A Head of Distribution reviews the quarter’s salesforce data and sees a critical problem. Their best agents, the rainmakers, are spending less than half their time actually selling. The rest of their day is lost to administrative drag: answering routine policy queries, generating simple quotes, and re-keying data.

This isn’t an isolated issue; it’s a systemic one. The latest 2024 Insurance Agency Workforce Report from Vertafore highlights this exact frustration: 52% of insurance professionals identified “automating repetitive tasks and data entry” as a key technology feature they need.

This administrative burden is a direct cap on new business. In the high-growth, relationship-driven markets of the Asia-Pacific (APAC), this inefficiency becomes a critical barrier to growth.

The $100-an-Hour Admin

Insurers know this problem all too well: their most expensive, high-value agents are buried in low-value administrative tasks. Every minute a top agent spends checking a policy status or finding a document is a minute they are not selling. This isn’t just inefficient; it’s a costly drain on the sales channel, turning a high-value asset into a support rep.

This forces a terrible choice:

- Slow down service: Frustrate clients by making them wait.

- Slow down sales: Frustrate agents with administrative tasks.

Insurers in key Southeast Asian markets like Vietnam, Indonesia, and the Philippines rely on massive, vital agency networks, making administrative friction their single biggest operational bottleneck. This problem is especially acute across the region’s high-growth digital economies, where customer expectations are set by super-apps, not by slow, traditional processes.

The AI Co-Pilot: Augment, Don’t Replace

This is precisely the problem AI-powered chat solutions are built to solve. This isn’t about replacing agents. It’s about giving them an intelligent ‘co-pilot’ capable of instantly handling 100% of the low-value, high-volume tasks.

Think of it as a force multiplier for your sales team. The agent remains the “pilot,” managing the client relationship and complex decisions, while the AI co-pilot navigates the routine data, paperwork, and queries.

How an AI “Co-Pilot” Works

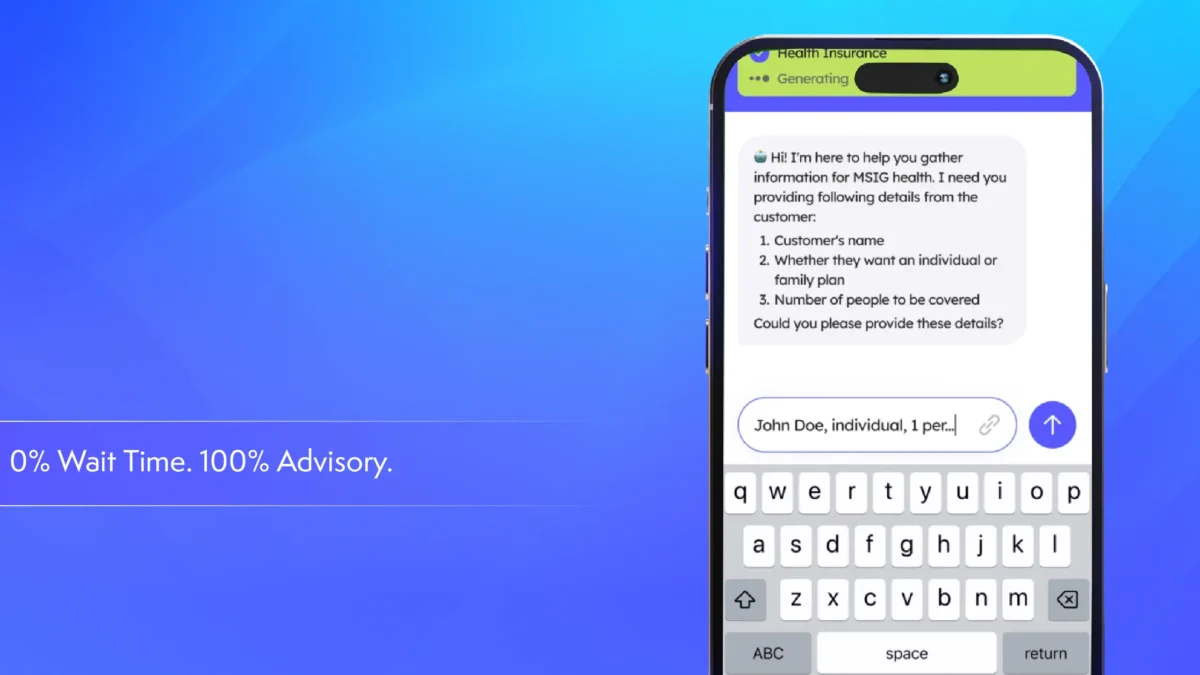

When an agent or a customer has a question, the AI chat-bot, which is integrated into the core insurance platform, steps in.

- For the Customer (24/7 Service): The AI co-pilot is an administrative assistant, available 24/7. An agent preparing for a client meeting asks: “Pull the claim forms and current status for policy #12345.” The AI instantly retrieves everything, freeing them for high-value sales and advisory work.

- For the Agent (Instant Quoting): The agent is with a client and needs a quote for a travel policy. Instead of logging into a clunky portal, they ask the co-pilot: “Generate a quote for a 10-day Vietnam trip for a 30-year-old.” The AI pulls the correct product and pricing in seconds.

- For Product Knowledge (Single Source of Truth): A new agent in Vietnam isn’t sure about the exclusions on a new auto policy. The co-pilot has all product documentation and can answer instantly, ensuring compliance and accuracy.

The Measurable Impact: Scaling Sales Opportunities

When you remove this administrative burden, the business case is simple and powerful. You are not just creating efficiency; you are manufacturing more selling time.

An agent who moves from 20% selling time to 80% selling time is not just 4x more efficient—they are a 4x more powerful growth engine.

This shift moves your most valuable human resource from defense to offense:

- From Admin to Advisory: Agents stop being data-entry clerks and become true, high-empathy advisors.

- From Taker to Maker: They move from taking routine service calls to making proactive sales and retention calls.

- From Churn to Retention: Customers get instant, 24/7 answers to simple questions, driving up satisfaction, while agents get the time to build the relationships that prevent churn.

Research from McKinsey & Company on AI in insurance supports this, finding that these tools can drive a 10% to 20% improvement in new-agent success and sales conversion rates. This isn’t a future-state fantasy; it’s a proven, off-the-shelf capability.

Automate the Admin; Empower the Advisor

In the APAC market, the agent relationship is still paramount. No one wants to be “sold” a complex life policy by a robot.

But every agent and every customer dreams of a world without frustrating paperwork, long hold times, or “let me find that and call you back.”

The next wave of growth will be defined by augmenting these vital sales channels. The goal is to give your agents a digital assistant so powerful it frees them to do the one thing it can’t: build human trust. An AI-powered tech platform is the engine that makes this possible.

Ready to empower your sales channel with an AI Co-Pilot? Connect with Igloo’s Tech Solutions team to discuss how practical AI implementations can be aligned with your specific distribution model and agent workflow across APAC.