Financial reconciliation: a critical but often agonisingly slow and error-prone process for any large enterprise, and especially insurance companies. For finance teams in the insurance sector, it’s a persistent headache—a necessary but resource-draining task that, when done manually, is fraught with risk. In an industry defined by volume and complexity, the traditional approach to reconciliation is no longer sustainable.

The Insurance Industry’s Unique Pain Points

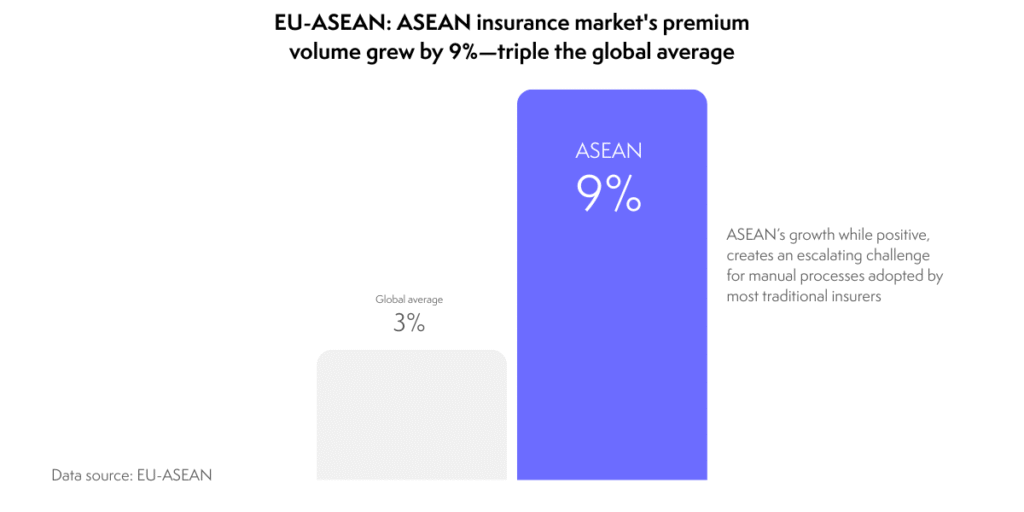

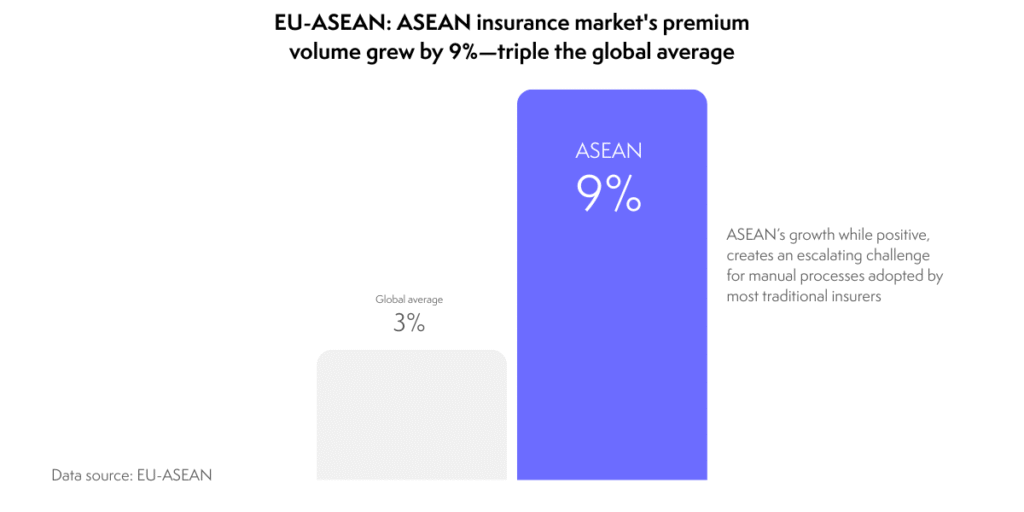

The challenges of financial reconciliation are magnified in Southeast Asia’s burgeoning insurance industry. Insurers are juggling an immense and rapidly growing high transaction volume; according to a EU-ASEAN report cited by Supermom Business, the ASEAN insurance market’s premium volume grew by 9%—triple the global average—creating an escalating challenge for manual processes.

This data isn’t neatly organised; it’s typically scattered across data silos. This is a widespread regional issue, with a 2024 AIBP survey finding that 40.6% of Malaysian organisations cite legacy IT infrastructure as a primary barrier to digital transformation.

Add to that the industry’s complex workflows. Reconciling payments involves navigating intricate commission structures, handling multi-currency transactions, and aligning everything with varied and often customised policy terms. This complexity makes manually matching records a monumental challenge.

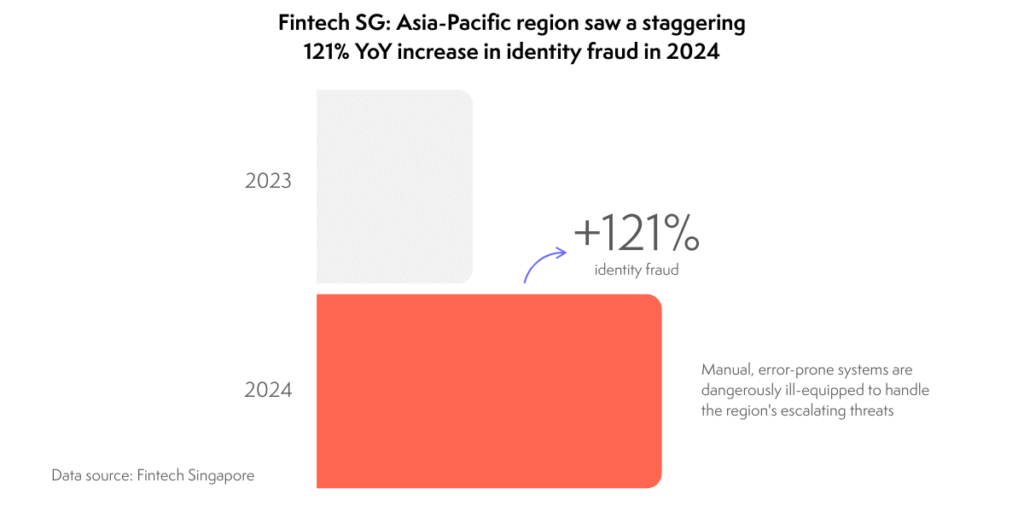

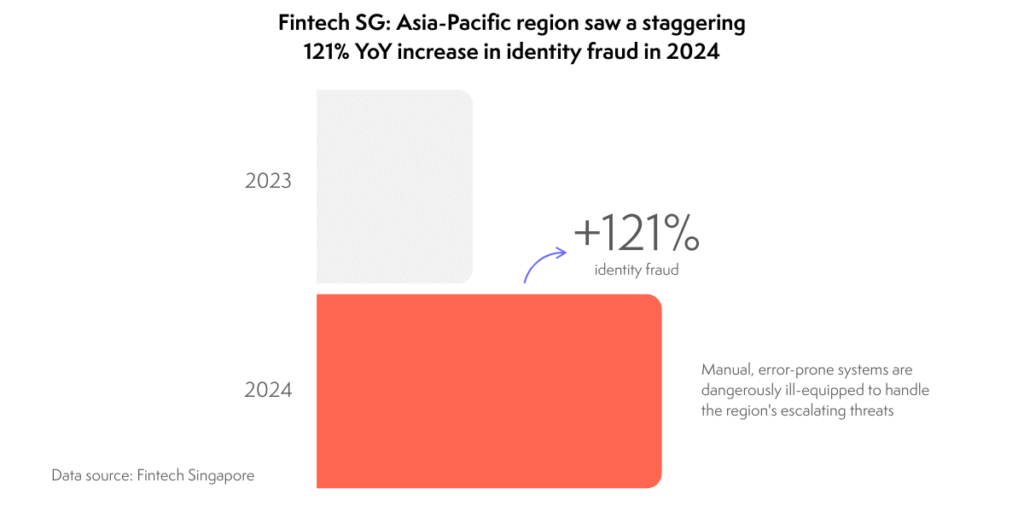

The inevitable result is human error and revenue leakage. Globally, insurers can lose up to $50 billion annually from such discrepancies, according to Optimus Fintech. This vulnerability is particularly dangerous in Southeast Asia, where the risk environment is rapidly deteriorating. A report cited by Fintech Singapore revealed that the Asia-Pacific region saw a staggering 121% year-over-year increase in identity fraud in 2024, highlighting how manual, error-prone systems are dangerously ill-equipped to handle the region’s escalating threats.

The Rise of Automation: Paving the Way for a Solution

Recognising these deep-seated challenges, many forward-thinking insurers and insurtechs have begun adopting automation to streamline their reconciliation processes. This first wave of innovation has already proven its value and laid the groundwork for more advanced solutions.

Pioneering companies have made significant strides in this area. For instance, AutoRek provides end-to-end automated reconciliation solutions that major insurers like Aviva have used to create fully auditable processes, reduce manual effort, and enhance compliance. Similarly, Aurum Solutions partnered with brokers like Swinton Insurance to slash daily banking reconciliation times by an incredible 97%, proving that automation can handle massive transaction volumes with unprecedented speed. Meanwhile, platforms like One Inc focus on creating a unified payment system that centralises both inbound premiums and outbound claims, simplifying back-office work and improving the overall customer experience.

These solutions have been instrumental in moving the industry forward. They prove the immense value of automation in tackling volume and speed. However, they often still require significant human oversight and don’t fully address the more nuanced challenges of interpreting and intelligently handling complex, unstructured data.

Igloo’s Breakthrough: Combining Advanced Automation with AI Agents

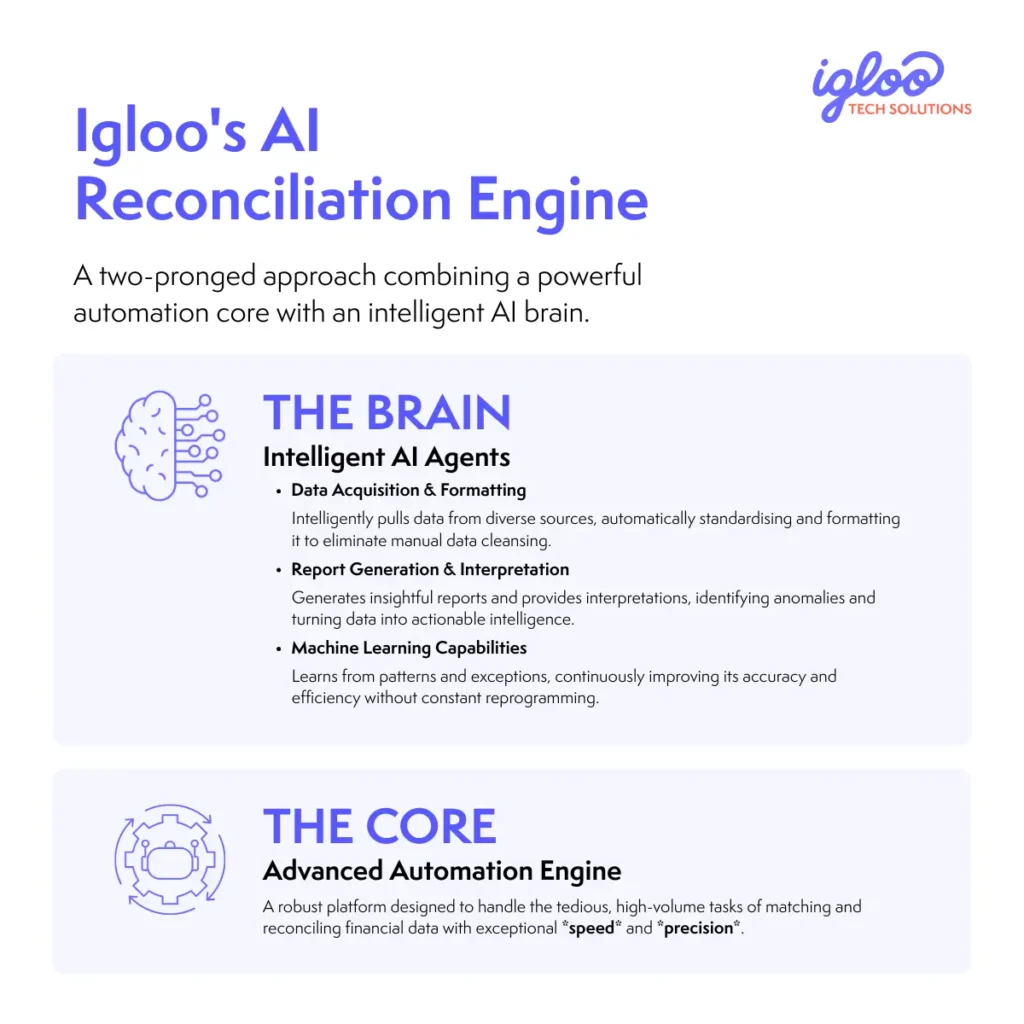

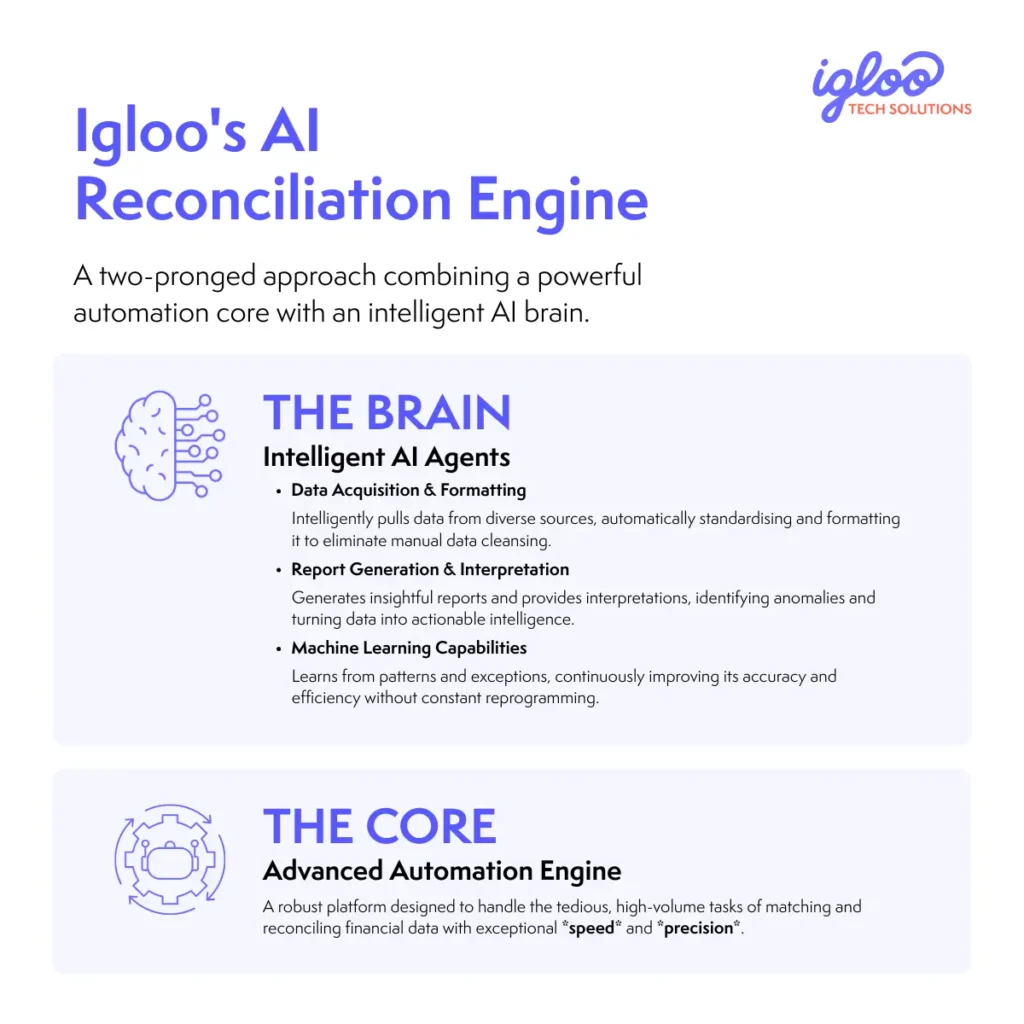

This is where the next evolution begins. Igloo moves beyond simple, rules-based automation by integrating specialised AI agents directly into the reconciliation workflow, creating a system that is not only automated but also intelligent.

This breakthrough is built on a two-pronged approach that combines deep industry expertise with cutting-edge technology. Leveraging years of experience working with renowned insurers across 8 markets in Southeast Asia, Igloo has developed a system that understands the specific nuances of the region’s insurance landscape.

The Core of the system is an Advanced Automation engine—a robust platform that handles the tedious, high-volume tasks of matching and reconciling financial data with speed and precision.

The Brain is a layer of intelligent AI Agents that performs tasks requiring cognitive capabilities far beyond standard automation:

- Data Acquisition & Formatting: AI agents intelligently pull data from diverse, disconnected sources, automatically standardising and formatting it. This eliminates the time-consuming and error-prone process of manual data cleansing.

- Report Generation & Interpretation: Instead of just outputting raw data tables, Igloo’s AI agents generate insightful reports on demand. They can even provide initial interpretations of financial performance, automatically identifying anomalies, flagging trends, and turning data into actionable intelligence.

- Machine Learning Capabilities: The system is designed to learn and adapt. It recognises patterns and exceptions over time, continuously improving its accuracy and efficiency without needing constant manual reprogramming.

The Tangible Impact: Unprecedented Results and Metrics

Igloo’s AI-driven approach has delivered transformative and measurable improvements for its partners, setting a new standard for what’s possible in financial operations. The results speak for themselves:

- Manual Efforts: Reduced by a staggering 90% per project on a monthly basis. This frees up finance teams from tedious manual work, allowing them to focus on high-value strategic analysis.

- Report Generation Turnaround Time: Slashed from weeks down to a matter of days, or even generated on-demand, giving leaders real-time visibility into their financial health.

- Manual Error Identification Accuracy: Improved from being human-dependent and fallible to a perfect 100%, ensuring complete data integrity.

- Missed Collection Rate: Improved from human-dependent to 0%, directly eliminating a significant and common source of revenue leakage.

- Payment Accuracy: Improved from human-dependent to a flawless 100%, preventing overpayments and ensuring all financial obligations are met precisely.

The New Standard for Financial Reconciliation

Manual reconciliation is no longer a necessary evil. The powerful combination of advanced automation and artificial intelligence has created a new benchmark for speed, accuracy, and efficiency in the insurance industry. By entrusting tedious processes to an intelligent system, insurers can eliminate human error, unlock significant cost savings, and empower their finance teams to drive strategic growth.

Ready to transform your financial operations and achieve 100% accuracy? Book a demo or discovery call to see how Igloo’s AI-powered financial reconciliation can work for you.

Learn more about Igloo’s broader mission to innovate with AI in insurance and solve the industry’s most complex challenges.