Southeast Asia’s digital economy is growing exponentially but remains dangerously exposed. In Indonesia, millions of gig workers operate without safety nets, while one-third of Philippine GrabFood drivers suffered accidents last year. Notably, 70% are willing to pay for protection—proving a massive, unmet demand.

Yet, this massive, mobile workforce operates without a reliable financial safety net.

They face daily risks of accident, illness, and income interruption, but traditional insurance offers them nothing but friction. The core problem is flexibility. A standard annual policy is a poor fit for someone whose income and risk exposure fluctuate hourly or daily.

This protection gap among gig workers is a systemic risk for digital platforms across APAC, leading to high churn rates and increasing pressure from regulators to provide social protection. The only viable solution isn’t a more expensive annual plan; it’s dynamic, usage-based coverage enabled by technology that matches protection to the exact moment of risk.

The New Workforce, The Rigid Risk Model

The sheer scale of the gig economy in APAC makes the protection challenge urgent. In markets like Indonesia, where informal employment is substantial, digital platforms have onboarded millions of workers previously outside the formal financial system. The massive shift towards digital gig work in the region, particularly among younger workers, has been widely documented by development institutions.

The traditional insurance industry failed to adapt for three key reasons:

- Expensive Premiums: Traditional policies demand large annual or quarterly premium payments, difficult for workers living week-to-week.

- Irrelevant Coverage: A part-time driver does not need the same coverage as a full-time employee, yet they are often offered the same take-it-or-leave-it package.

- Slow Claims: A paper-based process means an injured rider waits weeks for a payout, defeating the purpose of income replacement.

The rigid structure of legacy insurance distribution actively excludes the people who need protection most: those with variable income and unpredictable work schedules. That said, this creates an opportunity for insurers who are open to offering micro-insurance products to gig workers.

The Shift to Dynamic, Pay-per-Job Protection

The solution requires embedding insurance directly into the moment a gig worker begins a task, bridging the gap between high risk and high cost.

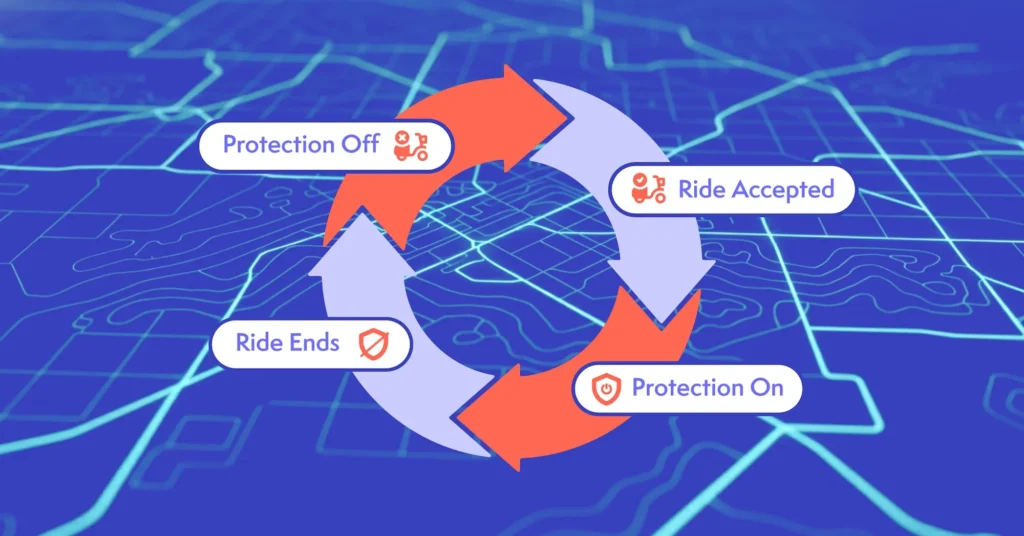

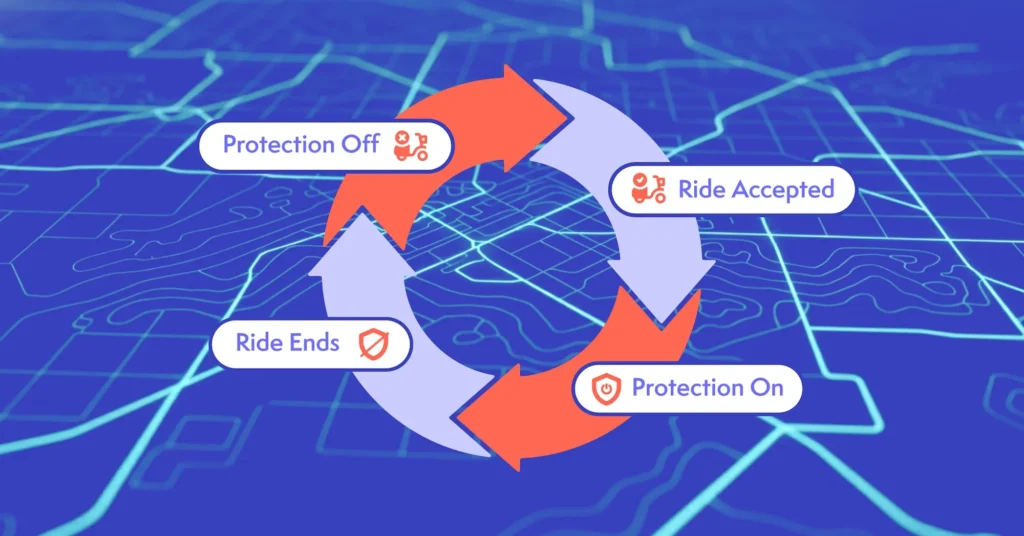

Instead of an annual policy, a rider activates coverage for a few cents when they accept a delivery. That policy covers them for the ride’s duration and automatically switches off when the job is complete. This usage-based approach offers immediate, powerful benefits:

- Affordability: Charging just cents per job ensures the premium remains a negligible operating cost, automatically deducted from the rider’s earnings.

- Relevance: The coverage is specific (e.g., accident, injury, income loss) and only active when the risk is present.

- Scale: Because the purchase decision is seamless—integrated directly into the workflow—take-up rates approach 100% for many platforms.

For a Grab partner in the Philippines, opting into an affordable personal accident plan—often costing less than a single cup of coffee per month—provides the critical protection that a full-service, high-cost plan historically excluded. In the volume game of the gig economy, turning these micro-premiums into a guaranteed layer of protection creates a high-margin, scalable revenue stream for both the insurer and the platform.

The Risk-to-Revenue Dynamic Loop: Making Invisible Insurance Profitable

Implementing dynamic coverage requires a sophisticated technology platform. Traditional carrier core systems cannot process millions of micro-policies, nor can they handle the high volume of data generated by constant on/off switches.

A modern insurtech platform must function as the Tech Liberator, providing the necessary agility to enable what we call the Risk-to-Revenue Dynamic Loop:

- Real-Time Data Ingestion: The digital platform provides granular trip data (route, duration, type of delivery) to the insurtech platform via seamless API integration.

- Micro-Underwriting: A no-code core system instantly underwrites and issues the policy in milliseconds using this real-time data.

- Frictionless Claims: The claims platform uses AI and intelligent automation to instantly verify routine claims against pre-existing data (time, location, identity).

- Feedback & Optimization: Crucially, the platform pushes claims data and behavioral insights back to the underwriting AI, allowing the partner to continuously refine pricing models and attachment strategies for higher customer LTV.

This dynamic loop makes protection both scalable and profitable. It’s about co-creating a data-driven safety mechanism that reduces risk for the rider while establishing a predictable, additional revenue stream for the ecosystem partner.

Visible Impact: Retention and Compliance

The business case for platforms to adopt this model is irrefutable, centering on two critical pillars: ancillary revenue and workforce stability. The market opportunity is vast; industry data projects the Asian embedded insurance market to reach $270 billion in GWP by 2030, with the region leading the global charge in innovation.

This growth is driven by two key factors:

- Driver Retention (Ecosystem Stickiness): The platform that offers a reliable safety net wins the talent war. By co-designing affordable insurance, the platform becomes a stickier ecosystem, lowering the costly driver acquisition rate.

- Regulatory Buffer (Proactive Compliance): As regulators in APAC become more focused on worker protections, providing a proactive, tech-driven safety net positions platforms ahead of potential mandatory requirements.

The workforce has transformed; insurance must transform its core model to match. This requires a technology platform built specifically for the ecosystem—one that offers rapid API integration and highly scalable claims automation. The future of the gig worker safety net is not in paper forms and phone calls. It is in the single, seamless tap of a screen, powered by an invisible, intelligent insurtech backbone.Connect with the Igloo Tech Solutions team to see how our infrastructure transforms daily rider risks into a sustainable, profitable safety net and how you can offer embedded micro-insurance products to these gig workers.