For any insurer, the claims process is the ultimate “moment of truth.” It’s the critical point where a policyholder, often in a state of distress, relies on the promise of their coverage. Historically, this experience has been fraught with friction—a slow, opaque, and cumbersome process for customers and a manual, costly one for insurers.

Today, the insurance industry is undergoing a drastic shift, with artificial intelligence at its core. AI is not just optimising but completely redesigning the claims lifecycle, turning this traditional pain point into a powerful competitive advantage by enhancing efficiency for back-office operations and creating a transparent, rapid, and empathetic experience for the consumer.

The Pain Points: Why Traditional Claims Processing is Broken

The long-standing challenges in claims processing stem from a reliance on outdated systems and manual effort, creating problems for everyone involved, especially the customer.

Manual, Inefficient, and Costly Back-Office Operations

For decades, insurance back offices have been burdened by a heavy reliance on paper-based workflows and rigid legacy systems. This environment creates data silos, making it nearly impossible for adjusters to get a complete, unified view of a customer or their claim. According to research by Accenture, underwriters can spend up to 40% of their time on non-core administrative tasks alone. The result is a cascade of inefficiency, with high administrative overhead driven by manual data entry, tedious document verification, and time-consuming assessments that are as costly as they are slow.

The Frustrating Customer Experience

From the customer’s perspective, the traditional process is often a black box. A lack of real-time updates and long, unpredictable wait times leave them in the dark, breeding anxiety and deep dissatisfaction. In fact, an Accenture report revealed that poor claims experiences could put up to $170 billion in premiums at risk over five years, as unhappy customers switch insurers.

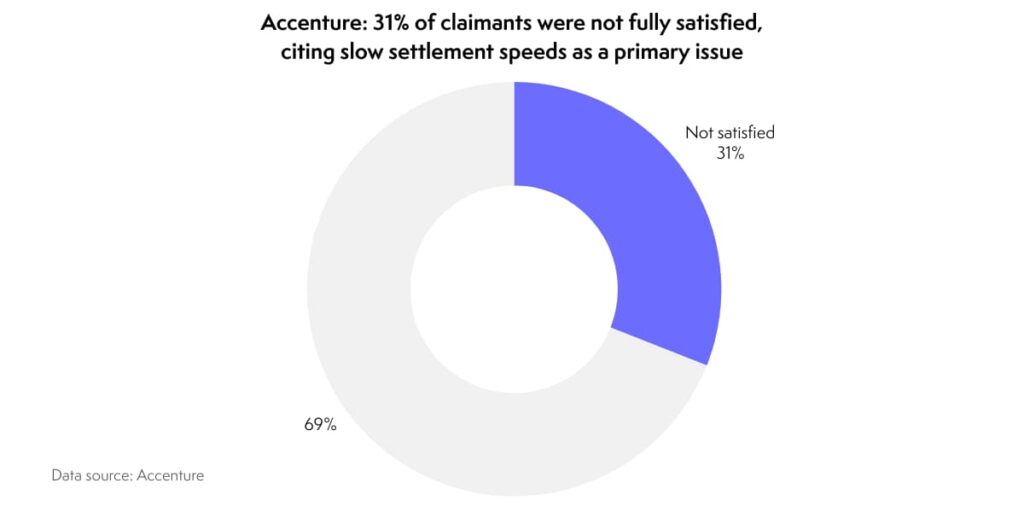

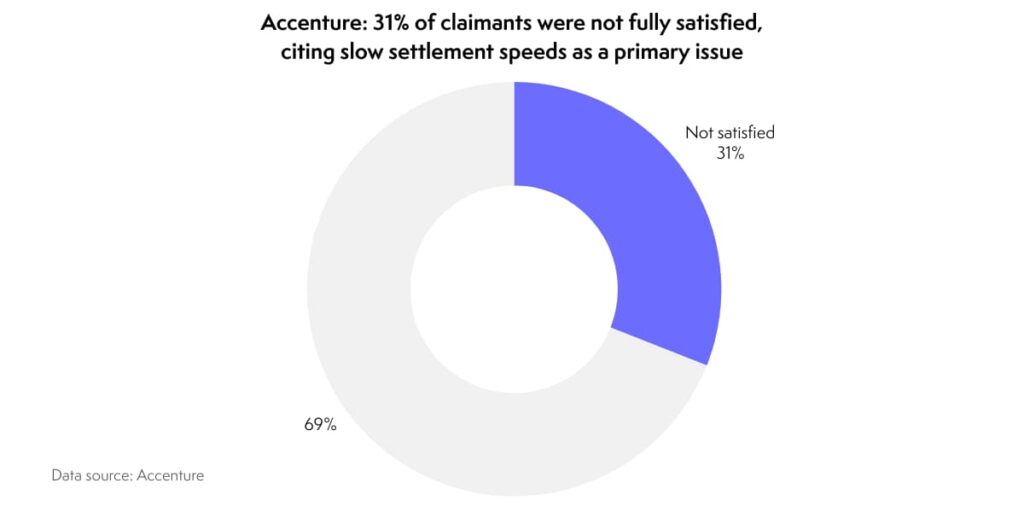

The same report found that 31% of claimants were not fully satisfied with their experience, citing slow settlement speeds as a primary issue. Policyholders are forced to repeat the same information across multiple channels, from the initial phone call to web forms and emails. This fragmented journey clashes with modern consumer expectations, especially in Southeast Asia, where a Swiss Re survey found over 40% of consumers would prefer to handle their insurance digitally. This gap between demand and reality erodes the very trust that the insurance promise is built on.

The Challenge of Fraud and Inaccuracy

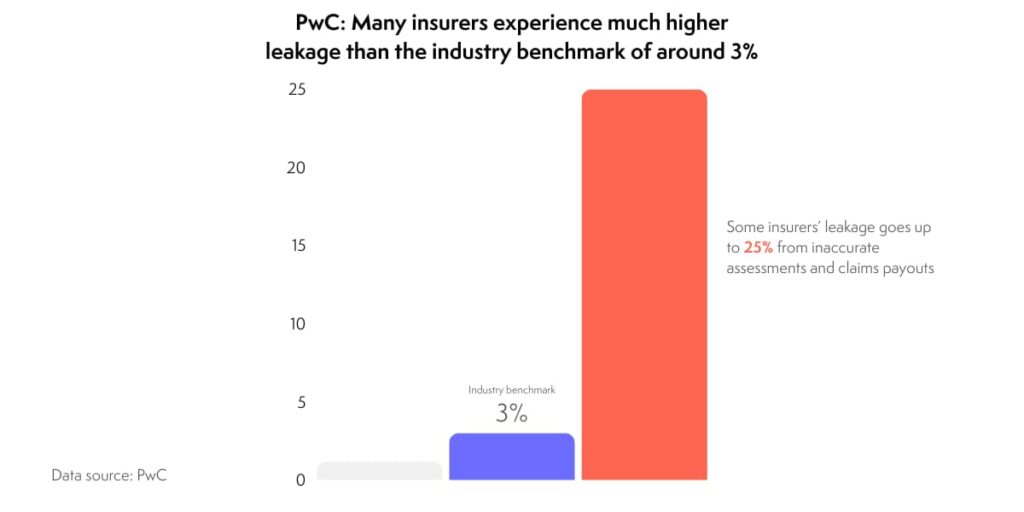

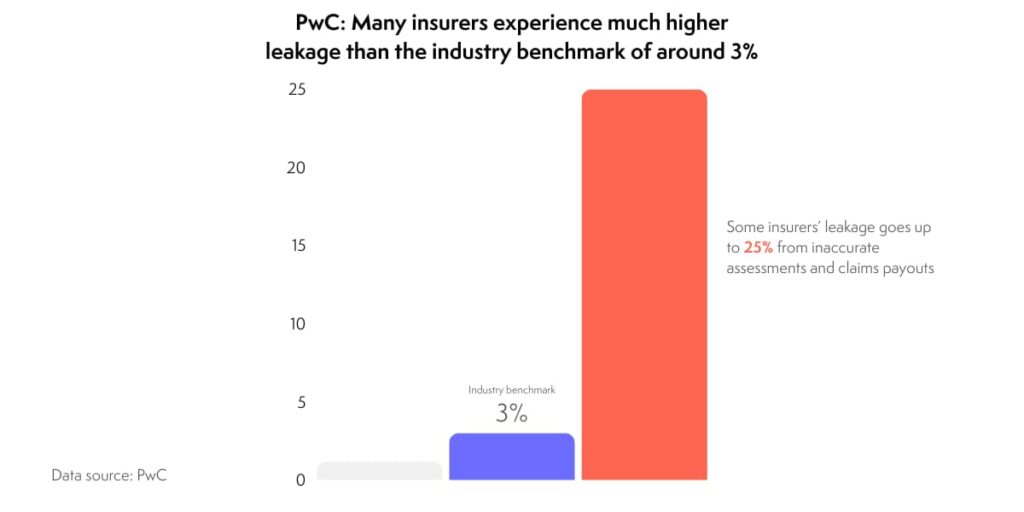

Beyond inefficiency, manual processes are inherently vulnerable to human error and deliberate deception. Manual reviews can lead to inaccurate assessments and claim payouts—a phenomenon known as “leakage”—that silently drain an insurer’s profitability. According to PwC, while the industry benchmark for leakage is around 3%, many insurers experience much higher rates of up to 25%.

Furthermore, the Coalition Against Insurance Fraud estimates that insurance fraud costs American consumers at least $308.6 billion a year. This is a global issue with significant local impact; as reported by Insurance Asia, the Asia-Pacific region saw a 22% year-on-year increase in fraudulent claims in 2023. These sophisticated schemes are incredibly difficult for human teams to detect at scale, resulting in significant financial losses for the industry each year.

The Rise of Insurtech: Early Innovators Tackling the Claims Challenge

In response to these deep-seated issues, a new wave of technology-first companies, or “insurtechs,” has emerged. These pioneers have made significant strides in reimagining what the claims experience can be.

Lemonade: By deploying AI chatbots like “AI Jim,” Lemonade completely changed customer expectations for speed. Handling the First Notice of Loss (FNOL) and processing simple claims instantly, they famously paid a claim in just three seconds. Their approach directly addresses the modern consumer’s demand for a fast, transparent, and digital-first experience.

Shift Technology: Focusing squarely on the integrity of the claims process, Shift Technology provides AI-native fraud detection and automation solutions to insurers. Their powerful platform can analyse vast datasets to spot suspicious patterns and networks with a level of accuracy that far surpasses human teams, directly tackling the industry-wide plagues of fraud and claims leakage.

Clearcover: As a mobile-first car insurance provider, Clearcover leverages technology to create a faster, more streamlined claims process tailored to the digital age. By empowering customers to manage their claims through an app and using technology to accelerate assessments, they can often pay out claims in minutes, not weeks, solving a major source of frustration in auto insurance.

Igloo’s AI-Powered Revolution: An End-to-End Transformation

While many innovators focus on solving specific parts of the problem, Igloo is taking a holistic approach. By leveraging a suite of in-house trained AI agents, Igloo is intelligently automating and transforming every critical stage of the claims lifecycle.

First Notice of Loss (FNOL) Triage AI Agent: The journey begins the moment a claim is filed. This agent instantly receives and categorises incoming claims, verifies basic policy information against the system, and intelligently routes complex or sensitive cases to human experts. Simple, low-risk claims are cleared to proceed automatically, setting the stage for a straight-through process.

Claims Guidance AI Agent (Chatbot): To eliminate customer anxiety and confusion, this agent acts as a 24/7 digital assistant. It provides policyholders with real-time status updates, proactively answers their questions, and clearly guides them on what documentation is needed next, ensuring a transparent and supportive experience.

Document Processing AI Agent: This agent tackles the administrative bottleneck of paperwork. Using advanced Optical Character Recognition (OCR) and Natural Language Processing (NLP), it reads, understands, extracts, and classifies critical information from submitted documents like invoices, damage reports, and medical receipts with speed and accuracy.

Adjudication AI Agent: This is the core decision-making engine of the system. The Adjudication AI Agent analyses all the verified data from the claim file, cross-references it against policy rules and conditions, assesses the damage or loss based on historical data and predictive models, and recommends a clear decision: approve, deny, or flag for specialised human review.

Settlement AI Agent: Once a claim is approved, the final AI agent ensures a swift resolution. It automatically and accurately calculates the final settlement amount based on the adjudication decision and triggers the digital payment process, delivering near-instant payouts directly to the customer.

The Measurable Impact of Igloo’s AI Claims Engine

This end-to-end AI framework is not just a theoretical improvement; Igloo’s implementation delivers tangible, quantifiable results that redefine industry benchmarks for efficiency and customer satisfaction.

The impact is clear and compelling:

- Human Intervention: Reduced to as low as 0% in many stages, enabling true straight-through processing for a significant volume of claims.

- Average Pending Per Claim (APEC): Drastically decreased to 0–1 day, virtually eliminating the painful waiting periods that define traditional claims.

- Accuracy Rate: A 90%+ accuracy rate for automated document processing and adjudication minimises errors and costly claims leakage.

- Fraud Detection Rate: An impressive 50–90% success rate in identifying and flagging potentially fraudulent claims before they are paid.

- End-to-End Claim Cycle Time: Reduced by an average of 60%, transforming a weeks-long ordeal into a process that can be completed in days or even hours.

- SOP Compliance Rate: A near-perfect 99% compliance rate ensures unwavering consistency and adherence to internal and regulatory standards.

Conclusion: The Future of Claims is Here

Artificial intelligence is no longer a futuristic concept in the insurance industry; it is a proven, transformative technology that solves the sector’s most persistent and costly problems. By seamlessly automating complex workflows, mitigating the risks of human error and fraud, and providing a vastly superior customer experience, AI creates a powerful win-win scenario for both insurers and their policyholders. The future of claims is not on the horizon—it is already here.

Ready to transform your claims operations and delight your customers?

Book a demo to see Igloo’s AI claims agents in action or contact us for a discovery call to learn how Igloo’s innovations in AI can be tailored to your specific needs.