Across Southeast Asia’s high-growth markets—specifically the Philippines, Thailand, and Indonesia—the human intermediary remains the primary architect of trust.

Bain & Company research highlights that the “Tied Agency” is not disappearing; rather, it is undergoing a fundamental digital reboot to remain competitive.

As FWD’s industry analysis confirms, human-led advisory still commands the vast majority of life insurance premiums in the region. But the traditional, fragmented sales cycle has become an unsustainable operational drag.

Field agents currently navigate a maze of manual quote calculations and unencrypted chat messages. By the time a policy is ready for issuance, the moment of high intent has often passed.

To capture the 2026 consumer, insurers must equip their agency force with a mobile-first strategy that collapses this cycle from days into minutes, digitising every touchpoint from discovery to digital issuance.

Collapsing the Quote-to-Bind Window

The primary bottleneck in traditional agency models is the gap between consultation and quote delivery. When agents must return to a branch office to run the numbers, leads cool.

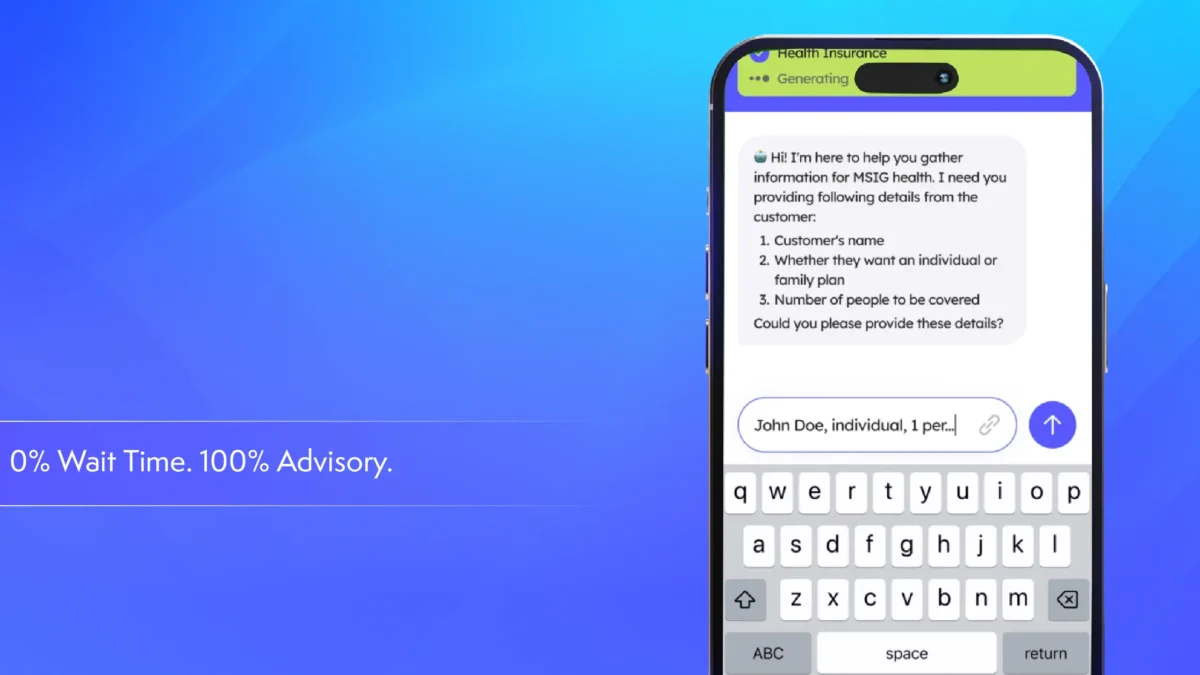

In response, a native mobile application enables agents to generate customised, compliant quotes instantly during the first meeting.

BCG research confirms that AI-native orchestration can collapse these friction windows by 60%, effectively preventing lead cooling by aligning the insurance grant with the moment of highest intent. This isn’t just a UX upgrade; it is a conversion strategy.

Closing a deal in the initial consultation is now the baseline expectation for mobile-first consumers in Southeast Asia.

Breaking the WhatsApp Entanglement

In many SEA markets, WhatsApp, Viber, LINE and Zalo have become the unofficial backend for insurance sales.

While convenient, this creates significant compliance risks and unmanaged data silos. A dedicated mobile strategy replaces this chaos with e-KYC and AI-driven document capture, auto-parsing data from IDs directly into application forms.

By moving from unmanaged chat to a structured mobile environment, insurers can target a 40% reduction in onboarding costs while securing sensitive customer data. This ensures that the “Source of Truth” remains with the insurer, not in an agent’s private chat history.

Integrated Digital Payments

Friction often peaks at the payment phase. Requiring a customer to perform a separate bank transfer or handle physical cash introduces a final, unnecessary point of drop-off.

Modern agent tools solve this by integrating directly with regional mobile wallet gateways used by 79% of SEA consumers. This integration with GCash, OVO, and other major wallet providers enables agents to complete the entire transaction in one session: quote, signature, and payment confirmation within the same digital journey.

This instant fulfillment satisfies the consumer demand for immediate protection. It significantly improves conversion rates for lead-fed agency models by removing the friction points where customer interest typically fades.

The Agent as a Relationship Manager

Beyond the initial sale, a unified mobile tool transforms the agent into a long-term advisor. By utilising Igloo’s agency distribution solution, agents gain access to a digital command centre that automates administrative noise:

- Automated Renewal Alerts: Notifying the agent 30 days before expiry to prevent policy lapse.

- AI-Driven Lead Scoring: Identifying which existing clients are most likely to need supplementary protection based on transaction data.

- Customer Profiling Assistant: Acting as an all-rounded admin assistant to help agents manage timely follow-ups and identify precise opportunities for up-selling or cross-selling based on shifting customer life stages and needs.

Empowering the Workforce: From Digitisation to Intelligence

The cultural barrier to digital adoption—specifically the fear of alienating career agents—is a common hurdle for regional COOs. However, the objective of a modern distribution solution is not complexity but radical simplicity.

Utilising no-code platforms allows insurers to deploy intuitive, consumer-grade interfaces that require minimal training. This represents a fundamental shift from distribution digitisation (merely moving paper to a screen) toward distribution intelligence.

By offloading administrative burdens to an automated backend, agents reclaim their time for high-value advisory work. The future of insurance in SEA is not a choice between humans or machines; it is a hybrid model where the human-led relationship is digitally accelerated.

Final Thoughts: Defining the New Standard of Distribution

In the 2026 landscape, speed is a component of trust. When an agent can provide a quote, secure a signature, and issue a policy in one seamless mobile experience, they demonstrate a level of professionalism that manual processes cannot match.

The successful insurers of the next decade will be those that realize the tied agency is not a relic of the past. It is instead a channel waiting to be liberated. Transitioning to a unified mobile-first strategy allows insurers to fundamentally accelerate their path to growth.

Ready to supercharge your agency force? Stop letting manual processes slow your growth. Discover how Igloo’s mobile-first distribution tools empower agents to close deals faster and serve customers better across Southeast Asia.