Here is the fundamental paradox of the insurance industry in Asia: Millions of consumers want protection for their daily risks, but traditional insurers cannot afford to sell it to them.

The problem isn’t demand; it’s distribution.

Consider a cracked smartphone screen or a lost e-commerce package. These are high-frequency, low-severity risks. A consumer in Jakarta or Manila might happily pay $2.00 to insure a new gadget. For a traditional insurer, the cost stack of manual processing—agent commissions, paperwork, underwriting—compresses margins on a $2.00 premium.

This creates the ‘Unit Economics Trap.’ Traditionally, insurers spend more than 50 percent of new premiums on customer acquisition alone. This cost structure makes low-premium micro-insurance via agents economically unviable—a key driver of the region’s persistent protection gap.

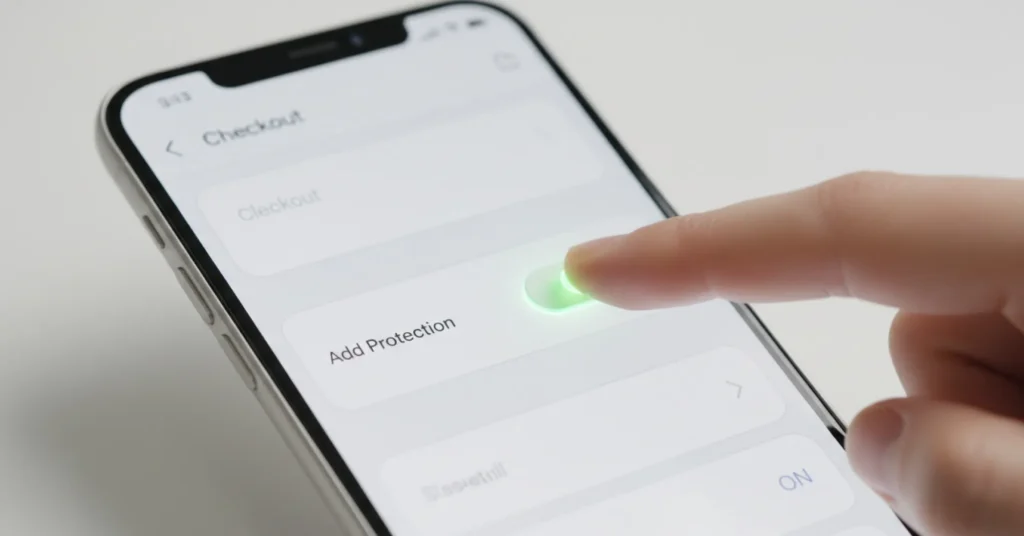

The solution isn’t to force agents to sell smaller policies. The solution is to integrate protection directly where the risk is acquired: at the e-commerce point of sale.

The Mathematics of Micro-Insurance

To understand why embedded insurance is exploding in markets like Vietnam and Indonesia, you have to look at the cost stack.

In a traditional model, the Customer Acquisition Cost (CAC) is high. An agent needs to drive to a meeting, make calls, or run ads. If the policy premium is $1,000, that CAC is offset by the revenue. If the premium is $5, the acquisition cost erodes the margin, rendering the policy unprofitable.

Embedded insurance reshapes this equation. Integrating protection into the checkout flow—whether shipping insurance on sneakers or screen protection on tablets—reduces CAC to near zero.

The insurance offers “piggybacks” on the primary transaction. The customer is already buying; the payment credentials are already entered; the trust is already established.

When you remove the cost of distribution, products that were once mathematically impossible become highly profitable revenue streams.

Why Retailers Care: The “Basket Size” Effect

For e-commerce platforms, the value proposition goes beyond just earning a commission on the insurance policy. The real value lies in what insurance does to the core conversion rate.

This impact is measurable: Broader market analysis confirms that embedded insurance can significantly increase customer lifetime value, while high-frequency categories in APAC often see double-digit attachment rates due to the low barrier to entry.

Purchase anxiety is a real barrier to sales. A customer staring at a $800 smartphone in their digital cart is doing mental calculus: “What if I drop this? What if it breaks in a month?” This hesitation often leads to cart abandonment.

When you offer a “Screen Protection Plan” for a nominal fee right next to the “Buy Now” button, you aren’t just selling insurance. You are selling confidence.

Consider the ‘AppleCare Effect.’ As the pioneer of this model, Apple proved that visible protection neutralizes purchase anxiety. They trained a generation of consumers to view coverage not as a complex financial product, but as an essential part of the unboxing experience.

By neutralizing the fear of loss, you remove friction from the primary transaction. Offering protection at the point of sale doesn’t just add a few dollars to the total; it gives the customer the psychological safety to commit to the big-ticket purchase.

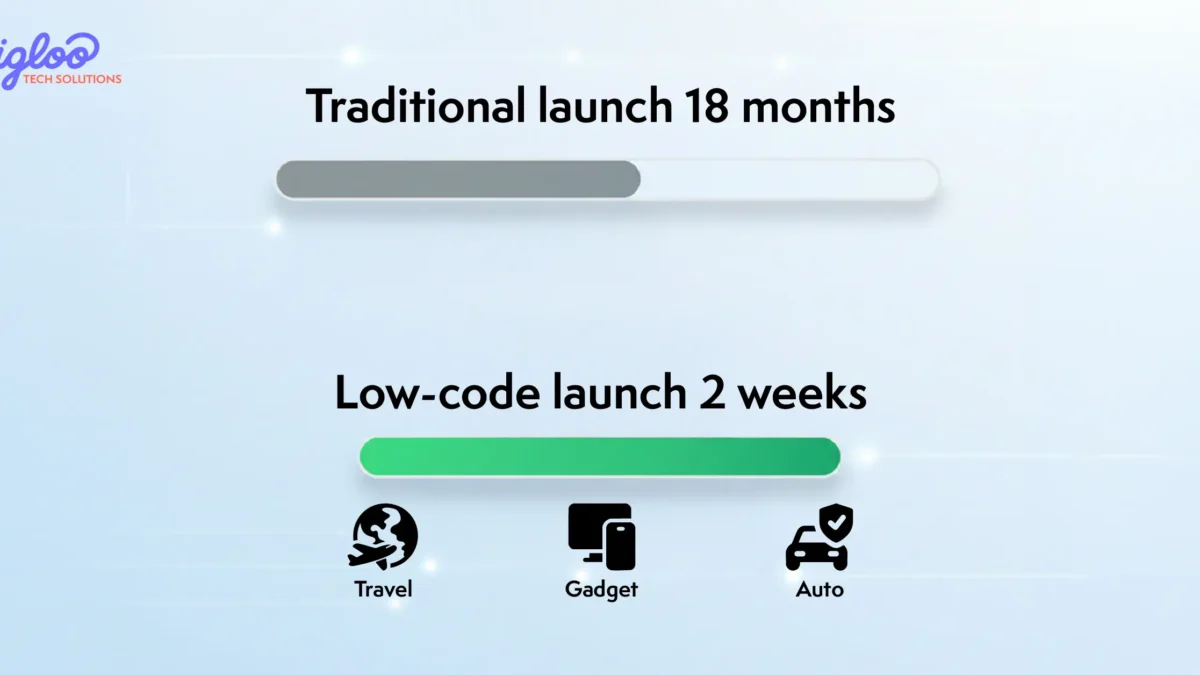

The Tech Stack: From Manual to Automated

This model only works if the backend is rigorous. A low-premium product relies on volume and automation to be viable.

If a customer adds shipping protection for $0.50, the policy issuance, policy document delivery, and eventual claims trigger must happen without human intervention. If a human has to touch that policy file, the profit is gone.

This is where the distinction between a “digitized” process and a true “tech stack” matters:

- Manual Stack (Profit Killer): Agent costs, manual data entry, and slow claims processing eat up the entire premium.

- Tech Stack (Profit Maker): Automated API triggers handle the issuance. The “Tech Cost” is minimal and fixed, revealing a clear, scalable profit layer.

The APAC Opportunity: The “Next 100 Million”

This mechanism resonates most strongly in APAC, where the “Next 100 Million” consumers represent a digitally native, historically underinsured middle class.

These consumers may not have a relationship with a life insurance agent, but they trust their favorite e-commerce super-app. They are used to buying goods, booking rides, and paying bills on a screen.

By embedding micro-insurance into these daily digital interactions, we aren’t just selling policies; we are introducing a new generation to the concept of insurance. A customer who has a positive experience with a $2 shipping claim today might be the customer who buys a $500 health policy tomorrow.

Frictionless is the Future

The days of expecting a customer to buy a product in one place and then go to an insurance branch to protect it are ending.

The winners in the next phase of digital commerce will be the platforms that treat insurance not as an afterthought, but as a native feature of the checkout experience. It creates a sticky ecosystem where the customer feels protected, the retailer increases their Gross Merchandise Value (GMV), and the insurer gains access to a massive, low-acquisition-cost audience.

Micro-insurance is profitable when technology makes the transaction seamless and invisible to the customer.

This is the core capability of Igloo Partner. Designed to act as the ‘connectivity layer’ between insurers and digital platforms, Igloo Partner handles the heavy lifting of API integrations and high-volume policy issuance. It allows insurers to deploy embedded products instantly—turning the theoretical value of micro-insurance into a tangible, automated revenue stream.

Connect with Igloo’s Tech Solutions team to explore how our low-code integration modules can turn your transaction data into a profitable protection ecosystem.