In the digital insurance race, the industry has obsessed over one metric: speed to bind. Insurers have invested millions into streamlined front-end sales flows, enabling customers to buy a travel or gadget policy in three clicks.

But what happens after the customer presses the buy button?

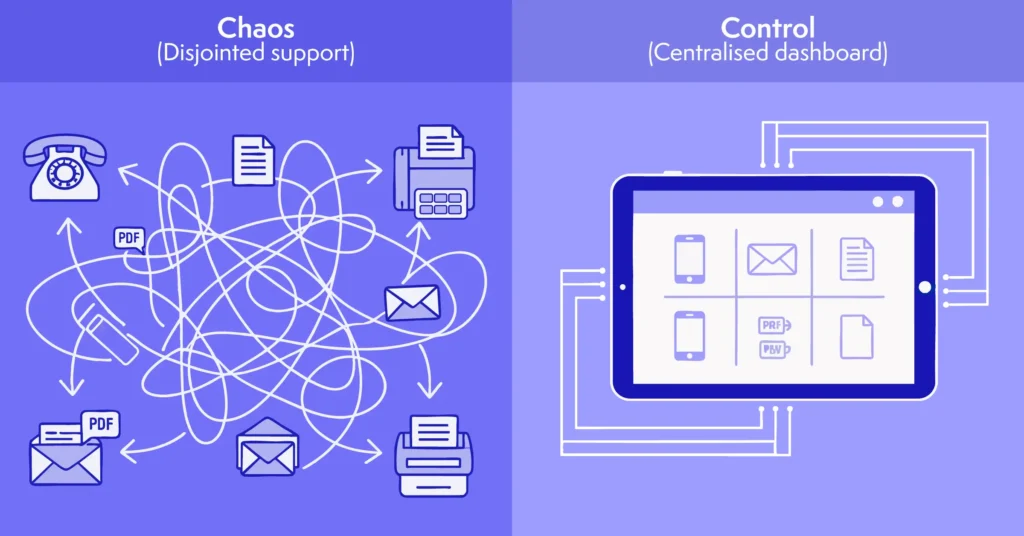

For most APAC customers, the digital experience falls off a cliff. A fragmented maze of legacy processes quickly replaces the slick sales interface. Filing a claim requires a PDF download; checking status involves a call queue; updating an address means a 48-hour email wait.

This creates a dangerous experience gap. While acquisition is digital-first, service remains analogue-heavy.

In a region of integrated super-apps, this disconnect is no longer just an annoyance. It kills retention. The next competitive battleground is not how fast you can sell, but how seamlessly you can serve.

The High Cost of the “Service Maze”

The fragmented post-sales landscape drains operations just as much as it frustrates customers.

When customers cannot find answers via self-service, they switch channels. A customer who cannot view their policy renewal date on an app will call the contact centre. A claimant who cannot see a status update will email the agent.

This “channel hopping” significantly drives up the Cost to Serve. A digital interaction costs pennies; a phone call costs dollars.

For insurers operating on thin-margin micro-insurance products, these economics are fatal. If a $5 premium policy generates two phone calls to customer support, those calls wipe out the customer’s profitability.

Legacy core systems cause this problem. Because underwriting, claims, and billing often sit on separate databases, the insurer lacks a single “view” to present to the customer. This results in a service maze that frustrates the user and exhausts the engineering team trying to maintain it.

The Expectation: The “Super-App” Standard

[Screenshots of Grab, Gojek and Shopee’s home screens in a single image]

In APAC, other insurers do not set customer expectations. Super-apps like Grab, Gojek, and Shopee set them.

These platforms have trained millions of users to expect a unified ecosystem. A user does not log into a separate portal to see their ride history or check their food delivery status. They access everything from a single dashboard.

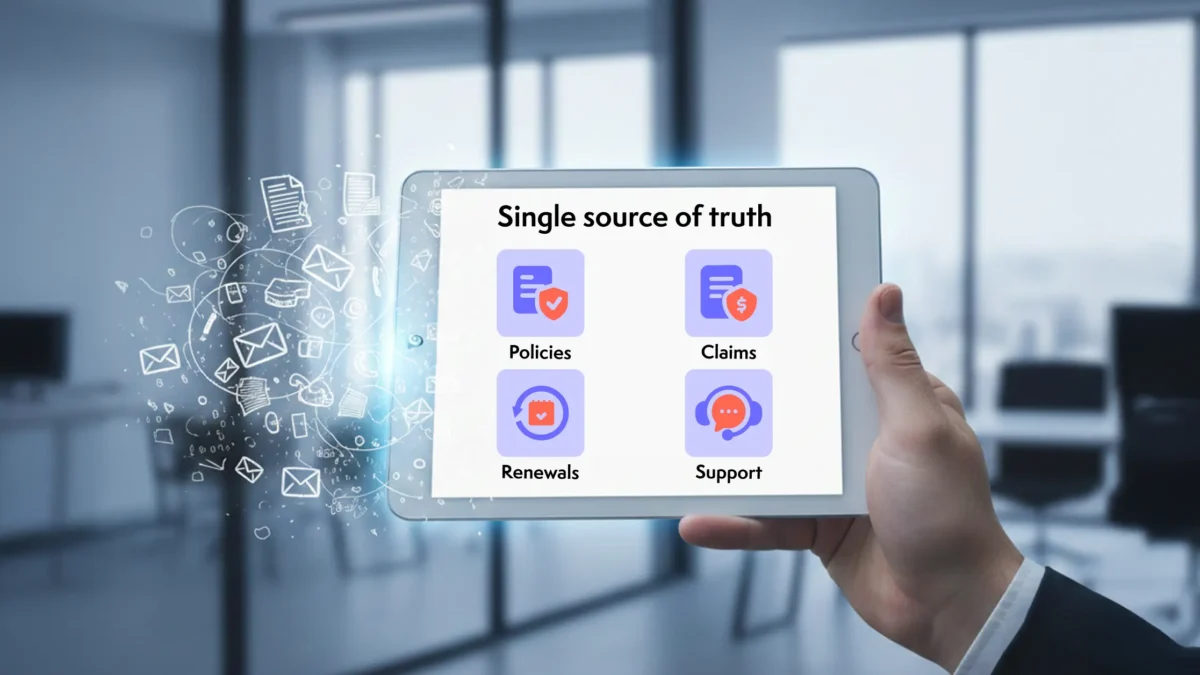

Insurance customers now demand the same autonomy. They want a Single Source of Truth where they can:

- View all active policies (Health, Auto, Travel) in one wallet.

- Initiate and track claims in real-time.

- Modify personal details or payment methods instantly.

- Renew coverage with a single tap.

If an insurer’s app functions simply as a PDF repository, users will delete it. To drive retention, the post-sales portal must be a functional tool that gives the customer control.

The Solution: The Unified Customer Portal

The answer lies in consolidating these fragmented touchpoints into a Unified Customer Portal.

This acts as more than a cosmetic website update. It serves as a strategic technology layer that sits on top of disparate legacy systems, pulling data via API into a clean, customer-facing interface.

A robust portal solves the operational inefficiencies of the legacy model:

- Self-Service First: By allowing customers to handle Tier-1 tasks (downloads, status checks, renewals)and resolve standard customer support queries, call centre volumes drop. This frees up human support agents to handle complex, high-empathy cases.

- Transparency Reduces Anxiety: The question “Where is my claim?” drives the majority of follow-up calls. A portal that displays a real-time progress bar (e.g., “Reviewing Docs > Approved > Payment Sent”) eliminates the customer’s need to ask.

- Cross-Sell Visibility: When a customer logs in to check their auto policy, the portal can contextually display their lack of travel protection, driving organic cross-selling without aggressive outbound marketing.

The “Engineering” Challenge (and Solution)

Historically, engineering teams viewed building such a portal as a significant resource challenge. It required building custom pipes to connect the Claims System, the Policy Admin System, and the Billing System; these were often three different pieces of software from three different decades.

This is where Igloo’s unified portal solution changes the equation.

Instead of building a custom interface from scratch, insurers can deploy Igloo’s ready-made customer portal that integrates seamlessly with existing core systems. This consolidates data to give customers a single control centre to manage their policies, submit claims, and contact support.

This approach offers two critical advantages:

- Speed: Insurers can launch a fully branded, white-label portal in weeks, tailored to their look and feel, without waiting for a multi-year core transformation.

- Flexibility: Business teams can configure workflows to match changing product needs, bypassing the typical six-month engineering queue.

From Cost Centre to Engagement Hub

Digitising post-sales service transforms it from a cost into an engagement engine.

Consider the renewal loop. In a traditional model, renewal creates friction involving mailers and phone calls. In a unified portal, the platform triggers a push notification: “Your Auto policy expires in 7 days. Tap here to renew at the same rate.”

By removing the friction, retention rates climb.

Furthermore, a portal provides data. It shows exactly what the customer views and where they drop off. This behavioural data empowers the product team to refine offerings based on actual user needs rather than assumptions.

Service is the New Sales

In the competitive APAC market, customer acquisition becomes more expensive every year. The most sustainable path to growth is retaining the customers you already have.

An all-in-one customer portal is no longer a luxury “nice-to-have” feature. It creates the defensive moat that protects your book of business from digital disruptors.

If customers must pick up the phone to solve a simple problem, you are already losing them. The goal is to put the power of the insurance company in their pocket.

Igloo’s Unified Customer Portal connects to Turbo, our digital core and legacy bridge. This powers a seamless user experience while giving operations a unified platform to manage claims, reimbursements, and reconciliation.

Ready to Close the Experience Gap?

Stop forcing your digital customers into analogue service channels. Connect with Igloo’s Tech Solutions team to see how our modular platform can unify your post-sales experience, reduce operational costs, and drive long-term retention.