach more customers and provide personalized offerings in this evolving landscape.

Regulatory demands

Insurance companies face increasing regulatory demands that affect operations and service delivery. Proactively investing in technology streamlines compliance, reduces errors, and ensures timely reporting. Embracing digital tools enhances efficiency, builds customer trust, and supports long-term success.

Strategies for Balancing Innovation with Legacy Systems

Insurance companies must balance innovation with legacy systems, integrating new technologies while maintaining established processes. A thoughtful approach enhances customer experience, boosts efficiency, and supports data-driven decisions. By innovating without sacrificing reliability, insurers can become agile and better meet market demands while preserving client trust.

Assessment and Planning

Assess your current processes and technologies to identify strengths and weaknesses, gathering insights from your teams and customers. Develop a strategic plan with specific digitisation goals that align with your business objectives, focusing on key areas like customer engagement and claims processing. Regularly review your progress and adjust your strategy to adapt to changing market demands.

Incremental Approach

An incremental approach to insurance digitisation allows businesses to implement gradual changes, reducing risks and easing resource management. Focus on key areas like customer service or claims processing, enabling teams to test new technologies and adjust before larger rollouts. This strategy fosters a culture of continuous improvement, guiding future enhancements based on real feedback from customers and staff.

Integration Solutions

Integration solutions connect various systems within an insurance company, enabling seamless data sharing and reducing manual errors. This leads to better customer experiences, as agents can access accurate information quickly and improve service delivery. Investing in these solutions simplifies operations and supports future growth.

Insurance Distribution Innovation

Insurance distribution strategies are crucial for reaching customers effectively and efficiently in today’s fast-changing market. With technology reshaping how consumers buy insurance, businesses must adapt to meet these new expectations. A well-crafted distribution strategy not only improves customer experience but also enhances operational efficiency and drives growth.

Understanding the various channels available—like digital platforms, agents, and partnerships—allows insurance companies to tailor their approach. By leveraging data and technology, businesses can identify target audiences, optimise outreach, and ultimately deliver the right products at the right time. Embracing these strategies is essential for staying competitive and meeting the needs of modern consumers.

Navigate internal resistance and upskilling

Addressing these challenges requires a clear strategy and strong leadership. By fostering a culture of innovation and supporting staff through training, companies can navigate the complexities of digital transformation. Embracing these changes not only improves efficiency but also enhances customer experience, ultimately driving growth in a competitive market. Insurance execs embarking on their digital transformation agenda need to be prepared to tackle the following:

Budget Constraints

Budget constraints can hinder insurance businesses in their digitisation efforts, but prioritising investments that improve customer experience and streamline processes leads to long-term benefits. Start small by targeting areas like automating claims processing or enhancing online interactions for quick returns. Partnerships with insurtech firms can also offer innovative solutions at a lower cost, helping build a strong foundation for future digitisation.

Data Security and Compliance

Data security and compliance are vital in the insurance industry as businesses undergo digital transformation. Protecting sensitive policyholder information not only meets legal requirements but also builds customer trust, preventing the reputational and financial damage that comes from data breaches. By implementing strong security measures and staying updated on regulations like GDPR and CCPA, insurers can create a safer environment for customers and enhance their market position.

Conclusion

As the insurance industry evolves, embracing digital solutions is no longer optional. Companies that adopt digital tools enhance efficiency, improve customer experiences, and stay competitive in a fast-changing market. The move toward digitisation empowers insurers to streamline processes, reduce costs, and open new avenues for growth.

The journey toward a fully digital insurance environment is filled with challenges and opportunities. By understanding the benefits and strategies for effective insurance distribution, key decision-makers can lead their organisations toward a more agile and customer-focused future. Embracing these changes not only positions businesses for success but also meets the growing expectations of today’s consumers.