In an era where consumers expect hyper-personalisation from services like Netflix and Amazon, the insurance industry has often lagged, presenting a confusing, one-size-fits-all approach. This disconnect between expectation and reality leads to customer frustration, high drop-off rates during the purchasing journey, and significant missed opportunities for both consumers and insurers. However, a technological shift is underway. AI is emerging as the key to bridging this gap, transforming how insurance products are recommended, understood, and sold in the digital marketplace.

The Core Challenge: Why Personalisation in Insurance is So Hard

For years, customers have navigated an insurance landscape fraught with friction. These persistent pain points have made purchasing the right coverage a daunting task rather than a seamless experience.

Information Overload

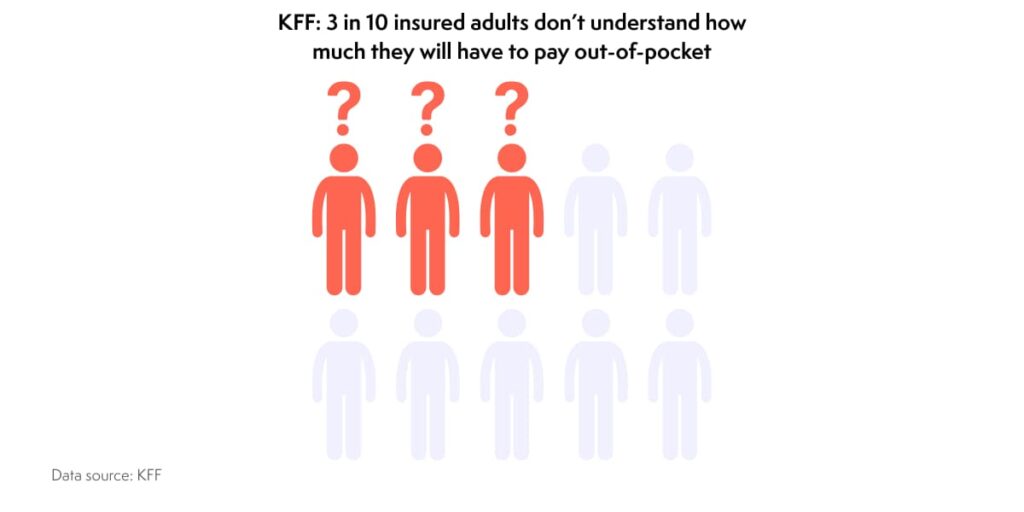

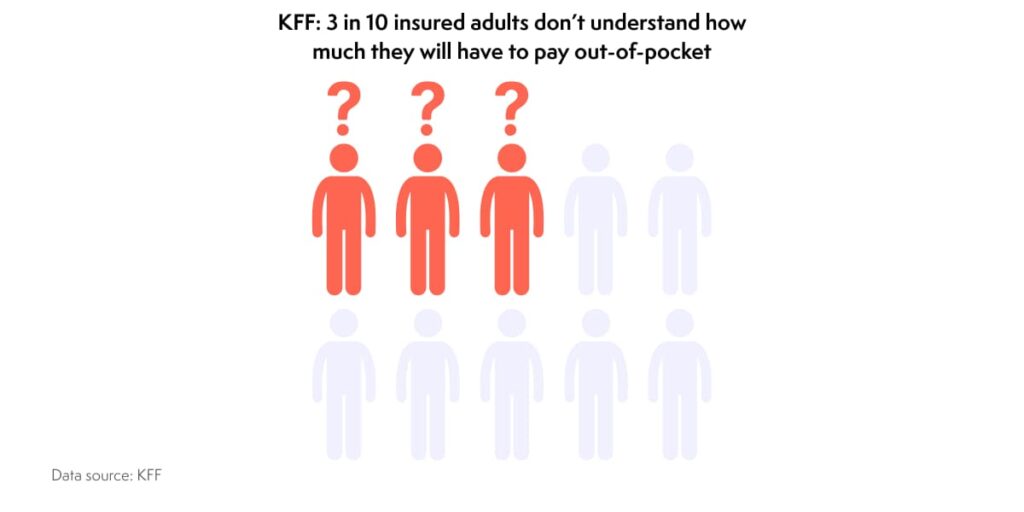

The traditional insurance model often bombards consumers with complex policy jargon, extensive options, and fine print that is difficult to decipher. This complexity is a significant barrier; a 2023 survey by the Kaiser Family Foundation (KFF) found that three in ten insured adults find it difficult to understand how much they will have to pay out-of-pocket. This overwhelming amount of information makes it nearly impossible for the average person to confidently choose the right coverage for their needs, leading to analysis paralysis or, worse, inadequate protection.

Lack of Relevance

How often has a generic insurance banner ad felt completely out of place? Products are frequently offered without considering a customer’s immediate context or life stage. This is a critical misstep in a region with a clear appetite for tailored, digital-first experiences. Yet, customers are often shown the same generic options, making the offerings feel impersonal and irrelevant. A person booking a short domestic flight simply doesn’t need the same travel insurance as a family going on a multi-week international holiday.

High-Friction Purchasing Process

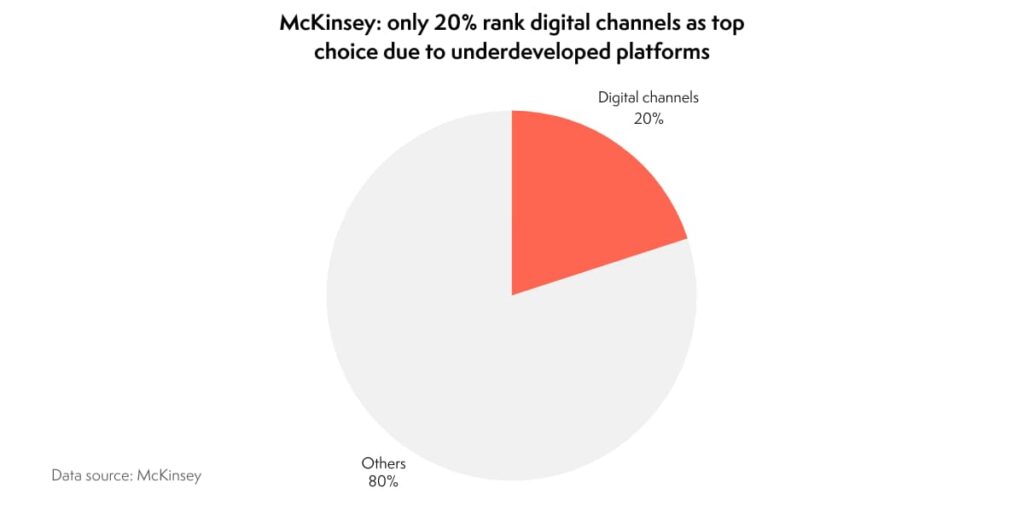

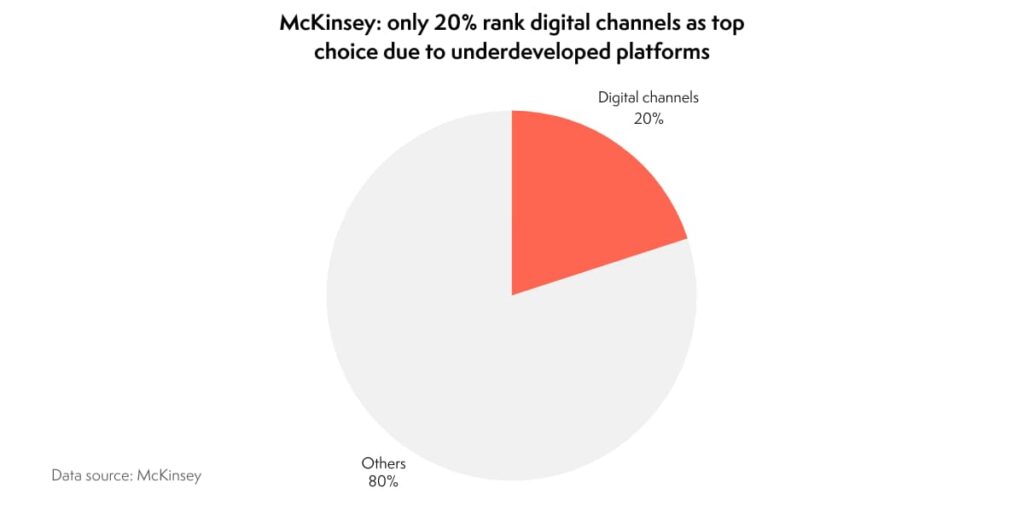

From lengthy application forms to clunky, non-intuitive digital interfaces, the path to purchasing insurance is often cumbersome. This friction has consequences; research from McKinsey highlights that leaders in customer experience outperform peers in revenue growth, yet only 20% of customers rank digital channels as their top choice for interactions due to underdeveloped platforms.

Missed Cross-Sell and Upsell Opportunities

Insurers have historically struggled to identify and present suitable add-ons or complementary products at the right moment. The opportunity to offer phone screen protection when a customer buys a new smartphone, for example, is often missed, leaving both value and revenue on the table.

Industry Trailblazers: Insurers Making Headway in Personalisation

Fortunately, a new wave of forward-thinking insurers and insurtechs are rising to the challenge, leveraging technology to address these pain points head-on.

Insurtech Disruptors (e.g., Lemonade): By utilising AI-powered chatbots like Maya, Lemonade has transformed the user experience. It creates a simple, conversational, and incredibly fast way to purchase policies and process claims, effectively cutting through the complexity that plagues traditional insurance.

Data-Driven Health Insurers (e.g., YuLife): This innovative company employs gamification and rewards for healthy behaviour. By using data to actively engage users, YuLife offers personalised wellness benefits alongside traditional coverage, turning insurance from a passive safety net into a proactive, daily tool for well-being.

Embedded Insurance Platforms: Many insurtechs in the embedded space focus on offering highly contextual insurance products directly at the point of sale within other digital platforms. Whether you’re booking travel or buying a retail product online, this model ensures the insurance offer is timely, relevant, and seamlessly integrated into the purchase journey.

The Igloo Difference: A Hyper-Personalised Engine for Southeast Asia

While these global players are making strides, Igloo goes beyond generic solutions by combining three powerful assets to create a best-in-class recommendation engine specifically tuned for the diverse and dynamic Southeast Asian market. This unique approach delivers unparalleled personalisation and drives real business results.

The three pillars of Igloo’s AI strategy are:

Rich, Regional Consumer Data: At the core of our engine are insights leveraged from over 1 billion+ facilitated policies across Southeast Asia. This massive, proprietary dataset provides an unparalleled understanding of regional consumer behaviours, cultural nuances, purchasing habits, and risk profiles that generic models simply cannot match.

Advanced In-House AI Agents: Our models aren’t off-the-shelf; they are in-house trained AI agents specifically designed to analyse this SEA-centric data. These sophisticated agents work in real-time to identify complex patterns and predict individual customer needs with astonishing accuracy, ensuring the right product is offered at the right time.

Proprietary Business Intelligence Algorithms: Technology alone isn’t enough. Our proprietary algorithms translate the AI’s data-driven insights into actionable, commercially-smart recommendations. The system doesn’t just find a relevant product; it intelligently identifies the most suitable add-ons to enhance a customer’s coverage and increase the overall basket size for our partners.

The Tangible Impact: Driving Growth and Customer Satisfaction

Igloo’s AI-powered recommendation engine delivers concrete, measurable results for its partners, turning personalisation into performance.

Our data proves the engine’s effectiveness:

- 24.7% Reduction in Drop-Off Rate: By presenting relevant, easy-to-understand offers at the perfect moment in the user journey, the engine significantly reduces friction and keeps customers engaged all the way through to purchase.

- 70% of Recommendations Match with Actual Purchases: This remarkable hit rate demonstrates the engine’s accuracy in predicting what customers truly need and want. It’s a powerful validation of our underlying data, AI, and algorithmic strategy.

- 2.2x Increased Uptake in Add-ons: Our engine excels at identifying and suggesting valuable supplementary coverage. This capability effectively increases the average revenue per customer while providing them with more comprehensive and valuable protection.

Unlock the Future of Insurance Sales

AI is no longer a futuristic concept in insurance; it is a proven, indispensable tool for driving digital sales, building meaningful customer relationships, and fostering long-term loyalty. Igloo stands at the forefront of this revolution, offering a sophisticated, data-rich solution tailored for the unique opportunities of the Southeast Asian market.

Ready to reduce churn, increase your digital revenue, and deliver the personalised experience your customers demand? Book a demo to see our AI product recommendation engine in action, or schedule a discovery call with our team to learn more about Igloo’s cutting-edge innovations in AI for insurance.