In Southeast Asia, the bank branch has effectively relocated to the smartphone. Across Vietnam, Indonesia, and the Philippines, millions of consumers now bypass physical tellers entirely, conducting everything from mortgage applications to daily transfers via mobile apps.

Yet, for many financial institutions, bancassurance remains stuck in the lobby.

The traditional model, built on tellers referring high-net-worth clients to specialists, remains essential for complex life policies. But it completely misses the high-volume, digital-native traffic flowing through the banking app every second.

For insurers and their banking partners, this disconnect is a missed opportunity. The next wave of bancassurance growth will not come from more desks in branches; it will come from embedding micro-insurance directly into the digital transaction flow.

The Friction of Traditional Cross-Selling

Why has digital bancassurance lagged behind payments and lending? The answer lies in friction.

In the traditional digital model, “buying insurance” on a banking app often means clicking a banner ad that redirects the user to a separate web portal. There, the user is forced to re-enter their name, address, and ID number, even though the bank already possesses this data.

In the era of the super-app, where customers expect one-click gratification, this friction is a conversion killer. A customer transferring money or paying a bill will not pause their journey to fill out a twenty-field form for a $5 policy.

To capture this market, the insurance offer cannot be a detour. It must be a native part of the journey.

Embed Protection at Relevant Transactional Touchpoints

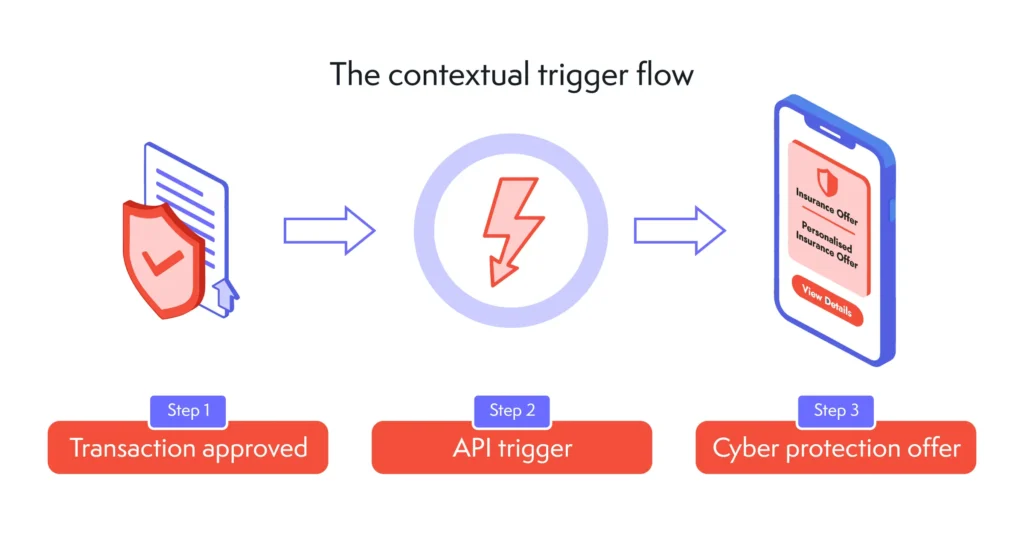

Successful digital bancassurance does not expect the customer to know exactly what to buy and when. Instead, it offers protection relevant to the specific financial action they are taking.

This is the shift from traditional product sales to seamless embedded offers relevant to the user’s immediate action.

By using the bank’s existing transactional data, insurers can trigger relevant offers via API at the exact moment of need:

- The Bill Payment: A customer pays their electricity bill via the app. Contextual Offer: “Protect your household appliances from surge damage for $1/month?”

- The Fund Transfer: A customer sends money to an e-wallet. Contextual Offer: “Insure this transfer against cyber-theft and fraud for $0.50?”

- The Loan Disbursal: A small business owner receives approval for a working capital loan. Contextual Offer: “Add credit life protection to cover your repayment in case of emergency?”

In these scenarios, the insurance is not a separate product; it is a feature of the banking transaction. The conversion rates for these “micro-moments” are exponentially higher than generic email campaigns because the value proposition is immediate and tangible.

Go-to-market at speed with the right tech

The strategic logic is clear, but the execution barrier is technical.

Banks and insurers operate on legacy core systems designed for stability rather than agility. Integrating these two monoliths to share real-time data and trigger instant policy issuance can mean a 12-to-24-month engineering project.

The bank’s engineering team is often bogged down with core banking updates and compliance mandates. They do not have the bandwidth to build custom integrations for every insurance product an insurer wants to launch.

This is where a Low-Code/No-Code (LCNC) middleware platform becomes the critical enabler.

Platforms like Igloo Tech Solutions act as the bridge between the insurer’s product engine and the bank’s mobile app. Because the platform is API-first and compatible with legacy systems, it allows the insurer to configure a new micro-insurance product and push it to the bank’s app without requiring a massive overhaul of the bank’s core architecture.

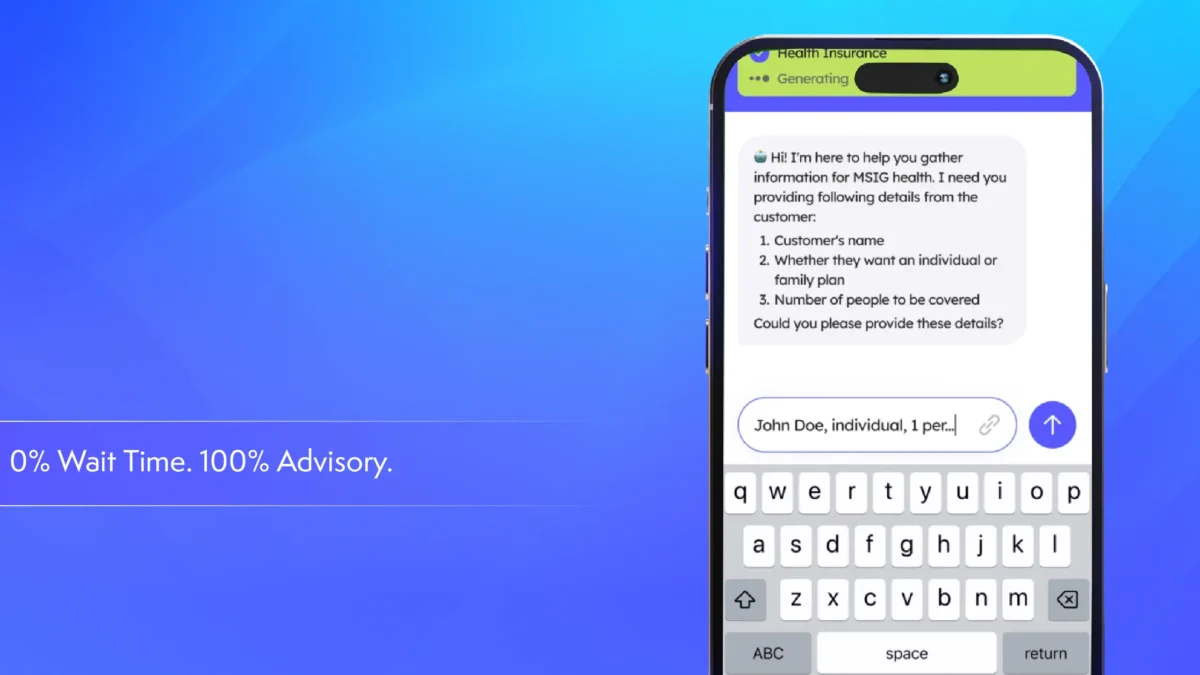

The 3-Click Experience: Using Partner Data

The operational secret to high-volume micro-insurance is eliminating the need for new data entry.

Verifying identity in Southeast Asia is complex, but the bank has already done the heavy lifting. They have performed the KYC (Know Your Customer) checks and have the verified ID, address, and payment method on file.

A modern embedded insurance platform capitalises on this partner data to pre-populate the entire insurance application.

- Trigger: The customer sees the offer (e.g., “Protect this Loan”).

- Consent: They tap “Yes.” The system pulls their verified KYC data from the bank’s ledger.

- Bind: The premium is deducted from their account balance, and the policy is issued instantly.

There are no forms to fill, no documents to upload, and no waiting periods. The risk assessment is instantaneous because the customer is already a verified entity within the banking ecosystem.

From Service Channel to Revenue Engine

For digital banks and traditional lenders alike, the pressure to diversify revenue is intense. Net interest margins are under pressure, and competition from fintech disruptors is fierce.

Embedded micro-insurance transforms the mobile app from a service channel into a robust source of non-interest income.

- High Frequency: Unlike a mortgage, which happens once, micro-insurance transactions (like bill protection or transfer protection) can happen monthly or even daily.

- Retention: Customers with multiple products, savings, lending, and protection are

statistically less likely to churn.

- Zero Marginal Cost: Once the API integration is live, the cost of underwriting and processing subsequent policies drops to virtually zero, bypassing the high operational overhead of branch-based sales.

Embedding bancassurance in a digital ecosystem

The race to capture the digital banking customer in APAC will not be won by who has the most branches, but by who offers the most complete digital ecosystem.

Customers already trust their banking app with their money. It is the most logical place for them to trust with their protection. But they will only buy if the experience is seamless, relevant, and instant.

For insurers, the mandate is clear: stop trying to force legacy processes into mobile apps. Instead, adopt the tech stack that enables you to meet the bank and the customer where they are.

Igloo Tech Solutions provides the SaaS-based infrastructure that makes this collaboration possible, enabling insurers and banks to launch embedded protection products in weeks, not years.

Ready to Transform Your Bancassurance Strategy?

Don’t let legacy tech block your access to the region’s fastest-growing channel. Connect with Igloo’s Tech Solutions team to discuss how our low-code platform can help you embed high-margin micro-insurance products directly into your partner’s digital ecosystems.